Having a Stash is the #NeoWay of saving for your dreams, opportunities, and emergencies. You may want to think of a Stash saving as a digital savings pocket where you can set aside funds for different purposes or life goals.

Hi there!

You must be reading this blog post because:

A) You’re a curious cat and figured, “what’s the harm in reading a blog post about Tonik’s Stash savings?”.

B) The title and photo about our awesome Stash spoke to the saver inside you.

C) You thirst for knowledge and want to use Tonik’s Stash product to make your life better.

Well, no matter what the reason is, we welcome you with open arms. *free hugs for everyone*

Now, before we get into the nitty gritty of what our Stash product is, let us give you context on how we were able to come up with this innovative product, that essentially acts like a money stash.

When our founder and CEO, Greg Krasnov, was conceptualizing the Tonik App in 2019, he wanted people to gain access to smart and efficient banking opportunities that they didn’t have before. And one of the opportunities he wanted to introduce to people was the Stash savings feature. A smart and new way of saving for your dreams, opportunities, and emergencies. You may want to think of the money stash feature as like a digital savings pocket where you can set aside funds for different purposes or goals you have in life.

Now, you might be thinking, “Tonik, that’s awesome! A digital savings pocket?! I mean what else could I ask for?” And to that we say, “hold our beer”.

Besides describing the money stash feature as a digital savings pocket, our incredible team designed our Stash product with the following goals in mind:

-

Help you set your goals.

-

Help you segregate your savings to actualize your goals.

-

Become a secure financial tool.

We wanted our Stash product to act as a gateway for more people to make wiser financial decisions and become a platform that’ll motivate the saver in them. To do this, we designed our Stash saving feature to help you create SMART (Specific, Measurable, Actionable, Realistic, Timely) goals. And to make it even better, we opted to turn the Tonik App into a platform that’s simple, fun, and motivating to engage with, if you haven’t already noticed.

Yet beyond all this, the primary objective of our Stash product is to really just help you dream big and save bigger. We’re here to help you help yourself if that makes sense. And to do that, we’ve listed down 10 Awesome Ways You Can Rock Your Tonik Stash Savings. Hopefully, this will help you get a better understanding of how you can utilize our awesome money stash feature to achieve your goals and create a better future for you, your loved ones, and everyone else around you!

Now, let’s get started!

Table of Contents

- Preparing for an emergency is hassle-free with Tonik’s Stash Savings.

- Achieve your educational milestones with Tonik’s Stash Savings!

- Plan your next adventure with Tonik's Stash Savings.

- Invest in yourself with Tonik’s Stash Savings.

- Achieve Hobby Happiness with Tonik’s Stash Savings.

- Collect Money and Save up for some awesome gifts with Tonik’s Stash Savings!

- Pool Money Together and Achieve your #CoupleGoals with Tonik’s Stash Savings.

- Make your wedding day extra special with Tonik’s Stash Savings.

- Plan the next chapter with Tonik’s Stash Savings.

- The possibilities are endless with Tonik’s Stash Savings!

Preparing for an emergency is hassle-free with Tonik’s Stash Savings.

stash to organize emergency savings 800x508-min_0.webp)

-

Some situations are beyond our control. For example, this COVID-19 pandemic. We at Tonik believe that one of the lessons this COVID-19 pandemic has taught us is the importance of having an “Emergency Fund”. An emergency fund is a savings pocket dedicated to helping us get back on our feet during tough and uncertain times, such as the COVID-19 pandemic. And although some might say it’s hard to create such a fund, it doesn’t have to be. At least it’s not when you’re using Tonik’s Stash feature. Because Tonik operates on a purely digital platform, creating and managing your emergency fund using our Stash feature is hassle-free, less time-consuming, and much more efficient. The only thing you’ll need to do is set aside a small portion of your monthly income, even as small as 5%, to get started on your emergency fund. As for your target total amount, we recommend saving up to at least 5-6 months' worth of your current salary. This is to make adjusting to your new normal as comfortable as possible. Keep in mind that learning more about Why An Emergency Fund Is Important can help you and your loved ones become financially prepared when facing these kinds of unexpected circumstances. So why don’t you go ahead and start building your own emergency fund with Tonik’s Stash feature now!

