Everyone has a type. Some like them quick and easy, while others like those who are in it for the long-term.

Obviously, we’re talking about loan apps!

Before loan apps came into the scene, people had to actually go to traditional bank branches and lending institutions to get a loan. They had to show up, wait in line, and (gasp) manually file paperwork!

Nowadays, you can just whip out your phone, make a few taps, and voila: you’ve got the cash you need in your bank account!

Navigating the different loan app types can be a real head scratcher though, but don’t worry, we’ve got this super quick guide for you to understand loan apps at a glance!

Table of Contents

Types of Loan Apps Available in the Philippines

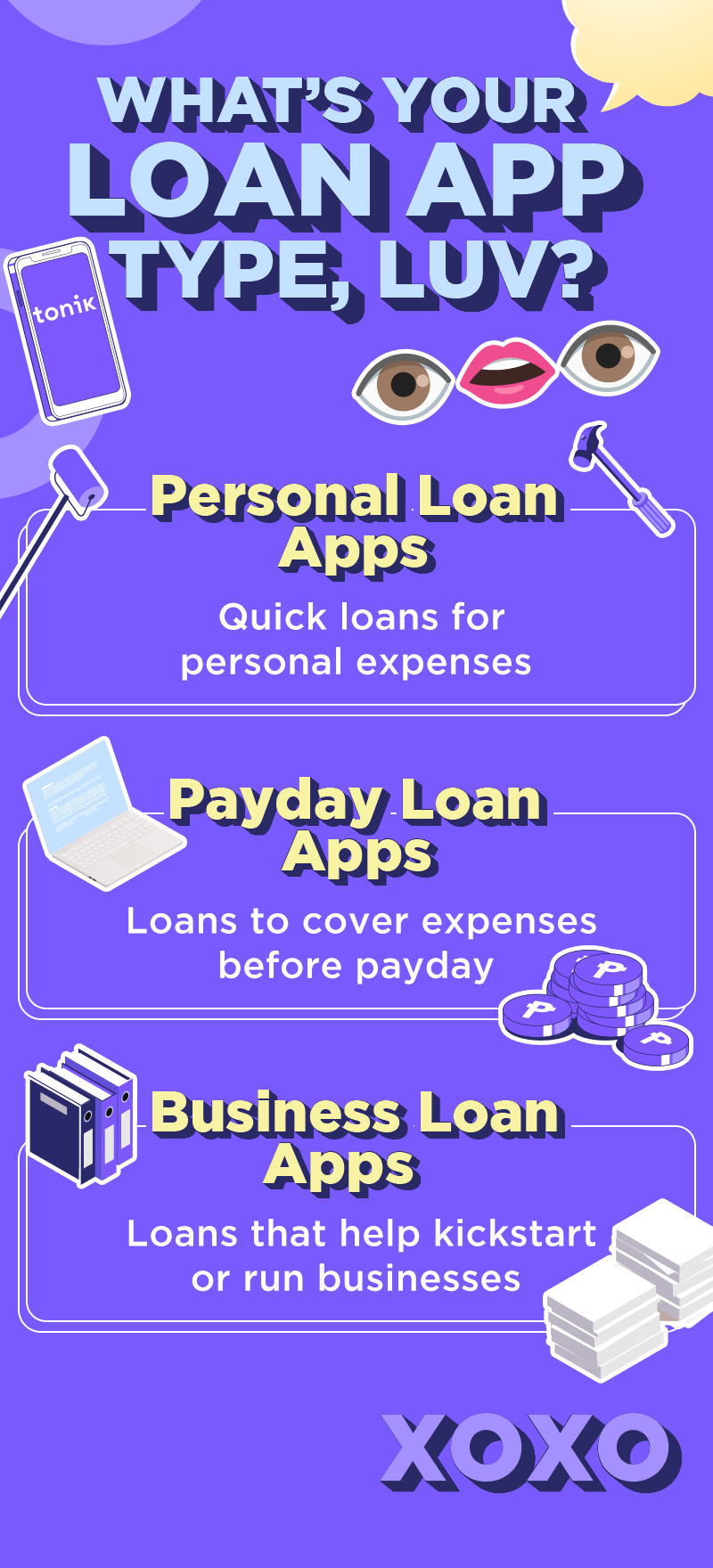

The beauty about loan apps is that there’s something for just about every purpose. Let’s check out each type below:

- Personal Loan Apps: These are loans designed to help you cover large expenses like home renovations, unexpected medical bills, and major purchases. They usually offer larger loan amounts with longer and more flexible repayment terms compared to other loan types.

