"Is digital banking safe in the Philippines?" This neobank has the answer.

If you’re asking if we have protection, the short answer is: yes we do. We believe that digital banking in the Philippines can be safe while still giving everyone a good time. We should know ‘cause we’re making it happen.

Tonik is the Philippines’ first ever neobank (meaning we’re purely digital!). While everyone has been raving about our high bank interest rates and convenience, our top priority is still your security.

Let’s cover all the bases before we get it on, shall we?

Table of Contents

FIRST BASE: We’re here for you with legit digital Philippine banking.

Trust is the foundation of any relationship, so let’s start ours on the right foot. Tonik made it official with the Bangko Sentral ng Pilipinas (BSP) as the first digital-only bank to receive the first digital banking license in the Philippines.

Our deposits are insured by the Philippine Deposit Insurance Commission (PDIC) up to 500,000 PHP per depositor. We have your back as you grow your money in our Tonik Account, Stashes, and Time Deposit.

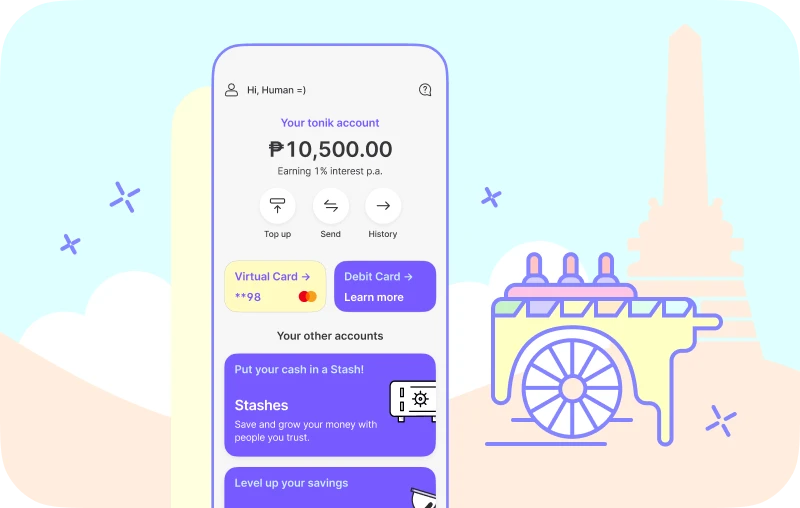

We have the products and services to compete with traditional banks like high-interest Savings and secured Debit Cards. We also have Tonik Shop Installment Loan for your gadget and home appliance needs, as well as Tonik Credit Builder Loan, a quick cash loan that helps you build good credit!

SECOND BASE: We go all-out and all-around-the-world for your security.

You always inspire us to take digital banking in the Philippines to the next level. Tonik aced evaluations from the Certified Information Systems Auditor (CISA), the world’s top expert for IT security audits.

Our cloud-based banking is powered by global financial technology leaders like Mastercard, Finastra, and Amazon Web Services. With cloud-based banking, we can act faster in emergencies, update our system against new threats, and integrate services for your ease and safety.

Our partner international mobile security experts, Daon, V-Key, and NICE Actimize, guard your data against malware and fraud. We’re bringing the big guns: military-grade encryption for your passwords and OTPs, Face ID biometrics, and automated fraud monitoring and control.

Rest assured that we are highly secure, and our security is tough. We can stay up, even during global tech glitches. We’ve got this, luv. Your money’s safe with us!

THIRD BASE: We're matching your lifestyle online and offline.

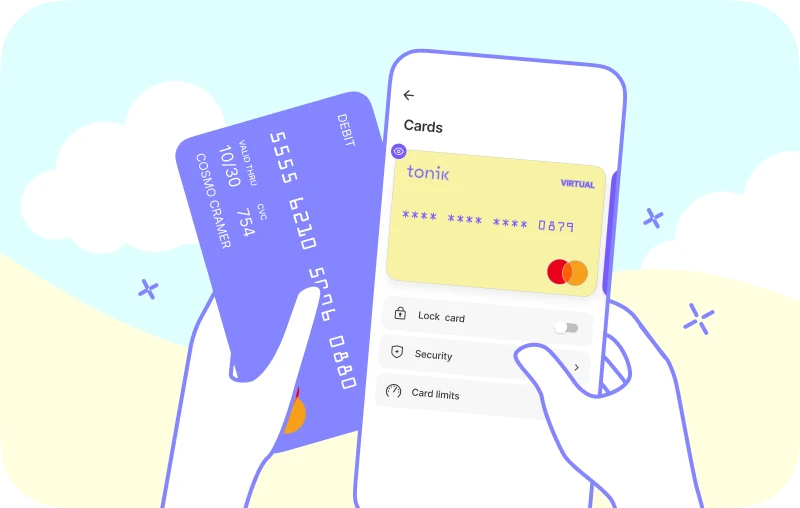

Use our cards for whatever you want, luv. Tonik Virtual and Physical Debit Cards were made for when you’re tapping “Add to Cart” or placing groceries into your pushcart.

Both Debit Cards are secured by Mastercard’s bodyguards, 3D Secure and Advanced Antifraud. So go and use our partner’s global network to your advantage. You’re more than welcome at most ATMs and card-accepting merchants in the Philippines.

When it comes to your payments, we collaborated with Radar Payments to help them go smooth like butter. We’re proud to say that Tonik is the first bank in the Philippines to be certified as compliant with the world’s Payment Card Industry Data Security Standard (PCI DSS).

You also have the power to protect yourself. Just open our money management app to freeze and unfreeze transactions, set spending limits, and even switch off the Debit Cards when they’re not in use. (No wonder hackers hate us.)

Your Virtual Debit Card is more than just a nice, free option. It’s a safer way of doing transactions online and faster to replace in emergencies. You can still order the Physical Debit Card if you prefer, which won’t have your name or card number on the face. We’re serious about protecting your data and privacy.

But it’s not only your Debit Cards that are secured. Your money stash is protected too. While your Debit Cards are linked to your main Savings Account, your Stashes and Time Deposits aren’t. Splurging while saving is entirely possible.

FOURTH BASE: We have big plans for our future together.

Tonik has always envisioned financial inclusion for everyone you love and more. When we found out that 70 percent of Filipinos remain unbanked, we knew we had to do something about it.

So we opened up the world of Savings products and Debit Cards to everyone through our neobank. Onboarding can be done on your mobile phone in as fast as five minutes. It’s quick, accessible, and secure, thanks to our security features and partners (Also Read: 10 Awesome Ways You Can Rock With a Tonik Stash Savings).

As we mentioned earlier, we also offer a quick and easy online cash loan, Tonik Credit Builder Loan! The first of its kind in the Philippines, it’s a loan that helps you build credit while borrowing up to P20K.

If you’re wondering “What is a credit score?”, it’s a way for lenders to gauge how responsible you are to pay back loans. It’s a standard measurement of trustworthiness across financial institutions.

Together, let’s make our dreams a reality.

If that’s a home run for you, hit download and let’s start this neobanking romance.