4 Ways Tonik is Breaking Down Financial Inclusion Barriers in the Philippines

It’s no secret that the Philippines is on a mission towards financial inclusion for 70 percent of its citizens. This ambitious goal has in fact, been buzzing quite a lot these past two years and as the fintech industry continues to get a significant foothold in the economy, the race to the finish line may just be 2 years up ahead.

While there is a complete roadmap for financial inclusion in the Philippines, one that is already underway, Tonik’s innovative features have been instrumental to breaking down current barriers to meeting this “super impossible dream.”

In this article we will brush up on the Bangko Sentral ng Pilipinas’ (BSP) plans and progress for financial inclusion in the Philippines so far and later on we will talk about the three ways Tonik is breaking down financial inclusion barriers:

-

First neobank in the Philippines - Get banked in just 5 minutes

-

Digital payments - Customers can transfer money as stealth and quick as a ninja

-

Highest-ever interest rates for local deposits - This is the place where you can get SIX

-

Loans - Never-been-loaned-to Filipinos can now get access without a credit history

Read on and you’ll learn how the goal of getting the unbanked banked is now impossible no more!

Table of Contents

- Roadmap for Financial Inclusion in the Philippines

- Digitalization paving the way for financial inclusion in the Philippines by 2023

- How Tonik is revolutionizing financial inclusion in the Philippines

Roadmap for Financial Inclusion in the Philippines

A few years back, The Bangko Sentral ng Pilipinas (BSP) embarked on a journey to present its plan to provide financial inclusion to the unbanked. The timeframe given by the BSP then seemed like a huge stretch considering how the statistics were so glaring – 2019 data from the BSP reflects that there are 51.2 million unbanked Filipinos — it made many employed Filipinos with a salary account think how it was even possible for the unbanked to live a life that allowed them to plan for a bright future. Makes us all think just how ingenious and resilient most Filipinos are to begin with but cut to the pandemic that caused a global lockdown in March of 2020, many Filipinos without a bank account were hit harder than most. Not having access to financing and simply being unbanked or underserved has proven to be a legit problem for all!

The road to financial inclusion in the Philippines was steep even at the start of 2020. It continues to be challenging, but at the onset of a pandemic it unexpectedly got fast tracked primarily because of two things: 1) the Philippine Government’s need to transfer relief allowances on-time during the first Bayanihan to Heal as One Act back in March 2020, in a safe and secure way; and 2) to keep the economy afloat through convenient and cashless digital payments that kept both merchants and consumers satisfied and sustained their daily lives.

While legitimate online banking and other online financing companies had already been operating in the Philippines, the fintech industry had in fact been thriving at the latter part of the decade, the real stimulus that pushed for digital payments and online financing was the desperation for safe, quick, and in-home solutions that allowed us all to move throughout lockdowns.

As unfortunate as the cause-and-effect journey sounds, it took a real tragedy to strike because most of those who comprised the 70% unbanked had too many perceived barriers to opening a bank account. What is interesting to note from all the studies done to get financial inclusion in the Philippines going however, was that the main barrier for many of the unbanked was the lack of a valid government-issued ID.

TOC- Table FindDigitalization paving the way for financial inclusion in the Philippines by 2023

Even before the pandemic, the BSP had already identified digitalization as a highway to financial inclusion in the Philippines.

According to BSP Governor, Benjamin Diokno, who is also known as the financial inclusion champion in the Philippines, the BSP has been financing digitalization because the features some of us currently already enjoy such as fast and easy transactions that “speed up income.” “It also makes financial products and services accessible, which in turn, enhances financial inclusion,” as Diokno puts it.

Traditional banks and other financial institutions are set to expedite their digitalization to align with the BSP’s goal towards financial inclusion in the Philippines, but as this may need more time, it’s the digital banks that unbanked Filipinos can really look forward to due to their innovative business operations and products that support digitalization measures of the BSP.

With the provision of five digital banking licenses in the country this year that will certainly help speed up the need for more banked Filipinos and financial inclusion in general. Another progressive step to look forward to is the PhilSys National ID system implementation that will definitely help unbanked Filipinos register for a bank account. At the rate developments are being done, the BSP’s goal to digitalize 50% or half of all transactions by 2023 that includes the financial inclusion of the 70% unbanked, can actually be attainable. This gives us Filipinos one more reason to smile and stay positive as better banking benefits have become just a download away!

TOC- Table FindHow Tonik is revolutionizing financial inclusion in the Philippines

Neobanking - NEO like NEW!

Open a bank account in 5 minutes! This is one of Tonik’s main propositions as a neobank - customers can do banking anytime, anywhere, right in the comfort of their own home without ever having to go to a bank. And we mean never. Tonik, as the Philippines’ first neobank, does not have a single branch. We are also the first neobank in the retail banking industry to get a digital banking license from the BSP. If you’re thinking, we will probably open a branch after the Philippines reaches heard immunity, that will also never happen.

