Would you be ready if (and when) your car breaks down? Can you confidently say you’re prepared to face a sudden layoff? How about an emergency medical expense?

We never wish for these unexpected scenarios to happen… but it’s best to be prepared, luv. That’s why having an emergency fund in place is truly important. With an emergency fund, you have a financial buffer that cushions you from the impact of life’s unpredictable moments, ensuring they don’t escalate into full-blown crises.

That’s why today, we’ve come up with this guide that will help you build an emergency fund suited for your needs and capacity.

Table of Contents

- Popular What is an Emergency Fund?

- The Importance of Having an Emergency Fund

- Assessing Your Financial Situation

- Setting Your Emergency Fund Goal

- Creating a Savings Plan

- Choosing the Right Place for Your Emergency Fund

- Managing and Using Your Emergency Fund

- Common Pitfalls to Avoid When Building an Emergency Fund

- Advanced Strategies When Building Your Emergency Fund

- Kickstart Your Emergency Fund with Tonik Bank

TOC

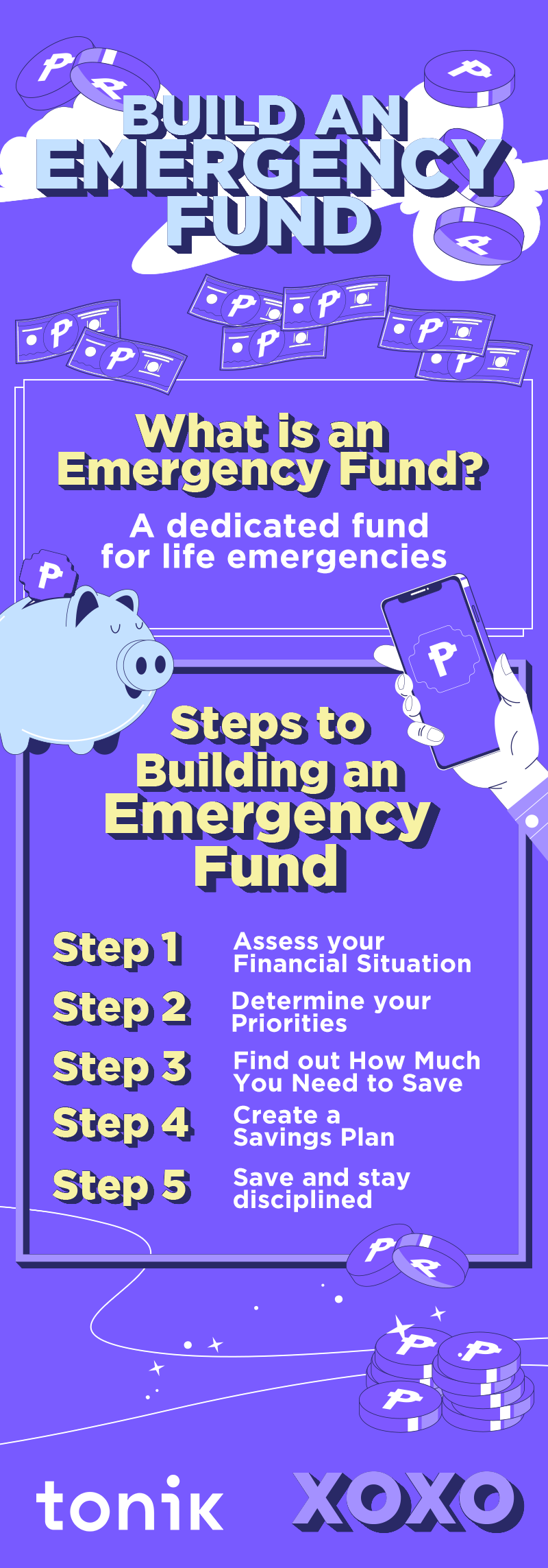

What is an Emergency Fund?

An emergency fund is essentially a financial buffer designed exclusively for unexpected expenses that are not part of your regular budgeting. This fund is not like your other savings accounts in that it is not intended for planned expenses like vacations, holidays, or major purchases. Instead, it's there to cover the costs of genuine emergencies—situations that demand immediate financial attention beyond your normal spending patterns.

Take note that your credit card does not qualify as your emergency fund. It’s just not the same thing, hun!

TOC

The Importance of Having an Emergency Fund

The value of an emergency fund lies in its ability to offer financial peace of mind. Knowing you have a reserve to cover unforeseen expenses means you're less likely to rely on credit cards or loans, preventing additional debt. This fund acts as a financial safety net, ensuring that you're prepared for any situation.

TOC

Assessing Your Financial Situation

Before you start building your emergency fund, you need to know the following first:

Understand Your Income and Spending Habits

To effectively build an emergency fund, start by gaining a comprehensive understanding of your monthly income and expenses. How much are you earning? And how much do you spend for needs each month? This involves tracking all sources of income and every expenditure, categorizing them to see where your money is going. This step is crucial for identifying potential savings and setting realistic goals for your emergency fund.

Analyze Current Savings and Debts

Take note of your current financial assets and liabilities. Assess how much money you have saved and the amount of debt you owe. This evaluation will help you understand your net worth and how much you can realistically contribute to an emergency fund without compromising your debt payments or other financial obligations.

Determine Your Financial Priorities

Answer this question: What matters most to you financially, luv?

Do you want to retire comfortably? Are you looking to fund higher education? Or you simply want to be ready for emergencies? Understanding your financial priorities helps you allocate your resources more effectively, ensuring that saving for an emergency fund doesn't come at the expense of other important goals.

