In case you missed it — Future Finance Manila 2022, a forum dedicated to the digital transformation journeys of Retail Banks and Insurers across the Philippines, was held last July 28 at Crowne Plaza Galleria, Quezon City. The live forum had the most esteemed speakers to talk about their respective companies and important issues on the country’s digital landscape, one of them being none other than our very own Tonik Country President, Long Pineda.

This awesome biker-slash-neobank president engaged a large crowd and represented Tonik excellence, speaking on the company’s behalf and how exactly we’re pursuing our mission to further financial inclusion in the Philippines.

Got FOMO? We’re here to step in and recap Long’s insightful talking points. Apart from financial inclusion, she also spoke much about Tonik’s journey from day 1 and lots more facts that you might not have known about us. Read on and learn more right here!

Table of Contents

- 1. Tonik’s main mission is to make financial inclusion in the Philippines more widespread than ever

- 2. Tonik started in 2018 and launched in 2021 during the pandemic

- 3. Tonik got its digital banking license in June 2021 and transitioned into a digital bank on Valentine’s Day 2022

- 4. Tonik launched #NeoNormal—it's the first neobank in Southeast Asia

- 5. Launching during the COVID-19 pandemic made Tonik more innovative in serving our market

- 6. Tonik puts the customer first

- 7. Tonik is one of the best funded fintechs in the region

- 8. Tonik has core values not seen in any other bank

- 9. Tonik has hubs in Singapore, Manila, and Chennai

- 10. Tonik is a controlled licensed bank subsidiary in the Philippines.

TOC- Table FInd

1. Tonik’s main mission is to make financial inclusion in the Philippines more widespread than ever

Tonik was actually born out of a noble cause to further the Bangko Sentral ng Pilipinas’ (BSP) drive for financial inclusion in the country.

Wait, so what exactly is “financial inclusion”? According to The World Bank, financial inclusion means that individuals and businesses have access to useful and affordable financial products and services that meet their needs delivered in a responsible and sustainable way. Did you know that around 70% of the Philippine population remains unbanked? This is the problem Tonik aims to fix by providing quick financial services, fully online, to the average Filipino with a mobile phone.

“When we speak about financial inclusion, we have to consider that when products are designed, you're talking about not just savings products, not just investment, you're also talking about insurance products,” Long mentions as she elaborates a part of the population not being able to access traditional banks. “All of these need to be designed considering the special needs of that segment of our population.”

TOC- Table FInd

2. Tonik started in 2018 and launched in 2021 during the pandemic

Tonik’s Founder and CEO, Greg Krasnov, along with Long, pitched the idea of the company to the BSP in 2018, who loved it. But because of COVID, it came to a standstill, and only on November 2020 was Tonik able to do its beta launch. Media buzz already began before Tonik’s commercial launch in March 2021, and we were able to make millions in deposits (USD 150 million, to be specific) since then. Not to mention, we got more awesome services like loans and bills payment. It’s only upward from here!

TOC- Table FInd

3. Tonik got its digital banking license in June 2021 and transitioned into a digital bank on Valentine’s Day 2022

We finally got our digital banking license from the BSP in June 2021, along with five other applicants. We also got to officially transition into a digital bank on the most appropriate day for Tonik—Valentine’s Day 2022, February 14! It’s only relevant since we’re in this neobanking romance together, right, luv? And we’re extremely proud to be officially the first bank to be granted a digital bank license in the Philippines!

