Like anyone else, we hate trust issues. You can sleep soundly knowing you and your money are safe in the Tonik App, luvs. Here’s why.

Cyber security is one of the biggest things to consider when choosing the mobile banks to place your money in. After all, nobody would ever want their hard-earned cash lost due to weak security measures and outdated systems. Nowadays, multiple cases of cyber security issues have been hitting local news more and more frequently, such as data breaches, phishing scams, system hacking, and the like. We get how scary this must be for customers everywhere and we don’t blame people for having trust issues when it comes to digital banking.

This is exactly why we’ve invested a heck of a lot of money into Tonik App safety and cyber security! Because trust issues really suck and that’d get in the way of our healthy, growing neobanking romance with you, right? We want you to be able to sleep soundly at night and build your confidence with us. To prove to you that we mean business and show you how Tonik protects Tonik Accounts from fraudsters, here’s a handy list of our online banking security measures that’ll make any sort of cyber security threat go bye-bye! You’re definitely safe in our hands, luv.

Table of Contents

1. Tough-to-crack passwords

First things first—passwords! You already know the usual password rules, such as keeping it safe, changing it often (just like your undies), and mixing it up or having a password generator. Once you've set your passwords, these are safeguarded by us even further through RCA asymmetric encryption, including your OTPs. Encryption ensures that your passwords and OTPs are converted into secret code so that they’re pretty much un-hackable! Our encryption is also at the same level of encryption used by intelligence agencies. Super awesome online banking security measures, right?

TOC2. Biometrics and facial recognition

We know you like no other person does, hun! Our awesome partner, Daon, whom we’ll talk more about later, provides identity verification services for Tonik, including fingerprint biometrics and facial recognition! So, if your ex or some nasty fraudster attempts to log in with your password or OTP from another device, they won’t be able to do so. Why? Because of your unique and uber good looks, luv! We’ll be requesting facial recognition to verify if it’s really you trying to log in, as per our one-device only policy. And you’ve only got one face, so that’s crazy impossible to fake, right?

TOC3. Two-factor authentication or 2FA

In relation to the first two items, we make sure two-factor authentication is always on when you try to change your password. Again, this is to verify that it’s really you updating it! When you attempt to reset your Tonik password, you’ll be receiving an OTP on your registered mobile number and then go through the facial recognition process. The more verification steps, the better for Tonik App safety, cyber security, and overall online banking security measures! Your good looks are yours and yours alone, hun, and you’re lucky we love it so much, and no one else’s!

TOC4. Safety from malware, viruses, phishing scams, and other nasty things

Phishing scams are running rampant nowadays, especially if you’ve heard the news of those scam texts and emails. Recently, people have been getting false ads of news jobs and sales promos, which are actually just scams. An innocent click of a button can launch malware or programs that can invade your phone. But with Tonik, you don’t have to worry! If you catch any of those nasty stuff on your phone by accidental clicking or other means, V-Key, our leading, globally recognized cyber security partner, will block your Tonik App from launching in the first place. Compromised devices are a huge no-no for us and we’ll totally know if yours is!

TOC5. We can keep a secret

Data breaches and the selling of personal information have also been one of those crazy pandemic things that have been happening in the country, especially with all those contact tracing forms. But we assure you that your data is safe with us, luvs. All your customer data is stored safely on the Amazon cloud with Advanced Cloud Security provided by AWS Shield. Say goodbye to external threats like cyberattacks and data theft. Your secret’s safe with us. Just cyber security things!