TOC- Table FInd

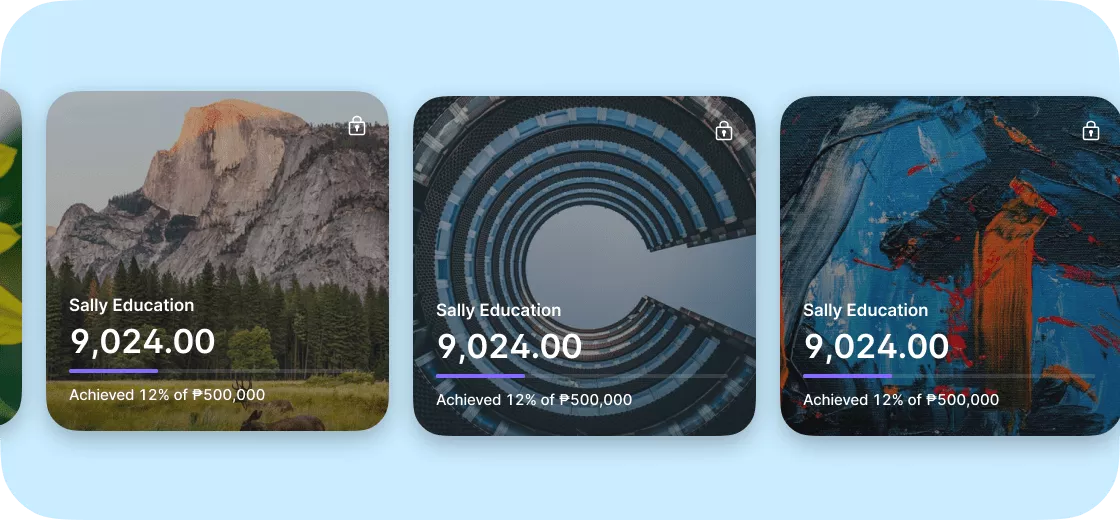

Achieve your educational milestones with Tonik’s Stash Savings!

organize financial goals through stashes 800x508_0.webp)

-

Knowledge is power, and we couldn’t agree more. Here at Tonik, we celebrate those who constantly read up and expound their knowledge, those who are always curious and seek for answers, and those who are innovative in their chosen field or specialty. This is because we at Tonik believe that education is the staircase towards success and innovation. And saving up for your educational needs shouldn’t be a hassle. Good thing Tonik’s Stash feature is here to save the day! Now, you can easily create your very own “Education Fund” to set sail and continue achieving milestones in your roadmap. Have the ability to finally save up and pay for your tuition fee, academic books, and other educational needs right at your fingertips. Now, you go get that bread with Tonik’s Stash feature!

TOC- Table FInd

Plan your next adventure with Tonik's Stash Savings.

stash as digital wallet 800x508_0.webp)

-

Most of us missed traveling this year. All the plans to get a tan on the beach, or snowboard in the winter seem like a distant dream, for now at least. But instead of just wallowing about how your plans didn’t push through, how about utilizing Tonik's Stash feature to save up on a "Travel Fund” for the next year or so? You can start by planning on where you wanna go, where you’re gonna stay, how you plan to go there, and budget all your expenses in an excel or Google Sheet. And once you’ve calculated how much you’ll need to save per month, then you can start using our money stash feature and do monthly/quarterly/semi-annual/annual deposits until you reach your target amount or even more! Now, aren’t you excited about planning your next vacay with us?

