Top Strategies and Options for Funding Your Business Expansion Plan in the Philippines

Did you know? There are over a million small and medium enterprises in the Philippines as of 2021. And a recent study also noted that 4 out of 5 Filipinos are interested in entrepreneurship. This clearly shows that Filipinos have a strong entrepreneurial spirit. Many of us know that doing business can not only help provide our needs—it can also allow us to build wealth, too!

However, the sad truth is not every Filipino who wants to start a business gets to do it. And if you’re one of the lucky few who’s done it, first and foremost, let me congratulate you, luv! Building and managing your business is no easy feat after all!

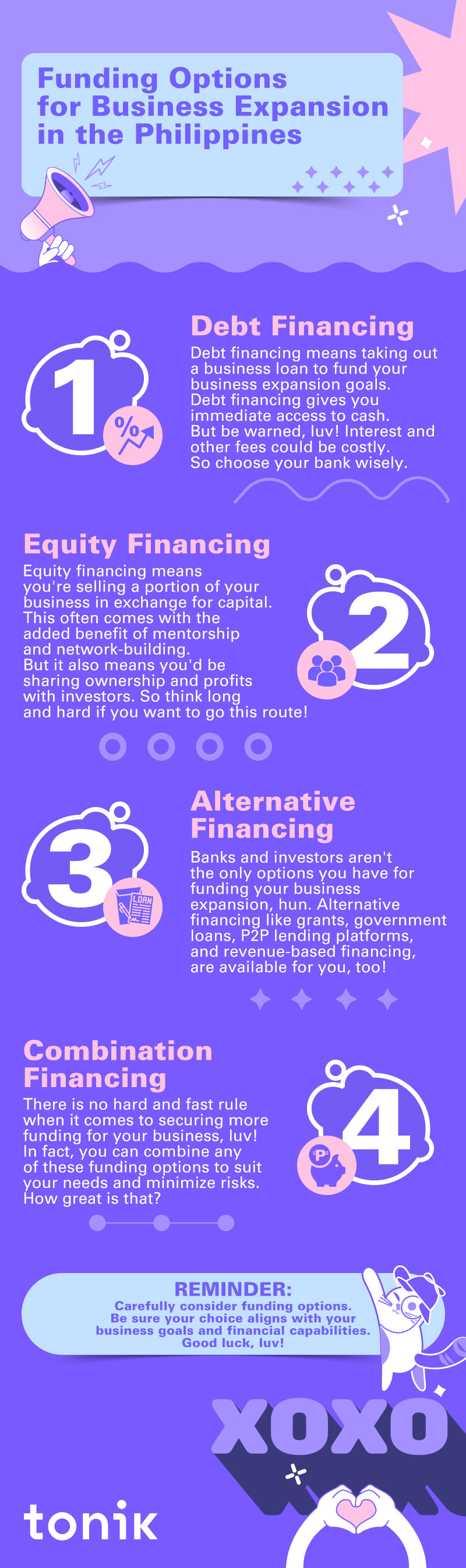

But let me ask you: Are you ready to take your business to the next level? Expanding your business can be an exciting opportunity for growth, but it often requires a substantial amount of funding. Thankfully, there are tons of business loans and other financing options that can support business expansion plans. Let’s explore them one by one.

Table of Contents

TOC

TOC

Debt Financing: Borrowing Your Way to Success with Business Loans

Many business owners opt to take out a business loan to fund their business expansion plans. Here are some of the most popular debt financing choices:

TOCTraditional Bank Loans

Traditional bank loans are a common choice for businesses seeking financing. These business loans offer competitive interest rates and flexible repayment terms. But it’s not for everyone. If you want to take out a business loan from a traditional bank, it's important to build a strong relationship with your lender and maintain a good credit score also known as credit history to increase your chances of securing a loan.

TOCOnline Loans

In recent years, digital banks have emerged as a great alternative source of business loans. In fact, for small businesses and startups, online loans have become their choice of business funding. It offers time efficiency and convenience that not a lot of traditional banks can offer. But when it comes to getting a business loan online, be careful, hun. Make sure you only transact with digital banks that are licensed by the Bangko Sentral ng Pilipinas. Otherwise, you might get scammed. Remember, there are only seven digital banks licensed by the BSP. And Tonik is the first of them.

TOCAsset-Based Lending

Asset-based lending allows you to borrow against the value of your assets, providing you with additional working capital.

| PROS AND CONS OF DEBT FINANCING | |

|---|---|

|

✓ Gives you immediate access to funds ✓ Allows you to maintain control over your business ✓ Helps build creditworthiness |

✘ Interest and fees can be costly depending on your lender ✘ Taking on too much debt can be financially risky for a business ✘ Defaulting on your business loan might mean you could lose your collateral |

💡Tip: When selecting a business loan, consider factors such as interest rates, repayment terms, and the lender's reputation. Comparing offers and negotiating with your lender helps you secure the most favorable terms for your business.