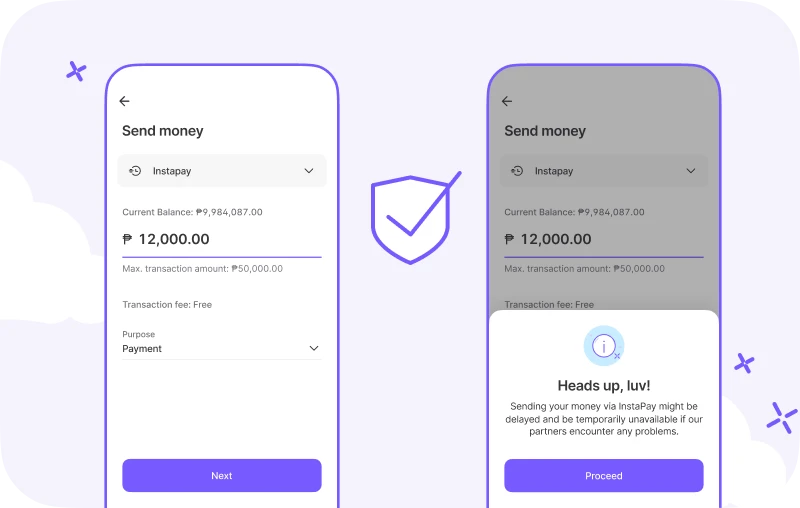

TOC6. Super-duper secure transfers

Encryption is truly key when it comes to Tonik App safety and online banking security measures. Don’t worry about all your transfers and transactions. They aren’t going anywhere. 256-bit encryption protection puts all transactions through secure channels that can’t be intercepted. Our security operations center monitors all customer-related activities for any possible threats coming from outside.

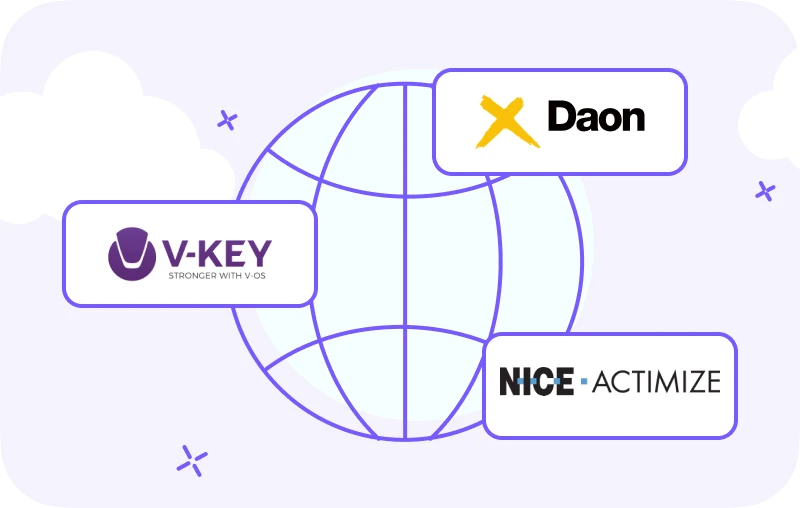

TOC7. Our world-class cyber security partners

As mentioned earlier, we’ve partnered with only the best, world-renowned cyber security companies for our online banking security. They ensure your utmost safety, luvs, and their portfolio and track records speak for themselves.

Daon provides our identity verification services, such as fingerprint and facial recognition biometrics. Daon is a world leader in identity technology and is trusted by leading brands all over the globe, from banks, hotels, airlines, and more. The company serves hundreds of millions of users on six continents and relies on the capabilities of only the finest experts in their field.

V-Key, on the other hand, is the operator behind multi-factor authentication, safe payments and transfers, personal data protection, and overall mobile app security. In our Chief Bulldozer Greg Krasnov’s own words, “We selected V-Key because of V-Key’s history with major banks around the region, where its solutions were well-validated and tested. Its technology is protected by a global patent and has been proven to deliver the trust factor and security to customers, which is among the most important issues for our potential customers in the Philippines.”

Finally, we’ve got NICE Actimize on our roster of cyber security superheroes. This partner is a leader in Autonomous Financial Crime Management and they provide their Essentials Anti-Money Laundering solutions. Their cloud-based product is built upon NICE Actimize’s proven, end-to-end anti-money laundering platform which includes Transaction Monitoring, Customer Due Diligence, and Sanctions Screening capabilities.