Banking doesn’t have to be so scary when you’ve got Tonik by your side

Let’s get real right here—banking can be a terrifying ordeal. We don’t even have to use any euphemisms. Even pop culture tends to portray banks in a cold light, and yes, we mean those daunting, often gray buildings with unfriendly staff and grouchy customers all around that we tend to see on our favorite movies or TV shows. Hell, even the Gringotts Bank shown on the Harry Potter films had actual goblin-bankers stashing away piles of gold with long, creepy nails and unfriendly grimaces on their faces.

And that’s just fiction! There are actual things that drive people away from entrusting banks with their money, whether it’s the barely-there savings interest rates, mean tellers, to having to submit a thousand documents just to open an account or get a loan. There’s a reason why around 70% of Filipinos don’t have a single bank account, and it’s because of these crazy banking nightmares and inconveniences that no one wants to get into.

This is where Tonik comes in to reset your entire perception about banking and we promise, no spell needed, that you’ll fall in love with the neo way of banking or #neobanking with us!

While we are technically still a bank, we’re definitely not your regular bank (*insert Mean Girls cool mom gif here*). Why? Because we’re here to bust those nasty banking boogeymen you don’t want to face. Here, we count six banking terrors and how Tonik is here to save the day. Apart from our awesome products, we’ve got even better offers for you as we celebrate World Savings Day on October 31. Read up and check out these spooktacular ways to wake up from your worst banking nightmares with Tonik!

Banking Horror 1: Low savings interest rate

Table of Contents

- Tonik Triumph: Time deposits with 6% interest rates

- Tonik Triumph: All-digital banking at the touch of your fingertips

- Tonik Triumph: Super safe digital banking with Tonik

- Tonik Triumph: Credit Builder Loan

- Tonik Triumph: Virtual debit card

- Tonik Triumph: NO TRICKS, JUST TREATS! No inbound fees on October 31 only!

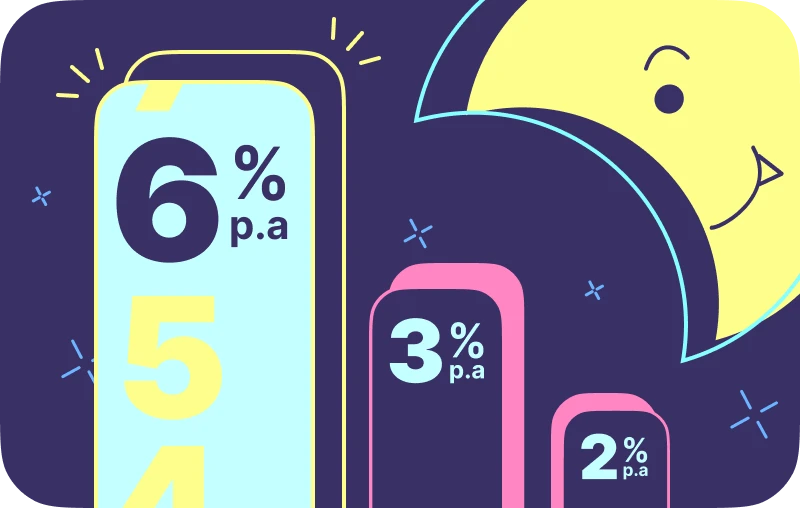

Tonik Triumph: Time deposits with 6% interest rates

Savings accounts and time deposits at more traditional banks hardly get your money anywhere. We’re talking interest rates of 0.5, 0.2, 0.02...even if your money sits in your (ex)bank’s time deposit for years, it’ll barely grow at all. This is exactly why Tonik’s Time Deposits are so revolutionary. Up until today, we offer the highest interest rates (yes, we still allow each customer to get one time deposit with our sweet, sweet 6% interest p.a.) for time deposits, out of all other banks, both traditional and digital! At Tonik, you get to dream big and save big. Even our Stash product, or your regular Tonik savings account, gets you at least a 4% interest rate, which is still a lot bigger than what other banks can give. What can we say? It’s an offer that you can’t refuse.

Banking Horror 2: Long lines and front-facing banXiety

TOCTonik Triumph: All-digital banking at the touch of your fingertips

Some more real talk for ‘ya: literally no one likes going to the bank and doing bank errands. Have you ever heard someone say, “I’m so excited to head to my bank today!” Nah, man. And that’s because going to your local bank straight up sucks, from the hours you’ve got to wait in line, to dealing with staff who look like they’re having just as much a bad day as you are. At Tonik, we’re fully digital and exist right at the palm of your hand—on your smartphone! Because we’re a neobank, all of your transactions are done online and from the comforts of home, or wherever you may be! All you need is a stable internet connection. And if you need to talk to someone from Tonik, our friendly customer care reps are here to help you out. Kiss all those hassling bank errands goodbye, because digital banking is the future.

Banking Horror 3: Unsecure banking

TOCTonik Triumph: Super safe digital banking with Tonik

With practically everything being on the cloud with Tonik, you might be wondering if your funds are even protected here. The simple answer is yes, they are totally safe, luvs, and there’s nothing to worry about. Tonik’s cloud is powered by leading fintech leaders Mastercard, Finastra, and Amazon Web Services. Your account is guaranteed protection against fraud by the DAON server-based face check security feature. Apart from that, your passwords and OTPs are subject to military-grade encryption, and your money is insured up to PHP 500,000 per depositor by the Philippine Deposit Insurance Corporation (PDIC). We’d get into more techie stuff here but we don’t want to bore you with more details—we're sure you get the works!

Banking Horror 4: Loans that are hard to get

TOCTonik Triumph: Credit Builder Loan

There are a lot of people out there who’d rather not get loans from banks just because of how damn hard it is. Again, you need multiple documents, plus credit history or collateral that you might not even have. Not to mention the process of going to the bank (here we go again) to apply for that loan. People often resort to borrowing from family, friends, or even worse...loan sharks. Have you ever seen Squid Game? Yeah, we don’t like stuff like that. Tonik’s Credit Builder Loan provides you with an easier time to get that safe and secure loan that’s fast and convenient. You only need 2 documents and 30 minutes on the app to get approved—no credit history needed! It’s called a Credit Builder Loan for a reason. Borrow up to PHP50,000 and pay up within how many months you choose.

Banking Horror 5: Lost or stolen debit cards

TOCTonik Triumph: Virtual debit card

If you’ve gotten your wallet stolen or misplaced your debit cards at least once, then you probably know what it’s like going through the taxing ordeal of having to replace them. This doesn’t include the anxiety-inducing stress you get from worrying if it’s fallen into the wrong hands out to steal your money! Tonik, on the other hand, issues virtual debit cards immediately upon your account opening. Since virtual debit cards aren’t made of plastic, then they’re very hard to steal or misplace, and are much, much easier to use when it comes to all of your online shopping and purchases. Apart from that, you can easily freeze them from your app if you feel like someone shady has gotten ahold of your card details. No calls needed!

Banking Horror 6: Banking fees

TOCTonik Triumph: NO TRICKS, JUST TREATS! No inbound fees on October 31 only!

Banking fees—no one likes 'em. Though 10, 20, 30, 40, 50 pesos might not look like a lot at first, it could get annoying the more you do your transfers and other transactions online. We hate fees a lot, too. So, to give you a treat, Tonik is canceling all inbound fees on October 31, so you can transfer from your (ex)bank to your Tonik account without any of those annoying added fees! Remember that it’s for one day only, so take advantage and put in as much as you can on your Tonik account during World Savings Day!