- Payday Loan Apps: Payday loans are what they sound like – quick solutions to financial emergencies that the borrower will have to repay on their next payday. Since they’re built for emergencies, they offer fast disbursements, sometimes within hours of application. They also require minimal requirements.

- Business Loan Apps: Business loans cater to entrepreneurs and small business owners looking for capital to grow their businesses. They offer higher loan amounts and longer repayment periods. They may also provide specialized loan products tailored to different business needs, such as microloans for small enterprises or equipment financing.

Pros and Cons of Using Loan Apps

Before you go trigger happy with loan apps, you should know that it’s not always rainbows and butterflies in Loan App Land. Here are the pros and cons:

Pros

- Convenience: You can apply anytime and anywhere, more often than not with minimal requirements.

- Speed: Quick approval processes and disbursements, often taking only hours or even minutes.

- Accessibility: All you need is a phone and stable internet to download loan apps!

Cons

- High Interest Rates: Loan apps often charge higher interest rates compared to traditional loans, which can add up over time.

- Privacy Concerns: Sharing personal and financial information online always carries some risk. A safer version of loan apps are neobanks like Tonik, who keep their security airtight.

Security Features of Loan Apps

While loan apps do their best to keep your money and personal data safe, you should also do your part in protecting yourself while borrowing money online. Here are a few safety tips you should follow:

- Verify Legitimacy: Ensure the loan app is registered with the Securities and Exchange Commission (SEC) and other relevant authorities.

- Read Terms Carefully: Understand the interest rates, fees, and repayment terms before committing to a loan.

- Secure Your Device: Use strong passwords and avoid sharing personal information over public WiFi networks to protect your data from unauthorized access.

- Opt for BSP-Licensed Neobanks: You know... like Tonik! We’re BSP-licensed (the first neobank to be licensed, actually, no big deal) so you can rest assured that you’re safe borrowing from us compared to just any old loan app.

Which Loan Apps in the Philippines Offer Long-Term Payment Options?

If you’re more of a slow-and-steady kind of borrower (no judgment, luv—we love a planner), then you’ll want a loan app that won’t pressure you into high payments right away. Say hello to Tonik Bank’s Credit Builder Loan. 💜 Whether you’re juggling bills, saving for something big, or just prefer to spread things out, Tonik’s got your back with repayment terms of up to 12 months. That means smaller monthly payments and more breathing room in your budget—yes please! And here’s the glow-up part: every on-time payment gets reported to credit bureaus, helping you build that credit score while you borrow. It’s all fully digital, super quick, and of course, BSP-regulated—so you can borrow smart and safe. Ready to commit to the long game? You know where to tap. 📲

Impact of Loan Apps on Credit Score

A credit score is how lenders determine how well you manage your finances – that includes how you manage your loans! To give you a clearer picture of credit scores, here’s how loan apps can impact them:

- Positive Impact: Timely repayments can boost your credit score by demonstrating your ability to manage debt responsibly. A higher credit score can lead to better loan terms and lower interest rates. That’s why you should always pay on time, luv!

- Negative Impact: Late payments or defaults can damage your credit score, making it harder to borrow money in the future. It's crucial to make repayments on time to maintain a good credit rating.

Tonik App Makes Loans Easy

We’ve come a long way from traditional lending. Thanks to loan apps and digital banks, you can borrow the money you need on your day-to-day, for emergencies, even for starting and running a business!

They’re not 100% perfect though. They come with both pros and cons, and those can vary per loan app. Before applying, make sure that you’re dealing with a legit app, keep your device secured, and always read the fine print.

Lastly, luv, please, please, please take good care of your credit score! It’s important if you want to borrow more loans in the future, and generally achieve full financial freedom.

You know what could boost your credit? We’ll leave you with this quick tip and shameless plug: Borrow up to ₱20K with Tonik Credit Builder Loan!

It’s a quick cash loan that you can borrow using the Tonik App. With consistent timely payments, it’ll help you boost your credit and give you the financial future you deserve.

Ready, luv? Download the Tonik App and apply now!