Quick Take: What are the best debt consolidation loans in the Philippines?

Your best bets are personal loans, balance transfer credit cards, and home equity loans. A personal loan you can apply for is Tonik Credit Builder Loan. Not only can you use it for debt consolidation, but it can also help you in improving your credit score. Download the Tonik App to apply today.

Managing one loan is difficult enough. What happens when you have to juggle multiple ones on top of your daily expenses? That’s loan default waiting to happen, luv. Before you get to that point, you should consider debt consolidation!

Debt consolidation can be a powerful solution to simplify your debt, reduce interest rates, and ultimately achieve financial freedom. In this blog, we’ll teach you everything you need to know, including available options, factors to consider, the risks involved, and more.

Table of Contents

- What is Debt Consolidation?

- Understanding Risk-Based Pricing in the Context of Debt Consolidation

- Why Consider Debt Consolidation?

- Debt Consolidation Options in the Philippines

- How to Determine if Debt Consolidation is Right for You

- The Process of Debt Consolidation

- Risks and Potential Pitfalls

- Alternatives to Debt Consolidation

- Conclusion

What is Debt Consolidation?

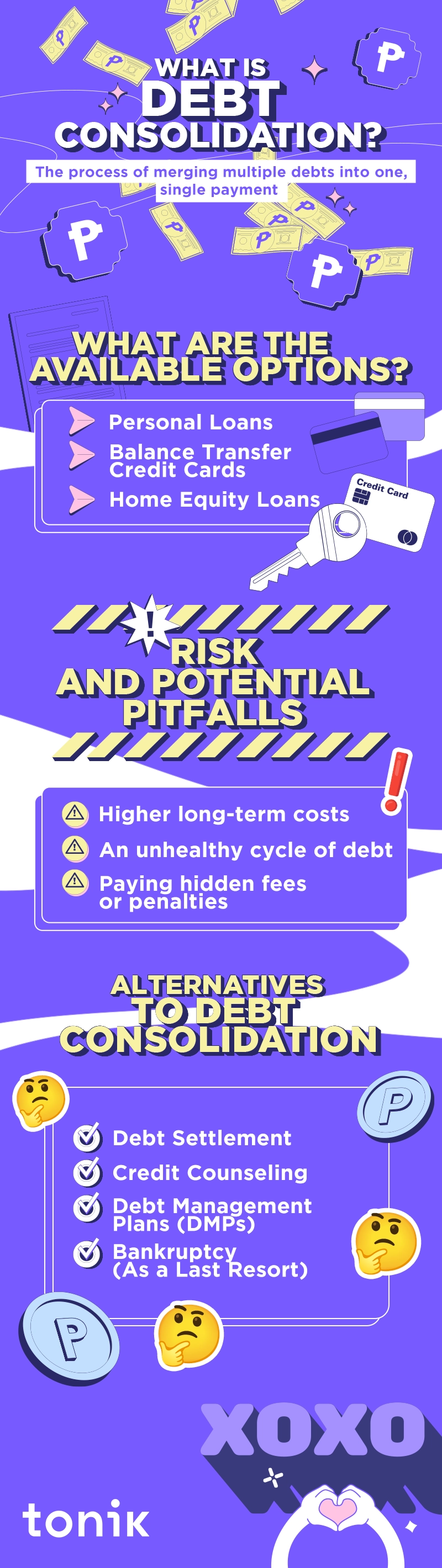

Debt consolidation is the act of taking out a single loan to manage or pay out multiple debts that you currently have outstanding- such as credit card balances, personal loans, or medical bills - into a single, more manageable payment.

This sounds like a tedious process to track since you would be getting a single loan or credit line to pay off your current debts but it’s actually a smart tactic, if you can manage it. It’s main purpose is to reduce interest rates and extended repayment terms, making it more affordable in the long run.

TOCUnderstanding Risk-Based Pricing in the Context of Debt Consolidation

Now, let’s pause for a moment and consider something crucial in the world of finance: risk-based pricing. Essentially, this is how lenders decide the interest rate you're charged based on how risky they think lending to you is. Your credit score, income stability, and existing debt all play into this. So, when you consolidate your debts, particularly if you're able to secure a lower overall interest rate, you're not just simplifying your payments—you might also be improving how lenders view your risk level. A better risk profile could mean lower interest rates on future loans, not to mention the immediate benefit of lower payments and possibly faster debt reduction. It’s a smart move that can have a positive ripple effect on your finances beyond just the immediate ease of payment management.

TOC

The Debt Landscape in the Philippines

To give you a clear picture of our debt landscape, let’s briefly take a look at the statistics.

As of April 2023, the Philippines has a total of ₱11.67 trillion worth of loans, and 1 out of 2 Filipinos have at least 1 loan. These loans include (but are not limited to) credit cards, personal loans, microloans, housing loans, and auto loans.

The bad news is that over ₱427 billion (yes, billion!) of those loans are considered bad, making debt consolidation a much-needed option.

TOCWhy Consider Debt Consolidation?

Debt consolidation can be an effective financial strategy if managed correctly. If you think this could be suitable for your situation, here are a couple reasons why you should consider it:

- Streamlined Debt Management - Managing multiple debts can be a daunting task, often leading to confusion and missed payments. Debt consolidation simplifies your financial life by allowing you to make a single payment for your current debts.

- Potential for Reduced Interest Rates - One of the most significant advantages of debt consolidation is the potential to secure a lower interest rate on your consolidated loan. If you know a thing or two about interest rates, then you already know that that your loan will cost significantly less when you get a low-interest loan.