TOCEquity Financing: Partnering for Business Success

Equity financing is another avenue to explore when funding your business expansion. This method involves selling a portion of your business in exchange for capital. Here are some examples of equity financing:

TOC1. Angel Investors

In the realm of business financing, angel investors are like the fairy godmothers and godfathers who sprinkle their magical funds and expertise to help your business flourish. These individuals, often successful entrepreneurs themselves, use their own money to invest in promising startups and growing businesses.

But their contributions go beyond mere financial support, they can become your mentors, too. Their experience and connections can open doors you never thought possible.

TOC2. Venture Capitalists

Venture capitalists specialize in investing in businesses with high-growth potential, seeking the next big thing in the Filipino business landscape. If your business has that special spark, venture capitalists can inject the necessary funds and expertise to fuel its expansion. They're like explorers charting new territories, ready to embark on an exciting adventure with you.

TOC3. Crowdfunding

Crowdfunding platforms have revolutionized the way businesses raise funds. Through these platforms, you can appeal to a wide community of individuals who believe in your business and want to support its growth.

Crowdfunding allows you to showcase your ideas, engage with potential customers, and build a loyal community around your brand. It's an effective way to gauge market interest, validate your business concept, and secure funds from a diverse group of backers.

| PROS AND CONS OF EQUITY FINANCING | |

|---|---|

|

✓ Often comes with the added benefit of mentorship and network-building ✓ Provides capital without burden of repayment ✓ Has the potential to secure more funds |

✘ Adding investors means giving up a portion of ownership of your business ✘ You end up sharing profits with investors ✘ Making critical business decisions can take longer with more investors |

💡Tip: When selecting an equity financing option, evaluate the investor's expertise, track record, and their fit with your business goals. Seek investors who can bring more than just financial support to the table. Better yet, make sure that these people are someone you can get along with, too.

TOCAlternative Financing: Exploring Unconventional Avenues for Business Expansion

In addition to traditional debt and equity financing, there are alternative funding options worth exploring. These include the following:

TOC1. Grants

Government grants and subsidies are available to support businesses in specific sectors or for projects that contribute to social or environmental objectives. If you don’t need funds ASAP and your business fits these ideals, then this is a good option for you. Take your time to research and apply for relevant grants that align with your business.

TOC2. Government Loans

Government-backed loans, such as those offered by the Small Business Corporation (SBC), provide accessible financing options for businesses. These loans often come with favorable interest rates and terms, making them an attractive choice for many entrepreneurs. But due to bureaucratic processes, it might take a bit longer for your funds to be disbursed.

TOC3. Revenue-Based Financing

Revenue-based financing allows businesses to secure funding based on their projected future revenue. It offers flexibility in repayment, as the amount repaid is tied to a percentage of the company's future revenue.

TOC4. Peer-to-Peer Loans

Peer-to-peer lending platforms connect borrowers directly with individual lenders, cutting out traditional financial institutions. This method can provide quicker access to funds and more flexible borrowing terms, offering an additional avenue alongside business loans.

TOCCombination Financing: Harnessing the Power of Synergy

When it comes to funding your business expansion dreams, why settle for just one option when you can have a fantastic fusion of financing possibilities? Combination financing is like mixing your favorite ingredients to create a recipe for success. Let's explore how this approach can help you achieve your goals.

TOC1. Mixing Debt and Equity: Finding the Perfect Balance

If you want to expand your business while still retaining full control of your business, that's where the magic of mixing debt financing with equity investment comes into play.

By harnessing business loans, you can secure the much-needed capital to fuel your growth spurt while keeping the reins in your capable hands. Use those funds to supercharge your operations, hire top-notch talent, or upgrade your equipment. But wait, there's more! With equity investment, you invite external investors to join your journey. These investors not only bring in financial support but also share vital industry wisdom and connections you might not get elsewhere.

TOC2. Tapping into Alternative Sources: Diversifying Your Funding Arsenal

Grants and government loans often come with attractive terms and can be a delightful treat for your business expansion plans. Meanwhile, revenue-based financing offers a fresh twist by allowing you to secure funds based on your projected future revenue. And hey, why not shake things up with a little peer-to-peer lending? It's like borrowing from your supportive network of friends who believe in your vision.

By harnessing the power of synergy, you'll end up with enough funds that can help your business grow and ensure your business's success story continues to unfold.

Final Thoughts

Funding your business expansion in the Philippines requires careful consideration and exploration of various financing options. Whether you choose business loans, equity financing, alternative options, or a combination of strategies, be sure to align your choice with your business goals and financial capabilities.

Remember, funding is not just about obtaining capital. It's also about finding partners who can contribute to your business's long-term success! Good luck, luv! We’re all rooting for you.