Have you ever smiled and nodded through a date, without understanding what they’ve been talking about? Well, feel free to ask questions, luv. You’re getting to know your potential partner, after all.

It’s the same for personal finance. Before entering a relationship with a bank, you have to know what you’re getting into. So when they’re showing off bank interest rates, don’t just smile and nod.

Let’s scrape the sugar off all that sweet talk and see what they really have to offer.

Table of Contents

What are bank interest rates?

Interest isn’t just a way to spark a relationship. In personal finance, it’s the result of being in the relationship between a lender and a borrower. When you lend money, you earn interest. When you borrow money, you pay interest.

So the “high bank interest rates” trending in Philippine digital banking? Those banks are telling you how much you’ll potentially earn when you open an account with them. When you do, you’re technically lending them money that they can invest and grow. In return, they’ll pay you interest with a percentage of growth that's spread over the course of a year called “interest per annum” or “interest p.a.”

Now, this is where size matters. Interest rates vary between banks. It factors hugely in how you compute your time deposit, savings, and investment earnings. At 0.01 percent interest per annum, your 10,000 PHP will earn 1 PHP in a year. That’s a big difference from 1 percent interest per annum, where your 10,000 PHP will earn 100 PHP in a year.

But passive income is just one side of the coin. The flip side is beating inflation. How many fried chicken meals can you buy with 10,000 PHP? If each meal costs 100 PHP, you can buy 100 meals. But if inflation hikes the cost up to 105 PHP, well, you’re eating 5 meals less. Your money’s purchasing power goes down, leaving your stomach and bank account feeling a bit emptier.

With high bank interest rates, your savings have the chance to earn more and outgrow inflation.

Understanding Interest Calculation

Understanding Interest Calculation

Understanding Interest Calculation

Now, you might be wondering exactly how these interest rates translate into earnings on your savings. Let's break down the magic behind interest calculation for savings. Essentially, when you deposit money into a savings account, the bank pays you interest as a thank you for letting them use your funds.

This interest can be calculated in two main ways: simple interest, which is based on your initial deposit, and compound interest, where you earn interest on both your original deposit and the interest it has already generated. The latter can significantly accelerate the growth of your savings over time, especially with higher rates and more frequent compounding periods.

Understanding the dynamics of simple and compound interest is crucial because it directly influences how much money you can earn from your savings. Whether your bank compounds interest daily, monthly, or annually can make a big difference in your financial growth. Let's explore how you can leverage this knowledge to maximize your savings with us

TOC- Table FIndHow high can you go?

Real talk: most savings account interest rates are pretty low. Traditional banks typically offer less than 1 percent interest per annum. Not only that, but the government also gets a cut of your earned interest with 20 percent withholding tax. (That’s the law.)

So if you have 10,000 PHP earning 0.01 percent interest per annum, get ready to see a lot less.

Withholding tax will slash your 1 PHP earned interest down to 0.08 PHP.

But for Philippine digital banking, it’s a different story. Tonik is bringing digital-only banking to the country as the first-ever neobank. We hold the first private digital bank license from the Bangko Sentral ng Pilipinas (BSP). Our deposits are insured by the Philippine Deposit Insurance Commission (PDIC) for up to 500,000 PHP per depositor.

One of a neobank’s many perks is that we don’t need to deal with the overhead costs of maintaining and staffing branches. That’s why we have one of the highest bank interest rates in the country.

Our savings account or Tonik Account earns 1 percent interest per annum, our savings pockets or Stashes earn up to 4.5 percent interest per annum, and our Time Deposits earn up to 6 percent interest per annum. (One 6% p.a. TD per customer is allowed).

We’re shaking up Philippine digital banking by helping you save more than ever. And our numbers back it up.

TOC- Table FInd

Is that your calculator or are you just happy to see us?

How to compute for Tonik Account & Stashes

Your Tonik Account starts earning the moment you deposit any amount. (No minimum or maintaining balances!)

Plus, it can fund high-earning savings pockets called Stashes. Save for personal goals like “Emergency Fund,” “New Ride Stash,” etc. with Solo Stashes. Or save with family and friends for group goals like “Parents’ Anniversary Gift,” “Barkada Outing,” etc. through Group Stashes.

