Online cash loans are convenient financing tools that can help people during times of need. They give you access to funding for any situation, such as medical emergencies, sudden house repair work, or even help fund your dream business.

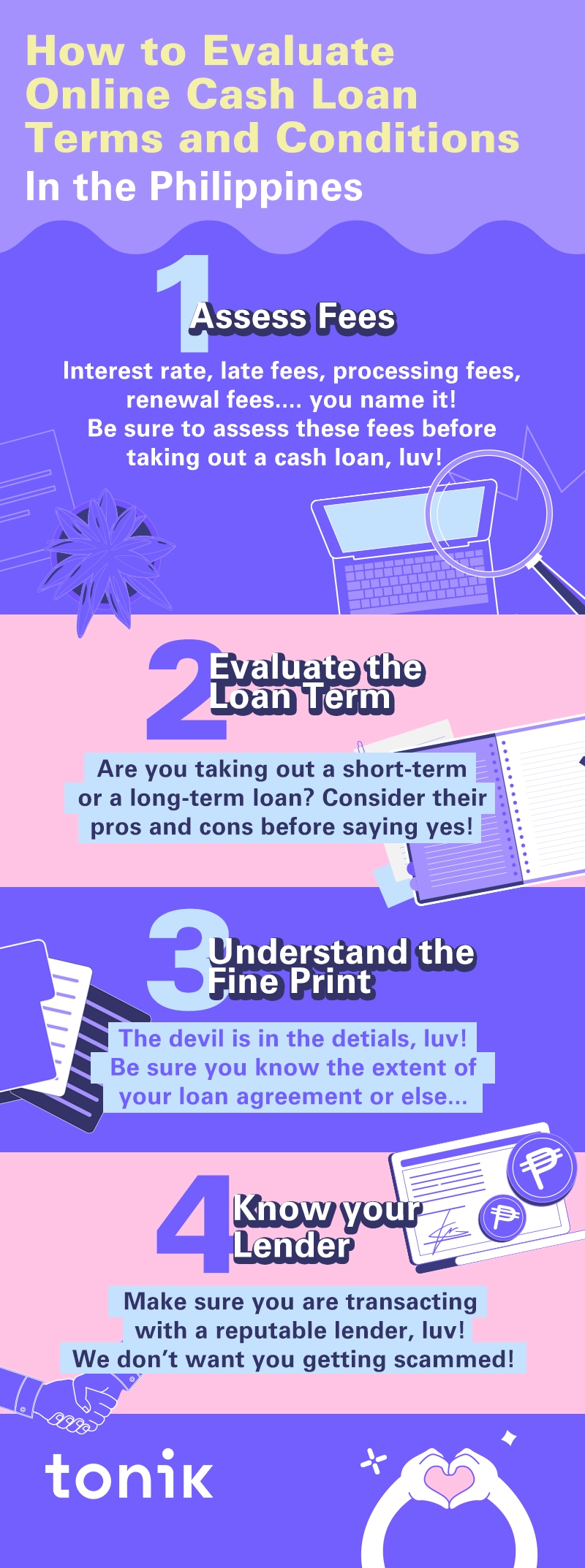

But because of their inherent value, it’s also crucial to evaluate the terms and conditions of cash loans, luv. This is to ensure you’re making informed borrowing decisions. Here in the Philippines, where access to credit is both crucial and still scarce for many individuals and families, evaluating loan terms becomes even more critical.

That’s why in this article, we will unravel the complexities of cash loan terms so you can confidently navigate the online lending landscape and select a cash loan that’s perfect for your needs.

Table of Contents

- Understanding Key Loan Terminologies

- Assessing Interest Rates and Fees

- Demystifying Interest Calculation

- Evaluating the Loan Term

- Reading and Understanding the Fine Print

- Checking for Flexibility in Repayment

- Consideration of Collateral Requirements

- Understanding Default and its Consequences

- Considering the Reputation of the Lender

- The Bottomline

Understanding Key Loan Terminologies

Before delving into loan evaluation, let's familiarize ourselves with key loan terminologies, such as:

-

Principal: The fancy term for the amount you borrow.

-

Interest Rate: The fee charged by lenders for borrowing money.

-

Annual Percentage Rate (APR): The grand total of all the borrowing costs, including interest and fees.

-

Loan Term: How long you have to pay back the dough.

-

Default: This happens when you fail to meet your payment obligations and things get messy.