TOC- Table FInd

Invest in yourself with Tonik’s Stash Savings.

pocket savings feature in Tonik 800x508_0.webp)

-

Treating yourself is an investment, don’t let other people tell you otherwise. Yes, it’s good to work hard and save money, but it’s also good to reward yourself from time to time when you’ve been out and about working 24/7, 7/11, 168. Why? Well, rewarding yourself for accomplishing a task or making an achievement reminds you that your efforts and accomplishments lead to positive returns. This would then make your brain more motivated to work hard, since it expects you to be rewarded when exerting that much effort. We’re kinda like psychologists, you know? Just kidding (½)! Anyways, you can read up more on Why Rewarding Yourself is Important to know how it can be beneficial and help you achieve your goals. Plus, treating yourself doesn’t have to happen all the time. You can save up for a “Love Myself Fund” using Tonik's Stash saving feature and set aside a bit of your monthly savings for it. And when the time comes to finally reward yourself, at least you know you won’t go overboard. So, go ahead and treat yourself with Tonik’s Stash feature!

TOC- Table FInd

Achieve Hobby Happiness with Tonik’s Stash Savings.

segmentation of money online through stashes 800x508_0.webp)

-

Ever wanted to go on a marathon but just found it difficult to save up for those new kicks you’ve been longing for? Or have you ever desired buying one of those studio-quality microphones so you could finally actualize your dream of becoming a singer-songwriter? Well, you need to stop dreaming and start planning with Tonik’s Stash feature. Begin by doing thorough research on what you need to buy to get you started on your road to hobby happiness. Then, once you’ve narrowed down what your needs are,find out how much each item costs. This will help you plan your budget accordingly and know how much you’ll be needing to save per month. Then when you finish, download the Tonik App, make an account, then open a “Hobby Happiness Fund” with our money stash feature. Keep having fun with Tonik’s Stash feature!

TOC- Table FInd

Collect Money and Save up for some awesome gifts with Tonik’s Stash Savings!

tricks how to set aside money 800x508_0.webp)

-

Are you the type of person who loves giving gifts to your friends, no matter what the occasion is? Well, if you’re not, you should be. It’s fun. But anyways, now you can easily save up for your “Gift of Giving Fund” with Tonik’s Stash feature! (Cues choir music). Through our Stash feature, you can easily deposit, manage, and withdraw money all with the touch of your finger. Now, you can collect money for birthday presents, finally purchase that rice cooker your friend has always talked about, buy your little sister that camera she’s always wanted, or even bring home that action figure your niece has always been curious about. Start saving up for some awesome gifts with our Stash feature!

TOC- Table FInd

Pool Money Together and Achieve your #CoupleGoals with Tonik’s Stash Savings.

maintain solid saving habits through stash 800x508_0.webp)

-

You know that feeling when you finally meet the one? The one that makes your heartbeat fast. The one who makes time move slowly. The one who makes you feel butterflies in your stomach. The one who just suddenly asked if you were interested in purchasing a pre-selling condominium unit that’s fully furnished and has a turnaround time of 12 months. Yeah, that took a turn, right? Well now, saving up for your “#CoupleGoals Fund” has never been easier with Tonik’s Stash feature. When you access our money Stash feature, you can opt to create a “Group Stash” where two or more people can save up to achieve their #CoupleGoals or #SquadGoals. So, before deciding to say “yes”, how about trying out Tonik’s Stash feature first and think about saving up together for that condo?

TOC- Table FInd

Make your wedding day extra special with Tonik’s Stash Savings.

cash for casha 800x508_0.webp)

-

“I do”. Those two words should be what you say when your wedding organizer asks if you have a set budget for your upcoming wedding. Remember, planning a wedding takes a lot of time, effort, and most importantly, money. That’s why having a rough estimate of how much you’ll need for the outfit, catering, venue, food, ceremony, and other wedding essentials are good to know. This’ll help you plan your budget accordingly and calculate how much you’ll be needing to save during the months leading up to your special day. And to make your financial preparations simple, you might want to consider using Tonik’s Stash feature to easily get started on your “Wedding Fund”. We’re here to make your special day extra special!

