Diving into personal and business loans might seem like navigating a maze with unexpected turns at every corner. It's easy to feel overwhelmed by all the extra costs and fees that pop up, but guess what? With a bit of guidance and know-how, you can avoid these financial pitfalls and keep your journey smooth and straightforward.

This blog is your guide through the loan fees, minus the confusing banking speak (a.k.a. origination fees, APRs, etc.). We're talking about the upfront charges, the extra costs for paying off your loan early, and all those other fees that seem to come out of nowhere. Our mission is to equip you with practical advice and insights, turning what looks like a dense fog into a clear path forward.

Are you ready to take charge and make informed decisions that benefit your wallet? Let’s peel away the layers of confusion and stride confidently into managing your loan. It's about being savvy, alert, and ready to take on those extra charges with a winning strategy. Let’s get to it!

Table of Contents

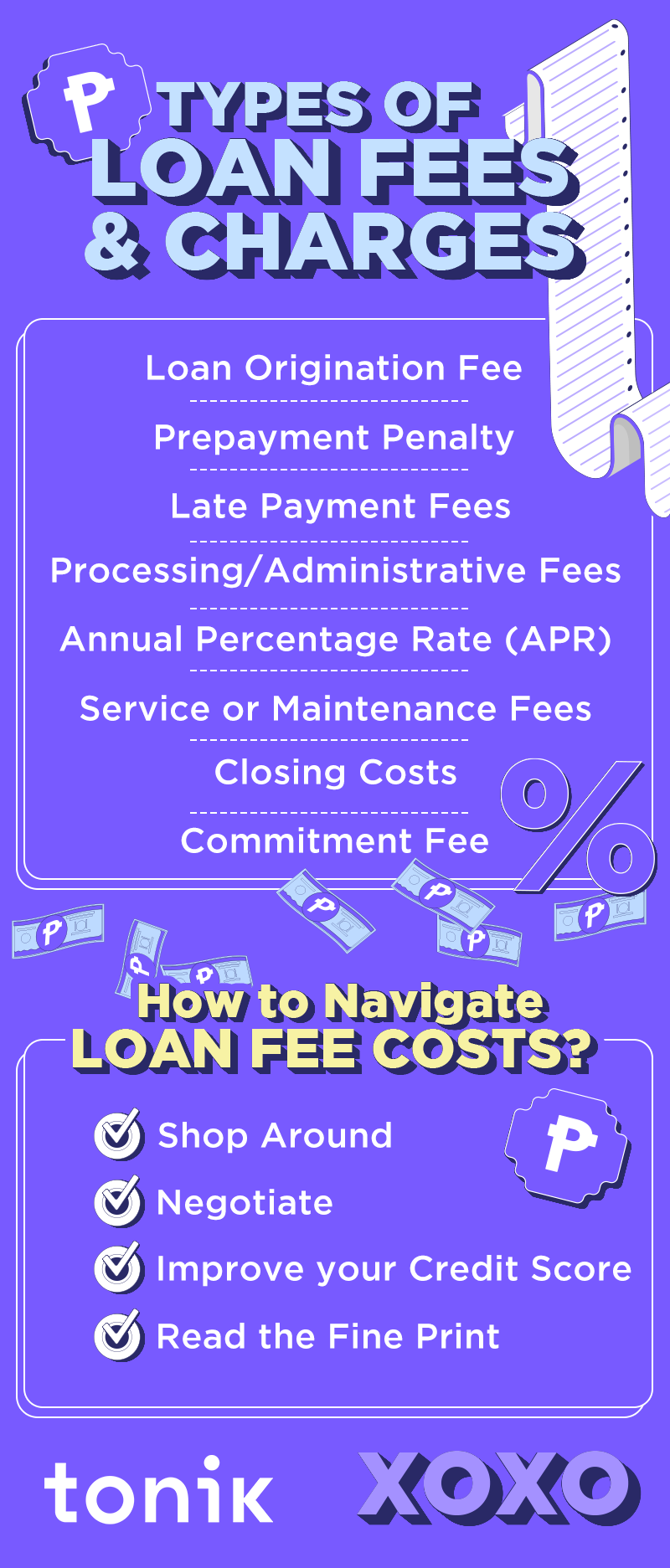

Types of Personal & Business Loan Fees and Charges

1. Loan Origination Fee

Think of the loan origination fee as the entry fee to the rollercoaster of borrowing money. It’s what lenders charge for processing your loan application, including credit checks and administrative costs.