- Improved Financial Stability – Debt consolidation can provide you with a clearer repayment plan and a predictable monthly payment. This financial stability can lead to improved budgeting and financial discipline, reducing the risk of falling deeper into debt.

- Enhanced Credit Score - Consistently making on-time payments on your consolidated debt can positively impact your credit score. This can then lead to more favorable financial opportunities in the future like lower interest rates on future loans or credit cards.

Debt Consolidation Options in the Philippines

Debt consolidation isn’t just one thing, hun. You can choose from multiple options, each one with its own set of advantages. Here are the three primary debt consolidation options that you can choose:

- Personal Loans for Debt Consolidation - Personal loans typically have fixed interest rates and terms, making it easier to budget for your monthly payments. You can also find many of them online, and they have loan apps too (like yours truly). Before choosing one, just make sure they’re legit. Here's a quick guide to help you make the right choice!

- Balance Transfer Credit Cards - Many credit card providers in the Philippines offer balance transfer promotions with low or even zero percent interest rates for a specific introductory period. By transferring your existing credit card balances to a balance transfer card, you can take advantage of these low rates and pay off your debt more efficiently.

- Home Equity Loans - If you own a home in the Philippines, you may consider a home equity loan as a debt consolidation option. Home equity loans allow you to borrow against the equity you've built in your home. While there are risks in pledging your property as collateral, they often come with lower interest rates compared to other types of loans.

How to Determine if Debt Consolidation is Right for You

Before you dive into debt consolidation, you have to first assess carefully if it’s indeed the correct route for you. Here’s what you need to do:

- Evaluate your current debts - Note the interest rates, payment terms, and outstanding balances for each debt. Look for high-interest debts that are eating away at your finances, as these are often the ones you'll want to target with consolidation.

- Assess personal financial habits and discipline - Debt consolidation can be a powerful tool, but it's not a magic fix. Successful debt consolidation requires discipline to make consistent payments and avoid accumulating new debt.

- Consider long-term financial goals and strategies - Debt consolidation should be a part of a broader financial plan. Consider what you want to achieve in the future, such as homeownership, retirement, or building an emergency fund. Assess how debt consolidation fits into these goals and whether it helps you progress toward them.

The Process of Debt Consolidation

Now, do you think debt consolidation is the right path for you? If yes, then it’s time to break down the process step-by-step!

- Research and compare options - Begin by researching and comparing debt consolidation options available in the Philippines. Take the time to evaluate which option aligns best with your financial goals and needs. Look at interest rates, loan terms, fees, and any special promotions or offers.

- Apply for a debt consolidation loan or program - This typically involves providing requirements like financial documentation, such as proof of income, identification, and a list of your existing debts. Lenders will use this information to assess your eligibility and determine the terms of your consolidation loan or program.

- Use the approved funds to pay off existing debts - If your application is approved, you'll receive the funds necessary to pay off your existing debts. This is the best part, luv, so here’s an advanced pat on the back for getting approved!

Manage the single consolidated loan or payment - This is often more straightforward than managing multiple debts because you'll have one due date and one interest rate to monitor. Make sure to budget for this payment in your monthly financial plan and commit to making on-time payments to stay on track. Check out these helpful loan repayment tips!

Risks and Potential Pitfalls

Before we let you go on your debt consolidation journey, here are some of the risks and potential pitfalls that you should expect. Think of this as a parting gift!

- Potential for higher long-term costs if not managed correctly - One of the potential risks of debt consolidation is that it may lead to higher long-term costs if not managed correctly. To mitigate this risk, consider making extra payments when possible to reduce the total interest paid and pay off the consolidated debt faster.

- The danger of accruing new debts after consolidation - If you continue to use credit cards irresponsibly or take out new loans, you can quickly find yourself in a worse financial situation. Try your best to develop better financial habits to prevent this from happening.

- Paying hidden fees or penalties - Before committing to a debt consolidation option, thoroughly review and understand the terms and conditions. Some lenders may have hidden fees or penalties that can catch you off guard if you're not aware of them.

Alternatives to Debt Consolidation

If you’ve reached the end of this blog and you’ve decided that debt consolidation simply isn’t for you, don’t worry. There are alternatives that you can go for instead!

- Debt Settlement - Debt settlement involves negotiating with your creditors to settle your debts for less than the full amount owed. This can be a viable option if you're struggling to make minimum payments and have fallen behind on your debts. Just a heads up though: it can negatively impact your credit score, and there are no guarantees that creditors will agree to settle.

- Credit Counseling - Credit counseling agencies in the Philippines offer guidance on managing debt and improving financial literacy. They can help you create a budget, understand your financial situation, and develop a plan to repay your debts.

- Debt Management Plans (DMPs) - A debt management plan is an arrangement between you and a credit counseling agency to repay your debts at reduced interest rates and with a structured repayment plan. However, this may involve closing your credit card accounts, which may impact your credit score.

- Bankruptcy (As a Last Resort) - Bankruptcy should be considered only as a last resort when all other options have been exhausted. It's a legal process that can help you discharge certain debts or create a court-approved repayment plan. Bankruptcy has severe consequences for your credit score though, so this should only be treated as a last resort.

Consolidate Your Debts with Tonik Digital Bank Loans!

Want to make your search for the best debt consolidation option shorter? Then you should consider Tonik Digital Bank’s Credit Builder Loan!

Credit Builder Loan is a quick cash loan that let's you borrow up to PHP 20,000, and helps you build a solid credit history.

Ready for financial freedom through debt consolidation? Download the Tonik App and apply today!