We bet that before the pandemic, more than 70% of adult Filipinos also never thought of being able to open a bank account without having to enter a branch and speak with a branch manager in person. Well, Tonik’s founder and CEO had been aware of this way before he started Tonik. With knowledge on the great need of unbanked and underserved Filipinos, Tonik has definitely provided now-on-demand possibilities to consumers, acting as one of the newest catalysts to financial inclusion in the Philippines. We are literally the first digital bank to do banking 100% in the cloud.

One way is through its electronic know-your-customer (e-KYC) process. That’s how Tonik is able to approve bank account applications super fast! Partnered with best-in-industry third party banking solutions, we are able to securely and accurately screen our customers. Through this cloud-based process, we are able to provide customers quick, easy and hassle-free onboarding.

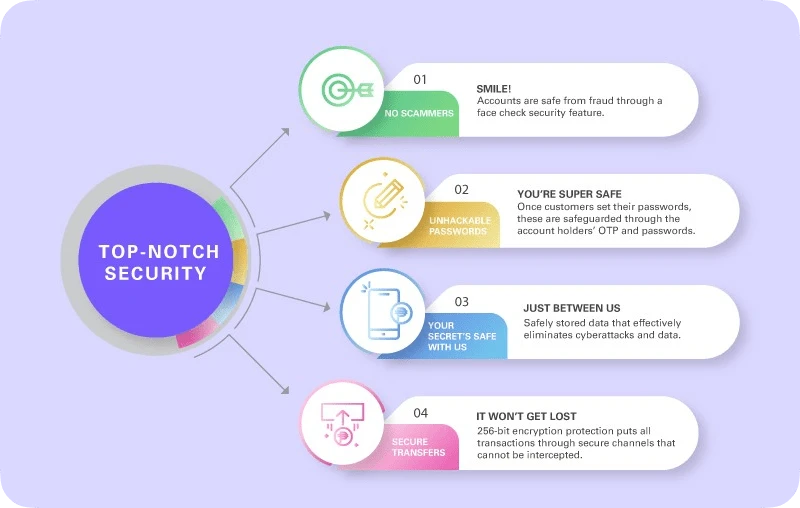

Cloud-servicing has also allowed Tonik to provide customers with secure bank accounts through our top-notch security partners like DAON. Our digital ninjas have been ensuring that customers sleep well each night knowing that no one can hack into their accounts. This is ensured through the following:

-

NO SCAMMERS - Accounts are safe from fraud through DAON’s server-based face check security feature. Customers’ accounts are protected should they lose or get their mobile phones stolen, even if the face ID is changed.

-

UNHACKABLE PASSWORDS - Once customers set their passwords, these are safeguarded through RCA asymmetric encryption of the account holders’ One-Time Pins (OTP) and passwords. This is the same level of encryption used by intelligence agencies.

-

YOUR SECRET’S SAFE WITH US - Customer data is stored safely in Amazon cloud with Advanced Cloud Security provided by AWSshield. This effectively eliminates external threats like cyberattacks and data theft.

-

SECURE TRANSFERS - 256-bit encryption protection puts all transactions through secure channels that cannot be intercepted. Our security operations center monitors all customer-related activities for any possible external threats.

On top of that, customers’ savings are ensured up to P500,000 by the Philippine Deposit Insurance Corporation. Visit our page to learn more about the security features of our Tonik app here.

With security fears addressed, customers can almost mindlessly go right ahead and download the Tonik app on Android or iOS. This really is one big leap for financial inclusion plans in the Philippines. All they need is a mobile phone, a stable wifi or mobile internet connection and one of any of the six valid government ID that we require:

- Philippine passport

- Philippine Driver’s license

- UMID

- SSS ID

- PRC ID

- Postal ID

Customers need not worry as Tonik is working on adding the National ID to our list – we are currently in the testing phase.

We have also created an onboarding instructional video to help customers who may be a little technophobic in this video.

TOC- Table FIndInnovative Digital payments - more than your ordinary digital wallet

Once customers open a bank account through the Tonik App, they automatically get a Tonik virtual card that they can use right away as long as they have deposited to their Tonik accounts. This is the best way to shop safely indoors and get purchases – no additional step needed, stress free, all made possible, the “Neoway.”