TOC- Table FInd

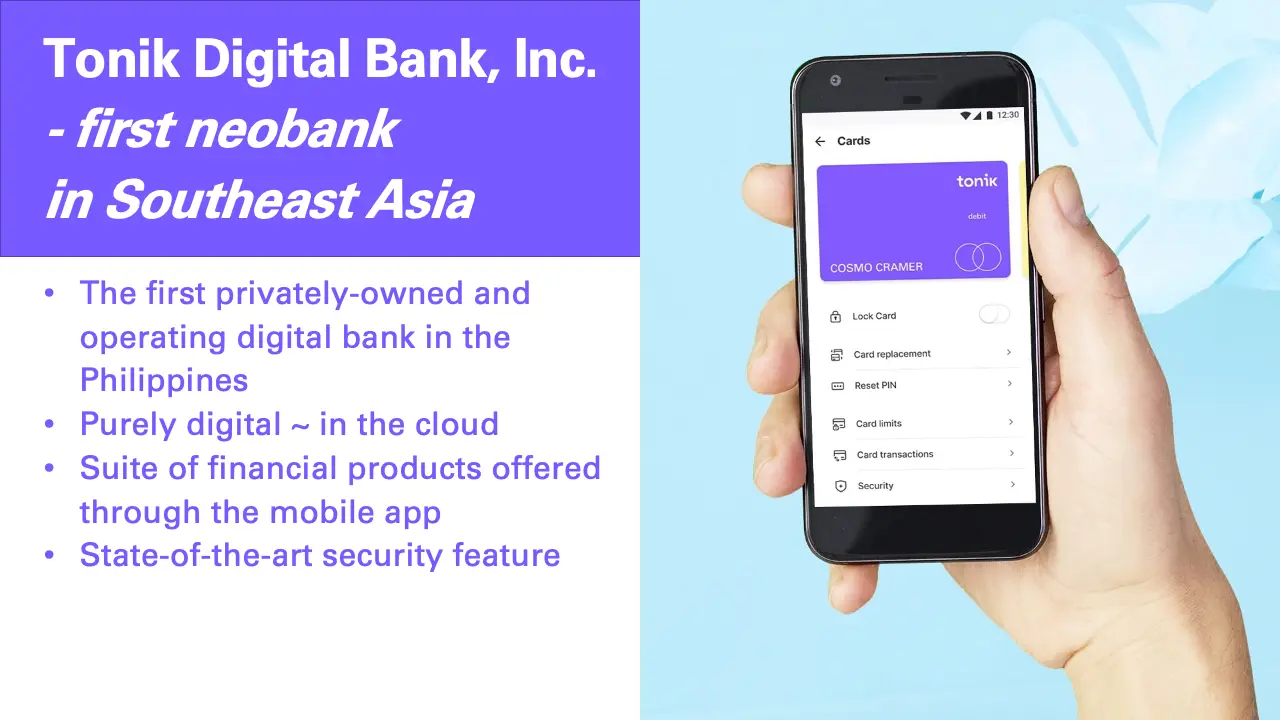

4. Tonik launched #NeoNormal—it's the first neobank in Southeast Asia

But wait, so exactly what is a neobank? In its essence, it’s a purely online bank whose services and products are on the cloud. All transactions are done online. Long also says that it’s not just the internet. “When you speak of digital banking, you speak of other things that are involved. First, you speak about being actively engaged in social media, because that's the only way you can get feedback from your customers. It's also important that it be on a mobile platform. In the Philippines, it's common for most people to have at least two mobile phones. They may not have internet in their homes, but they do have mobile phones.”

She continues, “Digital banking is also fast. Plus, you need to be able to attend to your customers 24/7, 365 days a year. It's supposed to be customer-centric, which means the products are designed around how the customer wants his account to work.”

TOC- Table FInd

5. Launching during the COVID-19 pandemic made Tonik more innovative in serving our market

“In effect, we had that rare opportunity of setting up a bank that was going to operate on a digital platform while doing it in a completely digital way. We set up a bank and brought people on board without even seeing each other face to face because of COVID,” says Long. But it worked to our advantage and allowed us to be more innovative, finding new ways to serve the customer.

We knew speed and ease of access were things we needed to work on as a neobank, therefore we partnered with the best-in-tech vendors and service providers (more on this later). Plus, we understood the importance of multiple touchpoints in the digital world. Other than our app, we needed to reach our customers through other online platforms, like our website, social media pages, and the like.

Long continues, “What we learned was that we needed to make sure that we invested in the most secure back-end systems to protect our customers' funds. What COVID also taught us was that because people are now more scared of going out, mingling with others and queuing up to go to a bank, they have to be able to access their bank accounts from someplace that is convenient for them without having to leave the comfort of their homes.”

TOC- Table FInd

6. Tonik puts the customer first

“The way we address our customers at the end of a five-minute journey to open a bank account is ‘Welcome on board, luv.’ Because what we're trying to do is establish a relationship. And when we establish a relationship, you establish trust. So that's what distinguishes Tonik from other players in the market right now,” Long mentions.

You, the customer, are number 1 in our hearts at Tonik. That’s why you’re our luv, hun, darling, and other terms of endearment. We provide customer-centric banking with bespoke financial products catered to your needs, whether those are Quick Loans or awesome, big-saving deposit products like our Time Deposit and Stashes.

Apart from that, you can talk to us whenever, wherever on your Tonik App and access our Customer Care team with ease should you be experiencing any difficulties. Your Tonik journey is as seamless as it can be.

TOC- Table FInd

7. Tonik is one of the best-funded fintechs in the region

Our funding has been a huge deal in various fintechs not just locally, but internationally as well. In a short amount of time, Tonik has raised USD 174 million, including USD 131 million in Series B funding led by Japan’s Mizuho Bank. This was big news to the fintech world particularly in Southeast Asia, since not many startups can say the same.

Long says, “This is also a testament to the very strong strategy that Tonik has and that we have delivered what we promised our investors.”

TOC- Table FInd

8. Tonik has core values not seen in any other bank

We’re not just a regular bank, we’re a cool bank. Kidding aside, Tonik truly tries to break from the traditional norms of your normal brick-and-mortar bank. This is not just seen in our technology, but also in our core values as a company. You’ve probably never heard of a bank that values street smarts and sense of humor in its employees. These traits are just as important as other values like teamwork, honesty, and reliability.

“We take our work very seriously, but we don’t take ourselves too seriously,” Long quips during her talk as she presented various caricature sketches of Tonik’s senior management.

TOC- Table FInd

9. Tonik has hubs in Singapore, Manila, and Chennai

While Tonik’s operations is primarily in the Philippines, with its headquarters in Metro Manila, we also have our Holding Company in Singapore, and our primary R&D center in Chennai, India. We’re a global team working together to serve our purpose and mission of making banking a hundred times more convenient and efficient for the regular citizen. There’s no such thing as borders for us—we work hand-in-hand no matter where we are on the globe.

TOC- Table FInd

10. Tonik is a controlled licensed bank subsidiary in the Philippines.

You might be thinking, can I trust a new digital bank in the Philippines? The answer is a resounding yes. First off, we are regulated by the BSP, and your money will be safely insured by the PDIC. Apart from that, we’ve also beefed up our security and technology and are sure to keep your information and hard-earned cash protected.

Our cloud-based banking is powered by global financial technology leaders like Mastercard, Finastra, Amazon Web Services and Google Cloud With cloud-based banking, we can act faster in emergencies, update our system against new threats, and integrate services for your ease and safety.

Plus, our partner international mobile security experts, Daon, V-Key, and NICE Actimize, guard your data against malware and fraud. We’re bringing the big guns: military-grade encryption for your passwords and OTPs, Face ID biometrics, and automated fraud monitoring and control. Once again, your money is super safe with us!

As Long concludes her talk, “So ladies and gentlemen, this is the journey that Tonik took and we hope to continue contributing to the financial inclusion drive of the Bangko Sentral and help the country move out and recover in terms of the economy.”