Let’s chat about something we often push to the back of our minds: retirement. It might seem a lifetime away, especially when you're juggling daily expenses, but planning for retirement is a bit like setting up a domino effect — start it right, and everything falls into place beautifully. Not only is it essential for your financial health, but getting a jumpstart on retirement planning can be the key to a relaxed and secure golden age. So, why not ensure your future self can kick back and enjoy without a worry?

Table of Contents

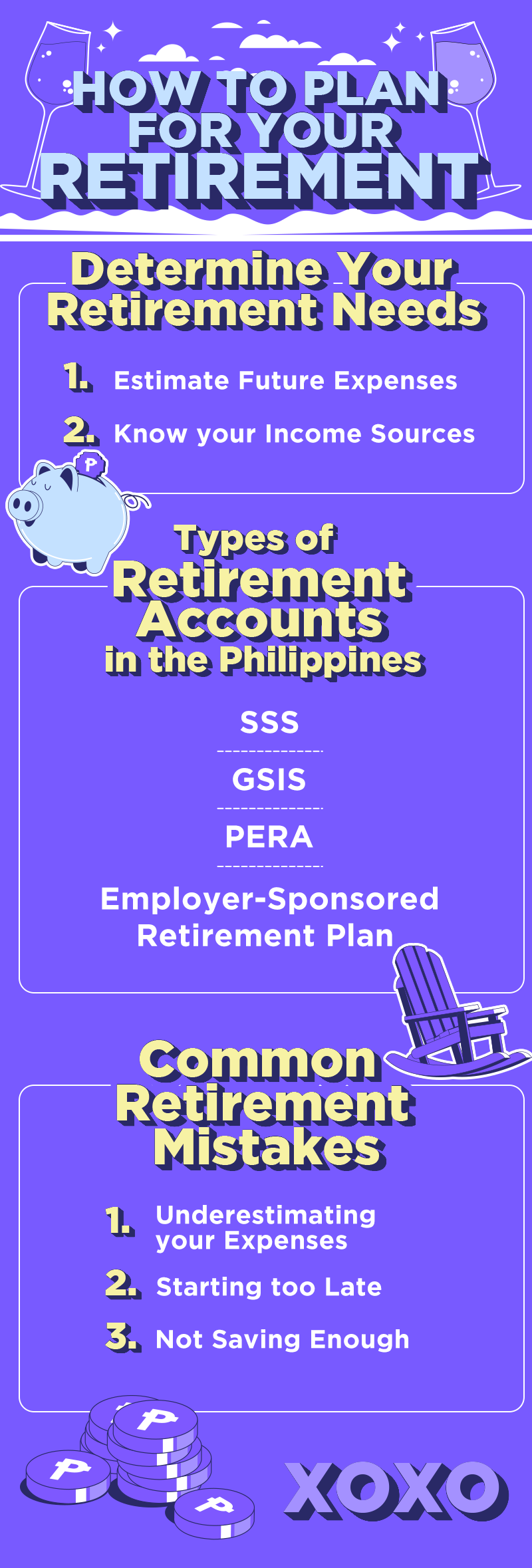

Determining Retirement Needs

First things first: how much will you actually need? This step is all about predicting your future lifestyle and figuring out how much it'll cost. Here’s what to consider:

- Estimate Future Expenses: Think about your current expenses and how they might change. Housing, healthcare, travel, and hobbies all come into play.

- Income Sources: Will you have a pension? How about personal savings or investments? Don’t forget about potential passive income sources like rental properties or dividends.

Crafting a clear picture now can help you avoid financial surprises later on.

Types of Retirement Accounts in the Philippines

In the Philippines, you’ve got a few options to park your retirement savings, each with unique benefits. Let's dive into some of them:

- Social Security System (SSS): This is for private sector employees and self-employed individuals. SSS provides a variety of benefits that go beyond just retirement pensions, including disability, maternity, and sickness benefits. The pension you receive depends on your paid contributions and the number of active years in the system. It's a defined benefit scheme, which means the benefit amount is determined by your covered earnings and your contributions.

- Government Service Insurance System (GSIS): Similar to SSS but specifically designed for government employees. GSIS offers its members benefits that cover a broad spectrum, including life insurance, retirement, and the GSIS Financial Assistance Loan (GFAL). Like SSS, the retirement benefit is based on the member's years of service and the compensation received.

- Personal Equity and Retirement Account (PERA): PERA is designed to be the Filipino version of the Individual Retirement Account (IRA) found in the United States. It allows individuals to save and invest for retirement with significant tax advantages which enhance the growth potential of the invested funds. Contributions to PERA are tax-deductible up to a certain limit (currently ₱100,000 per annum for residents and ₱200,000 for OFWs), reducing your taxable income for the year.

- Employer-Sponsored Retirement Plans: Many companies in the Philippines offer their own retirement plans, which can be a defined benefit plan (providing a fixed, pre-determined benefit upon retirement) or a defined contribution plan (where benefits are based on the fund's investment performance). One of the key advantages of employer-sponsored plans is the potential for employer-matched contributions. This means that for every peso you contribute to your retirement plan, your employer might add an equal or partial amount up to a certain limit. This effectively doubles your savings rate and significantly boosts your retirement fund.

Investing for Retirement

When it comes to growing your retirement fund, it’s all about smart investing. Here are some principles of long-term investing:

- Diversification: Spreading your investments across various asset classes like stocks, bonds, and real estate helps manage risk effectively. Each asset reacts differently to the same economic conditions, so diversification helps stabilize your returns over time.

- Risk Management: Your risk tolerance is influenced by your age, financial situation, and how comfortable you are with uncertainty. Younger investors often can afford to take on riskier investments because they have time to recover from market dips, while those nearing retirement may prefer more stable, lower-risk assets to protect their savings.

- Regular Contributions: Consistently contributing to your retirement savings exploits the power of compounding interest, where the returns on your investments generate their own returns. Automating these contributions can also help smooth out the effects of market volatility and ensure you're steadily building your nest egg.

Common Retirement Planning Mistakes

Even the best of us can slip up. Here are a few common pitfalls to avoid:

- Underestimating Expenses: Many people find that their expenses in retirement don't decrease as much as they expected. It's crucial to plan for potentially higher costs, especially for healthcare, and factor in inflation to avoid financial strain later.

- Starting Too Late: The earlier you start saving for retirement, the better. Starting late means you'll need to save much more to accumulate the same amount due to the lost compounding time. Begin saving as soon as you can, even if the amounts are small—thanks to compounding, these can grow significantly over the years.

- Not Saving Enough: Aiming to save at least 10-15% of your income for retirement can set you up for a comfortable future. Adjusting your spending habits early on can make this goal more attainable without requiring drastic lifestyle changes down the road.

Take Action Today

Planning for retirement might seem daunting, but it’s absolutely achievable with the right approach and a bit of discipline. Start by evaluating your needs, choosing the right retirement accounts, and committing to regular investments.

Remember, the steps you take today to secure your financial future will pave the way for a stress-free and enjoyable retirement. Ready to get started? Your future self will thank you, luv!