Borrowing funds has been easier now more than ever thanks to the advent of online loans. In fact, as much as 47.1% of the Filipino adult population borrow money as of April 2023. But despite how easy they are to secure compared to traditional loans, many people will still go the brick-and-mortar route simply because that’s what they’re accustomed to. Either that, or the thought of cyberattacks and scammers are scaring them off.

Fortunately, fear of any kind can be eased with information. Learn all about online loans when you read this comprehensive guide!

What is an Online Loan?

An online loan is essentially the same as a typical, traditional loan. The only difference is, you can apply and have the money disbursed online. This is why many consider online loans to be far more convenient. Most of them don’t require you to show up at the bank to apply – all you need is a smartphone and a WiFi connection.

Pros and Cons of Online Loans

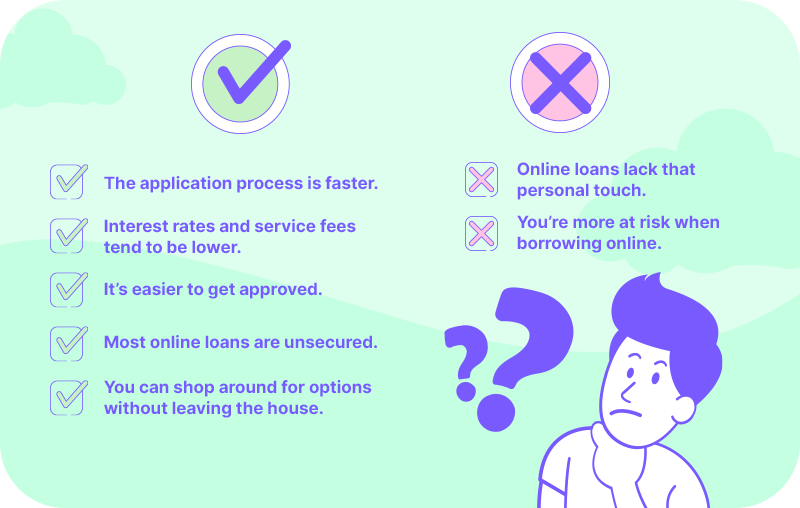

Online loans are convenient, but that doesn’t mean they’re perfect. Check out the pros and cons below!

Pros

- The application process is faster. Most online lenders can let you know instantly if you’re qualified for their loan products. For example, applications for the Tonik Quick Loan can be approved quickly and conveniently from your Tonik App.

- Interest rates and service fees tend to be lower. That’s because many of these online lenders don’t have the overhead costs that most traditional banks and institutions do.

- Interest rates and service fees tend to be lower. That’s because many of these online lenders don’t have the overhead costs that most traditional banks and institutions do.

- It’s easier to get approved. Instead of relying solely on your credit score, some online lenders use other information (such as utility payments and debt-to-income ratio) to evaluate your application.

- Most online loans are unsecured. This means most of them don’t require collateral, so there’s no risk of your assets getting seized if you have difficulties repaying the loan. Others do require collateral but don’t let that stop you from getting the loan you need.

- You can shop around for options without leaving the house. Your Googling skills may be put to the test, but that’s most of the heavy lifting already!

Cons

- Online loans lack that personal touch. It’s unlikely that you’ll be talking to any loan officers when applying for an online loan. This may be inconvenient for those who’d rather ask questions face-to-face, instead of reading information on a screen.

- You’re more at risk when borrowing online. Determining the legitimacy of a lender is more difficult these days.

Pro Tip: Look out for certifications and license from institutions such as the Bangko Sentral ng Pilipinas (BSP). That’s usually a good sign when looking for legit online lenders, luv!

Online vs. In-Person Loans

The main difference between online and in-person loans is the way they’re processed. For online loans, you can apply and have the amount disbursed without ever having to go to the lender’s office. You just need to visit their website or download their app. In-person loans, on the other hand, require you to visit one of the lender’s branches to apply for the loan and to submit all the requirements.

Types of Online Loans in the Philippines

Online loans come in many shapes and sizes. Here are the ones that you can find in the Philippines:

- Personal Loans

- Payday Loans

- Business Loans

- Student Loans

- Cash Advances

- Home Loans

- Car Loans

How to Find & Choose Safe Online Lenders in the Philippines

If you’ve decided to take out an online loan but don’t know where to start yet, here’s a quick step-by-step guide!