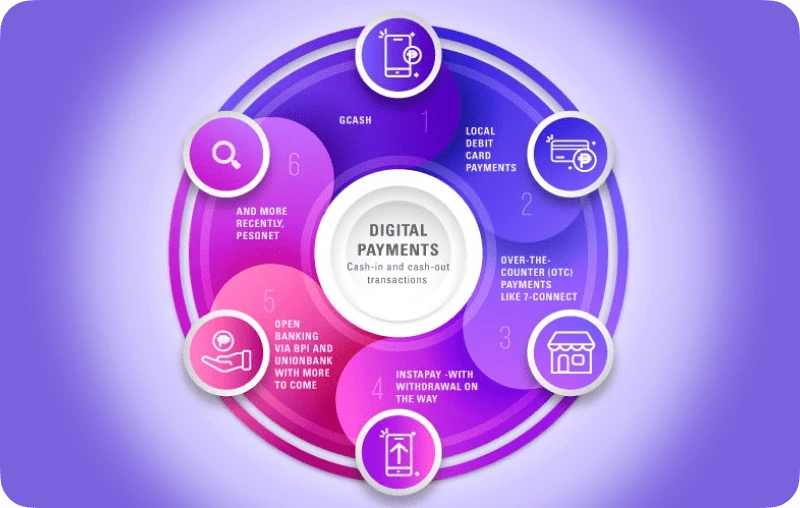

As mentioned earlier, the stimulus that paved the way for fintech to undergo a huge contraction was digital payments. To facilitate an even faster route to financial inclusion in the Philippines, Tonik has provided multiple deposit and withdrawal channels for consumers starting with the usual suspects like:

-

GCash

-

Local debit card payments

-

Over-the-Counter (OTC) payments like 7-Connect

-

Instapay - with withdrawal on the way

-

Open banking via BPI, Unionbank, and BDO with more to come

-

And more recently, PESONet

Even as the local “neo kid on the block,” Tonik has seen a significant traction on its digital payments and has helped move the BSP’s digital payments transformation roadmap, which prioritizes PESONet and Instapay payment schemes. Why? Because both digital payments schemes deliver fast, convenient, and secure retail payment options that are absolutely in line with lockdown protocols and measures that have added to the contraction of the local fintech industry. This will definitely disrupt existing business processes and accelerate the speed of digitalization and financial inclusion in the Philippines further.

TOC- Table FIndSuper BIG Deposit Savings that change the game for Financial Inclusion in the Philippines

BUT the real game-changer in the banking industry is Tonik’s competitive advantage of offering the BIGGEST interest rates in the country. This is the place where you can get SIX!

Digital banking or the #Neoway has been a breath of fresh air and a much-needed development as the world still struggles with reaching heard immunity. Small businesses and individual merchants have shifted to an all-digital payment scheme, for some, even all-digital solutions.

Addressing the need for an all-digital solution to restore the supply and demand balance, Tonik also addresses the greater consumer need: higher interest rates for deposits. While many lived on emergency savings and daily wages, Tonik has re-introduced the concept of easy savings – in the way that many couldn’t imagine an existing bank could provide them.

We really want Filipinos, especially the unbanked and underserved that’s why Tonik launched with a 6% interest per annum on its six-month term Time Deposit product. This means that ach Tonik customer is entitled to one time deposit with that special rate. How do we do it? Goes all the way back to Tonik being a neobank, not incurring costs on bank branches and other overhead expenses.

Tonik provides customers with varied choices to allow them to manage their savings – essentially, fall in love with saving even more through control over the date of maturity for their Time Deposits or time frame of their savings for Stashes. Check out the different deposits products and interest rates below:

TOC- Table FInd

Time Deposit

Customers can open one starting with an amount for as low as Php5,000. There are also no early withdrawal fees or penalties, just documentary stamp tax paid to the government if the customer withdraws early.

Learn more about Time Deposit terms and interest rates here.

TOC- Table FInd

Solo Stash and Group Stash

This is the super fun part in the world of neobanking. Stashes are essentially digital piggy banks for specific purposes. Say, customers have different wish lists for a new gadget or even an anniversary event for their loved one, they can put money in a specific stash so they can easily monitor their goals by keeping track of each Stash that even have pictures to remind them why they need to achieve their savings goal in the first place.

A Solo Stash lets users get a 4% per annum interest rate. Meanwhile, a Group Stash lets customers team-up with another Tonik user for their savings goals with a bigger rate of 4.5% interest per annum. These can be withdrawn anytime without a lock-in period.

Learn more about Stashes here.

TOC- Table FInd

Tonik Account

Every registered account gets 1% base interest rate per annum. Payout is monthly.

Learn more about your Tonik Account here.

TOC- Table FIndTonik’s Credit Builder Loan, providing financial inclusion to unbanked and underserved Filipinos without pulling credit history.

Apart from helping Filipinos save, Tonik provides loans. Customers can apply for a Credit Builder Loan in as fast as 30 minutes. This is a first in the local market as it is able to approve loans to the wider middle-class segment without having to base the loan approval on their credit history. If a customer has already created a Tonik account and has upgraded their account with a valid government-issued ID, then they can take a Credit Builder Loan based on the requirements found here.

While traditional banks have been focused on the top 5 percent of the Philippine market, we have the technology to unlock the credit potential of the mass market- most of who would be taking out a loan for the very first time in their entire lives.

Now tell us with a straight face where else in the Philippines an unbanked and underserved Filipino can get that all in a legit digital-banking-licensed and BSP-regulated neobank like us?

These are just four concrete ways Tonik is breaking down barriers to financial inclusion in the Philippines, but we just started – literally at the end of Q1 2021! We promise we’ll be rolling out something new every month now that we’re allowed to maximize our digital license.