-

Collateral: Something valuable you give as a guarantee to the lender.

Assessing Interest Rates and Fees

Interest rates play a significant role in determining the overall cost of a loan. Interest rates for bank loans is 7.29% on average. And these loans could either have a fixed interest rate or a variable interest rate. Fixed interest rate means it has the same rate throughout the loan term. While variable interest rate is subject to change based on market conditions. It's essential to understand how interest rates are calculated to gauge the financial impact they will have on your loan.

But when comparing different loan offers, it's important to consider not only the interest rates but also any associated fees. These fees may include:

-

Processing fees: Lenders may charge a service fee to cover administrative costs associated with maintaining and servicing the loan.

-

Late payment fees: If you fail to make your loan payment by the due date, lenders may charge a late payment fee. This fee encourages borrowers to make timely repayments.

-

Extension or Renewal Fee: If you need to extend or renew your loan term, lenders may charge a fee for this service.

To make a well-informed decision, take the time to compare interest rates and fees among various lending institutions. This allows you to identify the most favorable terms that align with your financial goals.

Suggested Post: The Good, The Bad, and The Ugly Truth About Philippine Interest Rates

Still unsure about cash loans, luv? Read up on Esquire’s super relatable feature of the Megastar, Sharon Cuneta’s, money tips and why she says loans aren’t actually a bad thing here.

TOCDemystifying Interest Calculation

Now, let's take a moment to dive into the nitty-gritty of how interest on your loan actually gets calculated, luv. Understanding this can be a game changer when it comes to managing your finances and ensuring you're getting the best deal out there.

Imagine you're baking a cake—the ingredients represent the principal amount, and the baking time symbolizes the interest. Just like how the right amount of time in the oven makes your cake perfect, knowing how interest works ensures you're not overpaying on your loan.

There are two main ways interest can be calculated: using the simple interest method or the compound interest method.

Simple Interest: This is like straight-up baking. You mix your ingredients (principal) and let it bake (accumulate interest) at a steady rate over time. The formula looks something like this: Interest = Principal x Rate x Time. Simple, right? It's straightforward, where you pay interest based on the original amount you borrowed.

Compound Interest: Here’s where it gets a bit more like a baking show challenge. Compound interest means that over time, your cake (loan) gets bigger because you're not just baking the original mix; you're also baking the interest that's already been added. This means your interest earns interest. While it can lead to a bigger debt cake, understanding this can help you strategize on paying off your loan faster.

Evaluating the Loan Term

Your loan term will significantly impact your repayment journey, hun. So let’s compare the two common types of loan terms that are offered by lenders.

1. Short-Term Loans

Short-term loans are like sprint races—quick, intense, and over before you know it. These loans typically have a shorter repayment period, usually a few months to a couple of years. You'll be hustling to pay off the borrowed amount in a shorter span of time.

But here’s the thing: Short-term loans may have higher monthly repayments compared to their long-term counterparts. Why? Well, since you're squeezing those payments into a shorter period, the chunks you have to pay each month can be a bit bigger. It's like downing a whole slice of cake in one bite—it's quick, satisfying, but boy, you really feel it.

2. Long-Term Loans

Long-term loans are like marathon races. They're a bit more laid-back and allow you to catch your breath. These loans have a lengthier repayment period, stretching anywhere from several years to a decade or more. You'll have more time to spread out those repayments, making them more manageable.

But here's the twist—long-term loans might seem less financially demanding month by month, but in the grand scheme of things, you'll end up paying more in interest over the extended period.

The bottom line is when evaluating loan terms, it's crucial to consider the implications of both short-term and long-term options. Ask yourself: Can you handle higher monthly repayments for a shorter duration, or do you prefer smaller monthly amounts but a longer financial commitment?

Ultimately, it's about finding the sweet spot that fits your financial situation and goals, luv. Whether you're sprinting or marathoning your way through loan repayments, crunch those numbers, assess your budget, and choose the loan term that works best for you.

Reading and Understanding the Fine Print

Hidden within the fine print of cash loan agreements lie important clauses that you must be aware of. Let's shed light on some common clauses you might encounter as you navigate the intricacies of loan contracts.

- Prepayment Penalty: Some lenders may impose a prepayment penalty if you choose to pay off your cash loan before the agreed-upon term. It's crucial to understand if such fees exist to avoid any unexpected costs, luv!

