Recession again? Just when we all thought we were coming out on the brighter end of the tunnel, it seems like we’re off to singing another Annie Lenox song..wait for it -here comes the rain again! But don’t you fret because recessions don’t have to hit so hard if you can prepare and manage your lifestyle and expenses for it, luv!

Since 2020, the Philippines has been in a drawn-out recession, aggravated by the economic impact of the pandemic and other global events. Prices for goods and commodities have been rising, prompting some politicians to advise Filipinos to tighten their belts in the coming months. With geopolitics and other global events impacting the global economy, we’re set to meet another recession. This again begs the relevant question of ‘How to save money in a recession?’. What are the best ways we can avoid these high costs while maintaining our savings and livelihood?

Part of 'adulting' is dealing with situations over which we have no control and making the best of what life throws at us. And as hoomans, we are completely capable of finding both old and new alternatives to keep life moving and avoid letting the costs of living get the best of us. Remember that previous generations (the boomers and Gen X'ers) have already been through terrible recessions and found ways to manage their expenses. Worry not, young Padawans, because you can do it as well. To help, here are some money-saving tips during a recession, hun.

Table of Contents

How To Save Money In A Recession:

TOC- Table FInd

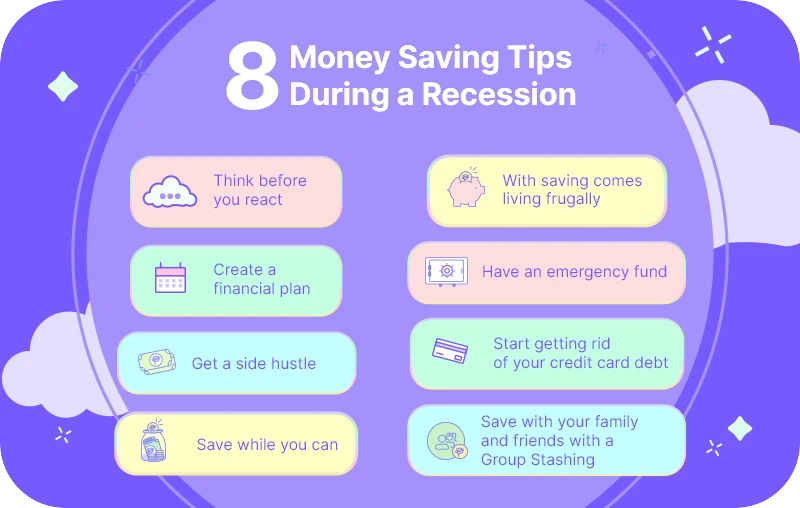

Think before you act

This may sound weird for a first tip, but it really is you putting your thinking brain ahead of your heart. We frequently let our fear get the best of us, leading to irrational decisions. Irrationality may lead you to make decisions that have a significant impact on your finances. So, rather than panicking, it is better to just observe things first. Remember that recessions do not last indefinitely. Feel your emotions, but don't let them overwhelm you.

TOC- Table FInd

Create a financial plan

Now that we've calmed you down after you panicked due to the high costs and inflation, it's time to start thinking about a financial plan. Getting out of this recession means devising a strategy to maintain control over your own life, and having a financial plan can help you get ahead. Begin by listing your budget, savings and investment plans, and financial goals. Financial planning can assist you in determining your monthly expenses. This is one money-saving tip that will undoubtedly come in handy during a recession.

TOC- Table FInd

Start getting rid of your credit card debt

Credit card debt can spell danger so make sure that you’re able to pay off your balances as soon as possible. Interest rates can increase quickly during recessions. Consider looking at alternatives like low-interest personal loans or balance-transfer credit cards if you want to spread out your payments. Try switching to credit cards that offer 0% APR if you have high-interest debt to transfer. To inquire about interest rate reductions, you might also try calling your current credit provider.

TOC- Table FInd

Save while you can

Save as much of your extra cash as you can now because a recession could swiftly deplete it. Save, save, save since economic downturns can significantly alter everyone's situation. An alternative is to think of expenses as a shared obligation. Get a roommate who will help you divide the costs of living or who will assist you split other expenses. Inflation is real, my friend. So “KKB” and “hati tayo” can really help during this time. Even better, why not save together? Learn more in tip number 8.

TOC- Table FInd

With saving comes living frugally

One of the few ways to achieve, maintain, and taste financial stability is to live your life frugally. It’s a tip that is tried and tested over the years. Start tracking your own expenses and then cut spending. Commit to days or months where you only eat at home and cancel subscriptions that you no longer use. Also, stop getting ‘budol’-ed by online shopping. Delay your purchases and retail therapy dreams for a while. We know it’s tempting every time the double digit sale comes out but be conscious of your savings and get what you really need.

TOC- Table FInd

Get a side hustle

There is a risk for unemployment rise during a recession so having multiple streams of income can help if you lose your job. A side hustle can help maintain your finances and save up for money too. Nowadays, you can find a lot of online jobs and many employers are begging for new workers too. If you think this is the best time to apply for a part-time job at Adonis, might as well! We’re kidding but there are plentiful ways to earn that extra cash so grab what you can and continue building up your savings.

TOC- Table FInd

Have an emergency fund

A lot of people say that you should save for at least six to a one-year worth of savings for an emergency fund, in case anything happens. But do you know where to put your emergency fund? We recommend that you put up your emergency fund into a high-yield savings account because they offer higher interest rates and are more convenient when you need to access your money at any time. You can easily open a high-yield savings account online through traditional or digital banks.

TOC- Table FInd

Save with your family and friends with a Group Stashing

A Group Stash is one method of saving money during a recession. A Group Stash, also known as 'paluwagan' in Filipino, is a non-interest saving and borrowing method. It's a method of pooling savings funds among close friends or, better yet, family. Now that we are in a recession, it is important to encourage members of the household to have this extra source of funds in times of need. Group stashing (yes it can also be a verb, hun!), also allows you to develop the habit of disciplined saving and keeps you from individually depleting your finances. If you want to survive the current recession, you should start saving with your OGs!

Tonik is one of the best places to open a high-yield savings account today. When you open a solo or group account with Tonik Digital Bank, you can earn up to 6% in interest. When you open an account with them, no initial deposit is required. The balance between maintaining and earning interest is zero. One of the products they provide is Group Stash, which is a safe way to save money with family and friends. With their Group Stash, you can invite a minimum of three people to save money with you. Members must contribute at least one peso for the Group Stash to earn 4.5 percent interest per year. If you need to withdraw, you'll need to ask your Group Stash owner, so choose someone trustworthy and responsible to ensure your savings are safe. What can you do with the Group Stash? It can be used to save money for emergency funds, bills, travel goals, tuition fees, or a new car. Furthermore, with their enhanced security features, you can prevent fraud when doing online transactions. It's quick, dependable, and will take your relationship with banking to a whole new level.

These are money saving tips during a recession. Make sure to take these hacks to heart and remember, no cheating on your financial goals, luv. Saving is a long-term plan and you need all the motivation that you can get.

Share these tips to your friends and family so they know how to survive a recession with you! Happy saving!