How to Maximize the Benefits of a Credit Builder Loan

Ready to boost your credit score but wondering how long it really takes? You’re in the right place. A credit builder loan can work wonders for your credit history—but only if you play it smart.

👉 Get the Tonik App to start your credit journey smartly.

Table of Contents

What’s a Credit Builder Loan Anyway?

Let’s cut to the chase. The Tonik Credit Builder Loan is the most strategic one you can get. It’s a smart, no-hassle way to build your credit from scratch. You borrow up to ₱20,000 and choose flexible payment terms up to 12 months—plus enjoy affordable monthly add-on interest rates. And if life throws a curveball, Tonik’s PayHinga lets you take up to two months payment holiday without stress.

Want the full scoop? Check out: What’s a Credit Builder Loan? Let’s Dive In.

1. Choose the right lender for a credit builder loan

Not all credit builder loans are created equal. Here’s what to look for:

- Fees and interest rates that won’t break your budget: Some lenders charge high fees or sky-high interest rates that can make your loan more expensive than it needs to be. Look for a credit builder loan with transparent, affordable rates so you can keep your repayments manageable without sacrificing credit-building benefits.

- Lenders that report to all three major credit bureaus (this is key!): The secret sauce to building a strong credit score is having your payments reported consistently to all three major credit bureaus in the Philippines. This helps create a complete and accurate credit history that lenders trust when you apply for future credit.

- Decide between online lenders for convenience or local banks/credit unions for personal service: Online lenders often offer convenience with fast application processes, while local banks or credit unions might provide more personalized service and financial advice. Choose the lender that best fits your comfort level and needs.

Picking the right lender sets you up for success with your credit builder loan journey.

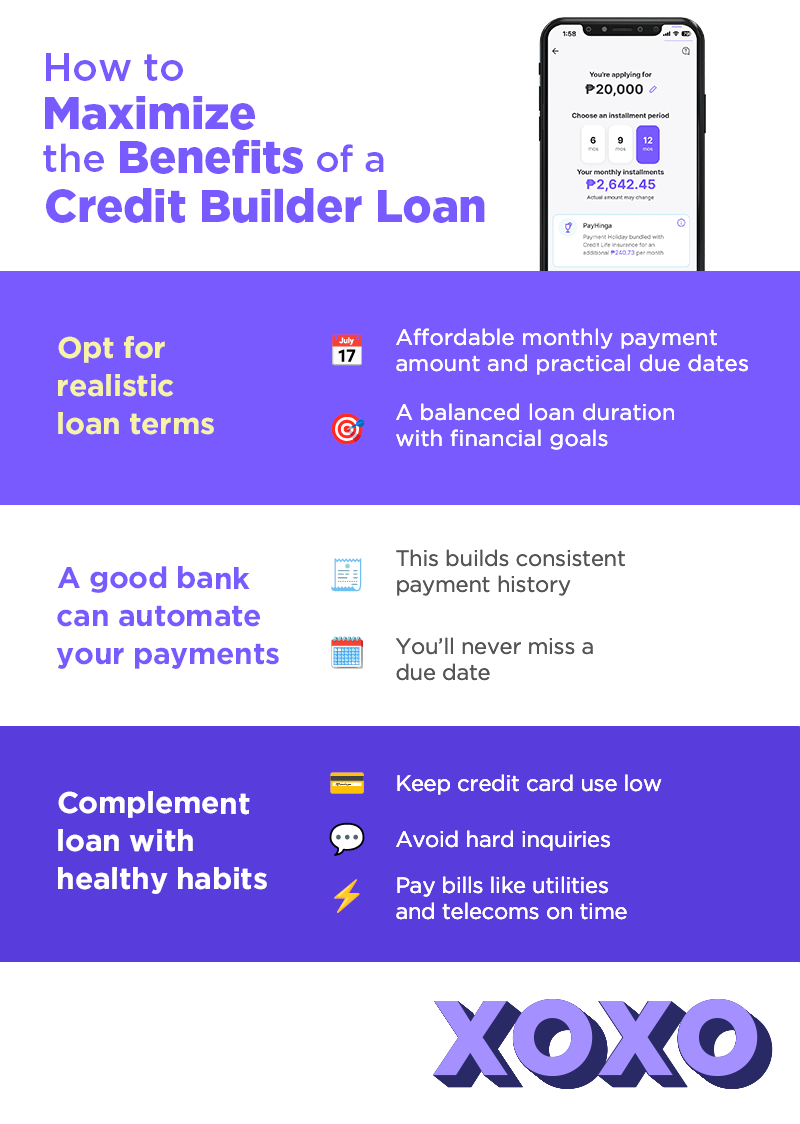

2. Set realistic loan terms

You want to build credit, not stress over bills. Choose credit builder loan terms that match your budget:

- Pick an affordable monthly payment you can commit to: It’s tempting to borrow the max, but setting a monthly repayment that fits comfortably in your budget means you’re less likely to miss payments—key to building good credit.