This fee usually ranges from 1% to 6% of the loan amount. Sometimes, it’s a flat fee. Whether it's a percentage or a flat rate, it plays a significant role in the overall cost of your loan.

Keep in mind, luv: The bigger the loan, the heftier the fee. It’s crucial to factor this into your total loan cost to avoid any unpleasant surprises.

2. Prepayment Penalty

Ever get penalized for being a bit too eager? That’s what a prepayment penalty is in the loan world. It's what you pay if you decide to settle your debt earlier than planned.

This loan fee isn't always in play. But when it is, it's usually during the first few years of your loan term. Always check your loan agreement to see if this applies to you.

3. Late Payment Fees

This one's pretty straightforward. Miss a payment deadline? Expect a fee. It's the lender's way of saying, "Hey, we noticed you forgot about us."

The best way to dodge this fee is simple, luv. Pay on time. Setting up automatic payments can be a real game-changer here. Or, just keep a note in your calendar. Set a regular alarm. There are tons of ways you can prevent having to pay this loan fee.

4. Processing/Administrative Fees

These fees cover everything from paperwork processing to general loan management.

For personal loans, these can vary widely but expect them to be in line with origination fees, percentage-wise or as a flat rate.

5. Annual Percentage Rate (APR)

APR is like the all-inclusive resort of loan costs – it bundles up the interest rate with other fees to give you the complete picture of what you’ll pay annually.

APRs are your best friend when shopping around for loans. They let you compare apples to apples across different lenders. Paying close attention to your APR will help you greatly understand what you’re getting into. So don’t forget it, hun.

6. Service or Maintenance Fees

These are the monthly or annual fees for the ongoing maintenance of your loan account. Not all heroes wear capes, and not all loans have these fees, but when they do, they’re for account management.

Typically, this kind of loan fee is more common in business loans. But they can still pop up in personal loans, so keep an eye out.

7. Closing Costs

Closing costs are the grand finale of loan fees, encompassing everything from attorney fees to appraisal fees, primarily in the realm of business loans.

These can vary significantly, but knowing they exist and planning for them can save you from sticker shock.

8. Commitment Fee

Consider this the fee for reserving your loan amount, especially in business lending. It’s a promise from the lender that they’ll keep the funds available for you.

Like many things in life, these fees can sometimes be negotiated. It never hurts to ask!

Navigating the Costs

So, how do we keep these loan fees from raining on our parade? Understanding is the first step, but there are strategies to minimize these costs and keep more money in your pocket. These include the following:

- Shop Around: Don’t settle for the first loan offer you receive, luv. Compare APRs, fees, and terms from multiple lenders.

- Negotiate: You’d be surprised what can be negotiated in terms of fees. All you got to do is start asking, hun. If you get approved, great! If not, then move on.

- Improve Your Credit Score: A better credit score can often lead to better loan terms and lower loan fees. One way to do this is to get a Tonik Credit Builder Loan, which helps you build credit while borrowing up to ₱20,000. Plus, it's open to both employed and self-employed individuals!

- Read the Fine Print: Knowing exactly what fees apply to your loan can help you plan or avoid them altogether.

Don’t Fear the Fees, Luv!

Loans don't have to feel like a financial storm cloud looming over your budget. With the right knowledge and tactics, you can manage to skip unnecessary loan fees and charges with confidence.

Armed with this guide, you’re now ready to step out and make informed, savvy loan choices. Let the sun shine on your financial decisions, rain-free, luv!