They each earn interest at different rates:

| Tonik Product | Interest Rate as of September 2021 *Interest is subject to 20% withholding tax. |

| Tonik Account (Savings Account) | 1% p.a. |

| Solo Stash (Savings Pocket) | 4% p.a. |

| Group Stash (Savings Pocket) | 4.5% p.a. |

Now how much your Tonik Account and its Stashes will earn is based on the amount they each hold at the end of the day (EOD Balance), around 8 pm to 12 mn:

Daily Earned Interest = EOD Balance x Savings Account Interest Rate x 1/Days of the Year

*Days in a Year can be either 365 (regular year) or 366 (leap year). Interest is still subject to 20% withholding tax.

So if you have 10,000 PHP as your EOD balance for each of these, you’ll earn this much in a day:

Tonik Account Daily Earned Interest = 10,000 PHP x 0.01 x 1/365

Tonik Account Daily Earned Interest = 0.274 PHP

*Net of withholding tax = 0.219 PHP

Solo Stash Daily Earned Interest = 10,000 PHP x 0.04 x 1/365

Solo Stash Daily Earned Interest = 1.096 PHP

*Net of withholding tax = 0.878 PHP

Group Stash Daily Earned Interest = 10,000 PHP x 0.045 x 1/365

Group Stash Daily Earned Interest = 1.233 PHP

*Net of withholding tax = 0.986 PHP

As you deposit more money more frequently, you’ll earn even more interest each passing day. This will be totalled and credited at the last day of the month or the first day of the following month.

Monthly Earned Interest = Sum of Daily Interest in a Month

How to compute for Time Deposits

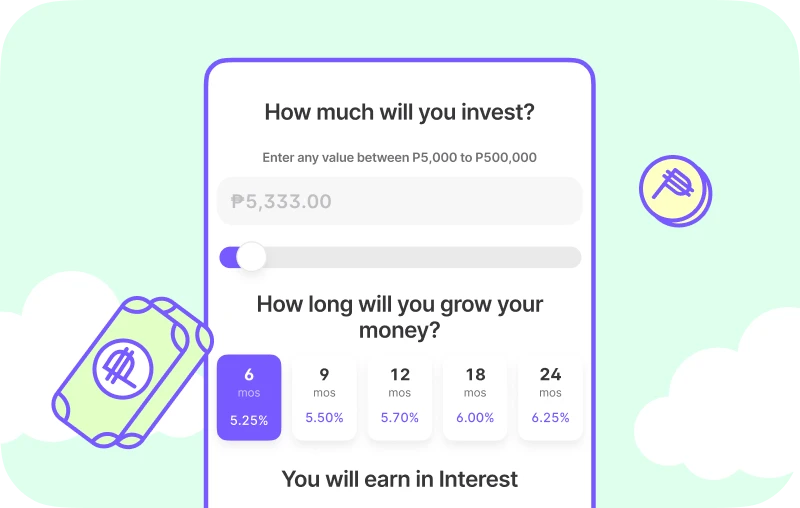

If you have money set aside, see if Tonik Time Deposits are for you. They are low-risk investments, where you lock away your money for some time to earn higher at a fixed rate. Pick from five plans (or get all):

| Lock-in Period | Fixed Interest Rate *Interest is subject to 20% withholding tax. |

| 6 months | 6.00% p.a. |

| 9 months | 4.50% p.a. |

| 12 months | 4.75% p.a. |

| 18 months | 5.00% p.a. |

| 24 months | 5.25% p.a. |

And here’s how to compute your time deposit earnings:

Interest = Investment Amount x Time Deposit Interest Rate x (Time Deposit Term in Days / Days in a Year)

*Days in a Year can be either 365 (regular year) or 366 (leap year). Interest is still subject to 20% withholding tax.

If you go for the 6-month plan and deposit 50,000 PHP, you’ll be raking in this much:

Starting Date: September 01, 2021

Maturity Date: March 01, 2021

Number of Days: 181

Interest = 50,000 PHP x 0.06 x (181/365)

Interest = 1,487.67 PHP

*Net of withholding tax = 1,190.136 PHP

Check out how much you can earn using our Time Deposit calculator here.

So what do you think of those numbers, luv? If we’ve caught your interest, hit that download button and let’s start this neobanking romance.