TOC- Table FInd

Plan the next chapter with Tonik’s Stash Savings.

earn financial independence through stash 800x508_0.webp)

-

Thinking about what you wanna do once you finally retire? Well, if you have, job well done! But if you haven’t, then there’s still time left! It’s never too late nor too early to start building a “Retirement Fund”. Saving as early as your 20s is actually a good thing because during this period, most people aren’t expected to carry that much financial responsibilities yet and therefore, have more opportunities to save up. While on the other hand, it’s also not a bad thing to save up later in the game since your goals and plans can be more realized and actualized. And what’s convenient about creating a retirement fund with Tonik’s Stash feature is the ease, efficiency, and accessibility when making and managing one. So, why not access our Stash feature today and start your retirement fund now?!

TOC- Table FInd

The possibilities are endless with Tonik’s Stash Savings!

creative ways how to save money 800x508.webp)

-

Lastly, why not create an “Anything Under the Purple Fund” with Tonik’s Stash feature and start preparing for whatever unrealized goal you’ve yet to encounter in life? You're scratching your head, aren’t you? Well, if you’ve been paying attention (which we hope you have), we’ve constantly put emphasis on the importance of why planning for the future is good, may it be uncertain or not. That is why we are confident that even if you don’t know what your plans are, you should already consider saving for them. Who knows? You might just end up saving the world. But let’s not get carried away. Save up with Tonik’s Stash feature first before saving the world.

Phew! We’re almost finished. Just hang on a bit more.

After everything we’ve discussed, you might be asking yourself, “So Tonik, since I now know how the Stash savings feature can help me rock my savings, how do I create one?”

Well, accessing our Stash is as easy as 1-2-3:

-

Download the Tonik App and register for an account.

-

Once you’ve created your account, click on the “Stash” Tile in the dashboard.

-

Select the “Start a New Stash” Button.

-

Choose amongst our incredible layouts or get creative and opt to create a layout yourself!

-

Select either “Solo”, if you’re saving by yourself, or “Group” if you plan to invite other members to your Stash.

-

Customize your Goal Name, Stash Photo, and Target Amount.

-

Then voilà! You’ve successfully created your own Stash. Congratulations!

Oh, and did we mention that by using Tonik’s money stash feature grants you access to up to 4.5% interest p.a. for its Group Stash?! It's just the gift that keeps on giving.

We said “up to” because the Solo and Group Stash have different interest rates p.a.. When you open a Solo Stash, you’ll earn an interest rate of 4% p.a.. While if you open a Group Stash, you’ll earn a higher interest rate of 4.5% p.a. different from our highest interest earning Time Deposits. To enjoy the 4.5% interest rate p.a., all you’ll need to do is Invite Others to your Group Stash (Minimum of 2) and then all three of you must contribute at least P1 to the stash for it to officially earn the Group Stash interest rate. You can even easily Track Your Group Stash Member’s Contribution conveniently through the Tonik App. What’s also really awesome about Tonik’s money stash feature is that when you finally decide to Withdraw Your Money or Close Your Stash, Tonik’s interface will simply transfer the Stash funds directly to your Tonik Account. Woot-woot! And if you ever feel the need to reach out to our Customer Care team, you can easily do so by using the integrated live customer care chat in the Tonik App.

After learning about our Stash saving feature, what its advantages are, and how you can utilize it in the #NeoNormal, you might be thinking, “Tonik, how can I start my Stash savings? I want to start my goal to saving well!” Well, all you’ll need to do to access the Stash savings feature is to open either Google Play Store or the Apple App Store and search for “Tonik”. Once you’ve downloaded the Tonik App and opened it, we will guide you through our quick and easy on-boarding process to get you settled in and introduce you to our products. And if you’re also up for leaving any Stash saving Reviews, you can do so through our respective Google Play Store or Apple App Store pages.

Well, we hope you learned something new today and wish that you continue spreading good vibes and purple hearts everywhere you go.

See you in the #NeoNormal!