- Default Consequences: Failing to meet your repayment obligations can lead to severe consequences, hun. Lenders may charge late payment fees, report your delinquency to credit bureaus, or take legal action. Remember: Honor your commitment to repay on time to prevent making a dent on your credit score.

- Collateral Seizure: For secured loans, where you offer collateral as a form of security, please keep in mind that the lender has the right to seize the pledged asset if you default on your payments. It's a significant risk, so carefully consider your ability to meet the loan's terms before providing collateral, luv.

- Change in Terms: Lenders may reserve the right to modify certain terms of the loan agreement. This could include adjustments to interest rates or repayment schedules. It's important to be aware of such provisions and ensure you understand the potential impact of any changes on your cash loan.

- Dispute Resolution: In case of disputes or conflicts, loan agreements often include a clause that outlines the process for resolving such issues. It may involve arbitration, mediation, or legal action.

- Personal Information Usage: Be mindful of how your personal information will be handled by the lender. Loan agreements often state how your data will be used, such as sharing it with credit reporting agencies or third parties. Be sure that you’re comfortable with the outlined terms regarding your privacy.

When reviewing loan agreements, take the time to thoroughly read and understand all the clauses within the fine print. If anything appears unclear or raises concerns, don't hesitate to seek clarification from the lender. After all, being well-informed and attentive to the details will help you make informed decisions and avoid any unpleasant surprises down the road, luv.

TOCChecking for Flexibility in Repayment

When it comes to cash loans, flexibility in repayment can be a lifesaver. Life is full of unexpected twists and turns, and having the option to navigate those challenges without drowning in debt is a game-changer. So, let's dive into the importance of checking for flexibility in repayment and the value it brings to borrowers.

Imagine this: You've taken out a cash loan, but suddenly, circumstances change. Maybe you face a sudden financial setback, or unexpected expenses pop up out of the blue. In these moments, having a lender who understands and offers flexible repayment options can be a true blessing.

Flexibility can come in various forms, like:

-

Having the ability to adjust your payment schedule

-

Switching from monthly to bi-monthly or quarterly payments, giving you some breathing room when you need it most

-

Offering hardship programs or options, which allows borrowers to temporarily reduce or pause their payments in cases of financial hardship

Checking for flexibility in repayment should be a top priority when evaluating cash loan options. It gives you the peace of mind and confidence to face unexpected situations without the added stress of rigid payment schedules. It's like having a financial ally in your corner, ready to support you when the going gets tough!

But keep in mind, not all lenders offer the same level of flexibility, luv. That's why it's crucial to do your homework and research different lending institutions. Look for those that are known for their customer-centric approach and willingness to work with borrowers during challenging times. It's like finding that one friend who always has your back, rain or shine.

TOCConsideration of Collateral Requirements

When it comes to cash loans, some lenders might ask you to put up collateral as a form of security. So, let's dive into the world of collateral requirements and understand the implications of secured versus unsecured loans. Plus, we'll uncover the consequences of failing to repay for both types.

1. Secured Loans

These loans are like having a safety net made of valuable assets. When you provide collateral, such as your car, condo unit, or even your prized stamp collection, you're assuring the lender that if you can't repay, they can seize that asset to recover their money. It's like giving them a piece of your financial puzzle as a security deposit.

Secured loans often come with a few perks. Lenders might be more willing to offer you lower interest rates because they have that additional layer of protection. It's like a win-win situation—lower interest rates mean more money stays in your pocket, and the lender sleeps better at night knowing they have a backup plan.

On the flip side, if you fail to make your repayments on a secured loan, things can get a bit messy. The lender has the right to take possession of the collateral you provided. Imagine losing your beloved car or the home you've worked so hard for. It's like the real-life consequences of a Monopoly game gone wrong. So, tread carefully and be confident in your ability to meet the repayment terms before opting for a secured loan.

2. Unsecured loans

These loans don't require collateral, which means you don't have to put any of your prized possessions on the line. But beware, unsecured loans often come with higher interest rates because lenders take on more risk without that safety net.

When it comes to failing to repay an unsecured loan, the consequences can still be significant. Lenders can report your delinquency to credit bureaus, which can damage your credit score and make future borrowing more challenging. So, even without collateral on the line, it's crucial to honor your commitment to repay on time.

As you consider collateral requirements, weigh the pros and cons of secured and unsecured loans. Assess your financial situation, the value of the collateral you can provide, and your confidence in meeting repayment obligations.