Step 1: Do Your Research

Do a quick search of legit online lenders in the country. Reading reviews can also help as they’re normally unfiltered opinions of customers’ experiences with the lender. Once you find a few potential lenders, visit their website and check out their interest rates, fees, and other important factors when choosing an online loan.

Step 2: Look for Credentials

Credentials are a good way to determine if a lender is trustworthy. See if they’re licensed by the Bangko Sentral ng Pilipinas (BSP) and if they’re registered with the Securities and Exchange Commission (SEC) or the Cooperative Development Authority (CDA).

Step 3: Check Their Security Measures

Of course, you’ll want your money and your information to be super secure. A good one to look out for is if your preferred lender has SSL encryption.

Step 4: Compare Lenders

Once you have all the information you need from your potential lenders, you can finally compare and contrast them to make your final decision!

How to Get Approved (Tips for Getting an Online Loan)

There’s no sure-fire way to get your loan approved. However, there are a few pointers that we can share to raise your changes:

- Monitor your credit score. It’s not the only factor they’ll consider, but a good credit score and a clean credit report will go a long way.

- Complete your application correctly. Take time to fill out the form and to collate all the requirements. Make sure all information is correct.

- Lower your debt-to-income ratio. Reassure lenders that you’ll be a good borrower by paying off some of your existing debts before applying for a loan.

- Stay calm and be patient. You may start to feel a bit jittery while waiting for your loan to get approved. No matter what you do, don’t apply for another loan! Just take a deep breath and wait for approval.

Online Loan Repayment Strategies

Related: Top Online Loan Repayment Strategies

Once you get your loan approved and disbursed, it’s important to come up with repayment strategies. First off, take note of the frequency of payments that your lender requires. Most ask for monthly repayments, while others may even require you to pay weekly.

The payment and its interest rate greatly depend on the size of your loan, so make sure you set aside enough money to pay on time. Otherwise, you may have to pay penalties, the lender may increase your interest rate, or – perhaps worst of all – result in a loan default.

Online Loan Alternatives

You may not qualify for a loan, or maybe you just think that it’s not for you. That’s okay, because there are a number of alternatives that you can choose instead!

- Use credit cards. This allows you to borrow up to a certain set limit so you can manage your spending habits. Many of them have higher interest rates compared to loans, but they’re great for smaller expenses.

- Try peer-to-peer lending. This lets you borrow funds from an individual investor instead of a bank or any similar institution. Interest rates and repayment terms can vary per platform.

- Borrow from friends and family. Why not? These are the people who love and know you the most. Just make sure to honor your commitment to repay them to avoid damaging relationships!

Online Loan FAQs

How long does it take to get an online loan?

It depends on the lender and type of loan that you choose. There are some that can approve your loan instantly or within a day, with disbursements as quick as 24-48 hours. Other, more traditional options may take for a couple days or even weeks to process.

What are the eligibility criteria for online loans?

The most common factors that lenders will consider are your credit score, income, employment history, and debt-to-income ratio.

What are the interest rates of online loans?

It’s different for each lender and loan type, and it can also be affected by your credit worthiness. Don’t forget to check your chosen lender’s website for information before committing to a loan.

Are online loans safe?

Lenders that are licensed and regulated are the safest options. You can also read reviews to be extra sure.

What should I look for when choosing an online loan lender?

Choose a loan that best fits your budget. You surely don’t want to get a loan that you’ll have a difficult time repaying later on. Good customer service based on reviews is also a plus, since you’ll never know when you’ll encounter problems.

Can I get an online loan with bad credit?

Yes, but your options may be more limited, and you may end up getting higher interest rates. The good news is, there are lenders out there who offer loans specifically to people with bad credit, so keep a look out for those!

What happens if I can't repay my online loan?

You may face penalties such as late fees and additional interest charges. If you let it go on for too long, it may negatively impact your credit score, or your lender may even take legal action. If you miss repayments, hurry and contact your lender. They might modify your loan or repayment plan so it's easier for you to pay them back!