- Balance loan length with your financial goals (longer terms = smaller payments, but more interest): A longer term means smaller monthly payments but you’ll pay more interest overall. Shorter terms cost less interest but can feel tight on cash. Choose a term that supports both your credit goals and your wallet.

- Avoid default at all costs—a missed payment on your credit builder loan can hurt more than help: Missing payments or defaulting on your credit builder loan can seriously damage your credit score. If unexpected expenses pop up, communicate with your lender early to explore options instead of skipping payments.

3. Automate your payments

Missing payments? No, thank you. Automate your credit builder loan payments to:

- Never miss a due date: Setting up auto-pay ensures your payments get made on time, every time, even if life gets hectic. Timely payments have a huge positive impact on your credit score.

- Build consistent payment history (big credit score booster!): Lenders love seeing a pattern of responsible payments. This consistency builds trust with credit bureaus and boosts your creditworthiness for future borrowing.

- If you think you might miss a payment, contact your lender immediately and explore options: Life happens. If you’re struggling to make a payment, reach out proactively. Some lenders, like Tonik with its PayHinga feature, offer payment holidays or restructuring to keep your credit builder loan on track.

Need the scoop on credit scoring in the Philippines? Peek here: Truth About Credit Scoring Philippines.

4. Monitor your credit progress

Stay in the know by regularly checking your credit report and score as you repay your credit builder loan:

- Use free tools and services to track your progress: Several online platforms and government agencies provide free credit reports or score updates. These are invaluable to measure how your credit builder loan is helping.

- Know which parts of your credit report are impacted by your credit builder loan: Timely loan payments show up as positive marks. Missed payments or defaults show up as negatives. Understanding this helps you spot issues early.

- Catch and dispute errors early: Mistakes happen. If you spot wrong info on your credit report, file a dispute promptly to keep your credit history accurate and healthy.

Here’s a handy guide: How to Check Credit Score in the Philippines.

5. Complement your credit builder loan with healthy habits

A credit builder loan is great, but your overall credit health matters too:

- Keep your credit utilization low on credit cards: Try to use less than 30% of your credit limit on any cards. High utilization signals risk and can lower your score.

- Avoid unnecessary hard inquiries (those credit checks that can ding your score): Every time you apply for credit, lenders check your report, which can temporarily ding your score. Only apply when you really need it.

- Pay your bills on time—utilities, phone plans, and more: While these don’t always show on credit reports, many lenders now consider payment history from utilities and telecoms as a sign of financial responsibility.

6. Know when to transition

Once you’ve built a solid credit history with your Credit Builder Loan:

- Consider moving on to other credit tools like secured credit cards or small personal loans: These help diversify your credit profile and offer new ways to build credit.

- Look for signs your credit profile is ready: Improved score, steady payments, and responsible credit card use show you’re ready for the next step.

- Keep practicing good credit habits even after your Credit Builder Loan ends: Credit building is a marathon, not a sprint. Staying consistent keeps your score healthy and growing.

7. Common mistakes to avoid

Don’t let rookie mistakes slow your credit builder loan progress:

- Taking a credit builder loan without a clear budget: Without a plan, repayments become stressful and risky.

- Borrowing too much or going for high-interest loans: Overborrowing can lead to missed payments; high-interest loans increase your cost unnecessarily.

- Ignoring your credit reports—watch your progress and errors closely: Monitoring keeps you in control and helps spot errors or fraud.

Why choose Tonik Credit Builder Loan?

Ready for a credit boost with zero hassle? The Tonik Credit Builder Loan offers:

- Payment terms up to 12 months so you can choose what fits you

- Loan amounts up to ₱20,000 — start small and build big

- Affordable monthly add-on interest rates

- No credit history? No problem! Perfect for first-timers

- PayHinga feature gives you up to two months payment holiday when you need it

Get started on your credit-building journey now with Tonik. No hidden fees, no complicated hoops—just smart, simple credit growth.

👉 Check it out here and download the Tonik App to apply today! Want more financial tips that don’t bore you? Stay tuned and keep adulting smart.