TOC

Setting Your Emergency Fund Goal

How Much Do You Need?

While the general recommendation is to save between 3-6 months' worth of living expenses, your personal goal may vary. Consider factors like job stability, income level, health issues, or the number of dependents in your household. For example, a person living alone can afford to build a much smaller emergency fund than a breadwinner of the family.

Tailoring your emergency fund to your specific needs ensures that you have a sufficient buffer for your unique situation.

Setting Goals

Begin with a small, manageable goal to avoid feeling overwhelmed. For instance, aim to save at least PHP1,000 every cut off then gradually increase your target as you become more comfortable with your saving habits. And when you set aside this fund, never touch it unless it’s actually an emergency! This approach keeps the goal achievable and provides a sense of accomplishment that motivates further saving.

TOC

Creating a Savings Plan

Follow these tips to build an emergency fund faster.

- Budget for Your Emergency Fund: Incorporate your emergency fund contributions into your monthly budget as if it were a fixed expense. This ensures that saving for emergencies becomes a non-negotiable part of your financial plan, much like rent or mortgage payments.

- Identify Areas to Cut Expenses: Examine your spending to find areas where you can cut back without significantly impacting your lifestyle. This might mean dining out less frequently, canceling unused subscriptions, or opting for more cost-effective entertainment options.

- Increase Your Income: Sometimes, no matter how much you budget, you might not have enough money at the end of the day for your emergency fund. To deal with this, consider taking on a side gig, selling items, or simply switching to a job that pays better. The additional income can accelerate the growth of your emergency fund, making it easier to reach your target sooner.

- Be Consistent: Setting up automatic transfers to your emergency fund can simplify the saving process. By automating savings, you ensure consistent contributions without having to think about it each month. Adjust these contributions as your financial situation changes, increasing them when possible, to accelerate your savings growth.

TOC

Choosing the Right Place for Your Emergency Fund

- Requirements for the Account: Your emergency fund should be readily accessible but not so easy to tap into for non-emergencies. Look for accounts that offer a balance of liquidity, safety, and a modest interest rate to help your savings keep pace with inflation.

- Comparing Options: Savings accounts, high-yield savings accounts, and money market accounts are popular choices for emergency funds. Compare these options based on their interest rates, fees, withdrawal restrictions, and accessibility to ensure you choose the best place for your emergency savings.

TOC

Managing and Using Your Emergency Fund

Defining an Emergency

An emergency is any unexpected expense that affects your ability to live or work, such as medical emergencies, urgent home repairs, a sudden job loss, or worse a sudden loss of life not covered by insurance. A bad break up or the threat of missing out on your favorite band’s concert does not constitute as an emergency, luvs! By defining what an emergency means to you, you ensure the fund is used as intended and not for impulse buys or non-essential expenses.

Accessing Funds When Needed

When a genuine emergency arises, it's important to access your funds without hesitation. This might involve transferring money from your emergency fund to your checking account. The ease of access is crucial, which is why the location of your emergency fund matters. But of course, exercise control. Only use the funds when absolutely necessary.

Replenishing the Fund After Use

After an emergency expenditure, prioritize replenishing the fund. This may require adjusting your budget or cutting back on non-essential expenses temporarily. The goal is to restore your emergency fund to its original level to ensure you're prepared for the next unexpected event.

TOC

Common Pitfalls to Avoid When Building an Emergency Fund

- Using the Fund for Non-Emergencies: One of the biggest challenges is resisting the temptation to use the emergency fund for non-emergency expenses. Discipline is key here. Remind yourself of the fund's purpose and the peace of mind it offers by having it available for real emergencies.

- Neglecting Regular Contributions: Consistency in contributing to your emergency fund is crucial. Even small, regular contributions can add up over time. Avoid the mistake of stopping contributions once you reach your initial goal. Life changes, and so might your emergency fund needs.

- Forgetting to Review and Adjust the Fund Size: As your life circumstances change, so should the size of your emergency fund. Regularly review your fund in light of changes to your income, expenses, or family situation. An annual review can help ensure your emergency fund remains aligned with your current needs, luv.

TOC

Advanced Strategies When Building Your Emergency Fund

Diversifying the Emergency Fund: Consider diversifying how you save for emergencies. While having liquid savings is crucial, you might allocate a portion of your emergency fund to higher-yield options with slightly less liquidity for long-term growth. This could include time deposits or high-yield savings account, depending on your risk tolerance and access needs.

Incorporating the Emergency Fund into Overall Financial Planning: Your emergency fund should be a component of your broader financial strategy, which might include retirement savings, investments, and insurance. Consider how these elements can work together to provide a comprehensive safety net. For example, having the right insurance coverages, can reduce the amount you need in your emergency fund for specific types of emergencies.

TOC

Kickstart Your Emergency Fund with Tonik Bank

It’s clear that having an emergency fund is more than just a financial strategy—it’s peace of mind in your pocket. Setting those clear goals, sticking to your savings contributions, and being wise about when to dip into that fund can truly shield you from the shocks life throws your way.

Now, if you're nodding along thinking, "Yep, I'm ready to get this emergency fund sorted," then I’ve got something you might want to hear about. Consider starting your Emergency Stash with Tonik Bank. Imagine not just storing your emergency funds but also watching them grow. Here at Tonik Bank, we offer a nifty 4% interest per annum for our Solo Stash. But wait, it gets better. If you’re into the idea of teaming up with at least two more people for a Group Stash, you can get as much as 4.5% interest p.a. with your savings! How's that for making your money work for you?

So, why not start today? Build that emergency fund with Tonik Bank and take a solid step towards financial security and growth. Let’s make those savings count!