TOCUnderstanding Default and its Consequences

Defaulting on a loan is like missing a step and stumbling into a financial pothole. So, let's unravel the mystery behind default and explore its consequences, both legally and financially.

So, what exactly constitutes default? Well, luv, default occurs when you fail to meet your repayment obligations as agreed upon in the loan agreement. It's like breaking a promise you made to your lender, and unfortunately, it can have some serious repercussions.

When you default on a loan, it's not just a minor blip on your financial radar! It can leave a lasting impact on your creditworthiness and financial well-being. These impacts can include the following:

- Legal implications: When you default, lenders have the right to take legal action against you to recover the outstanding amount. It's like being caught in a legal tango, and trust me, you don't want to be on the wrong end of that dance.

- Financial implications: Financially, defaulting can lead to a series of unfortunate events. Lenders may impose late payment fees and penalties that can quickly snowball, making it even harder to climb out of the debt pit! Moreover, your credit score can take a severe hit. It's like a red flag waving in front of future lenders, making it challenging to secure credit in the future or obtain favorable terms.

- Collection implications: Loan default can also result in your debt being sold to collection agencies. These agencies can be relentless in their pursuit of repayment. They may hound you with phone calls, letters, and even show up at your doorstep. It's like having an unwelcome guest who just won't take the hint to leave.

Aside from all these, default can also tarnish your reputation in the eyes of potential employers, landlords, and even insurance companies. It's like having a black mark on your financial record that follows you wherever you go. So, it's crucial to take loan repayment seriously and honor your obligations.

And by the way, luv, if you find yourself in a situation where you're struggling to repay a cash loan, don't bury your head in the sand. Reach out to your lender and explain your circumstances. They may be willing to work with you on a repayment plan or offer alternative solutions. Communication is key!

TOCConsidering the Reputation of the Lender

Reputation matters. A lender's reputation can speak volumes about their reliability, trustworthiness, and overall customer satisfaction. It's like getting a sneak peek into their track record and how they treat borrowers. By researching the lender's reputation, you can gain insights into their professionalism, transparency, and responsiveness. It's like reading reviews of a restaurant before deciding to dine there—no one wants to end up with a sour taste in their mouth, right?

To get a clear picture of your lender’s reputation, you can:

-

Check customer feedback: Reviews, testimonials, and ratings from other borrowers can provide valuable insights into their experience with the lender. Did they have a smooth borrowing process? Were the terms and conditions clearly explained? Did the lender handle any issues or concerns promptly and fairly?

-

Find out the legitimacy of the lender: With the rise of online lending platforms, it's essential to be vigilant and ensure you're dealing with a legitimate institution. Start by checking if the lender is duly registered and licensed with the Bangko Sentral ng Pilipinas (BSP) or the Securities and Exchange Commission (SEC).

-

Visit their website: Review the lender's website and look for clear and transparent information about their services, terms, and conditions. Legitimate lenders provide detailed information and are upfront about their fees, interest rates, and repayment options.

-

Reach out to the lender directly: Engage in conversations, ask questions, and assess their responsiveness and professionalism. A legitimate lender will be more than willing to address your concerns and provide the information you need.

-

Consult reliable third-party agencies/institutions: Trusted entities like financial institutions, consumer protection agencies, and industry watchdogs offer invaluable insights and information about legitimate lending operations. These organizations play a significant role in the ecosystem of consumer finance, acting as guardians against scammers and predatory lenders.

Their assessments and listings are often based on stringent compliance checks with relevant laws and regulations, including the Consumer Act of the Philippines. This Act ensures that all financial transactions are conducted with fairness, transparency, and respect for the consumer's rights, providing an additional layer of protection for borrowers.

By leveraging the resources and information provided by these reputable sources, you can navigate the lending landscape with greater confidence and security, knowing you're making informed decisions based on reliable advice. So, don't hesitate to reach out and verify the credibility of lenders through these trusted channels—it's a smart move towards safeguarding your financial well-being.

The Bottomline

Evaluating cash loan terms and conditions is a vital step in making informed borrowing decisions in the Philippines. By understanding key loan terminologies, assessing interest rates and fees, evaluating loan terms, reading the fine print, checking for repayment flexibility, considering collateral requirements, understanding default consequences, and researching the lender's reputation, you can navigate the borrowing process with confidence.

Remember, your financial well-being is at stake, and taking the time to evaluate loans will help you choose the best option that suits your needs and ensures a smooth repayment journey.