Where to Keep Your Emergency Fund: Digital Bank, E-Wallet, or Investments?

Quick Take: Where Should You Keep Your Emergency Savings?

Your emergency fund deserves a home that’s safe, easy to reach, and smart enough to grow. For most Filipinos, the sweet spot is a mix of digital banks, traditional savings accounts, and a small amount in e-wallets—so you’re always ready when life throws a surprise your way. ⚡

Table of Contents

Introduction

Life loves surprises—and not all of them are fun. A sudden medical bill, job change, urgent home repair, or car trouble can quickly mess with your finances if you’re not prepared. That’s why building (and properly storing) an emergency fund is one of the smartest money moves you can make.

Saving is step one. Step two? Deciding where to keep your emergency fund. Not all accounts are created equal, and choosing the right place for your emergency savings means your money stays protected, accessible, and stress-free when you need it most. 🙌

What Are Emergency Savings?

Emergency savings are funds set aside only for urgent and unexpected expenses. This is not your travel fund, shopping budget, or “because I deserve it” money. Your emergency fund is your financial safety net.

Every Filipino needs one because:

- Income can be unpredictable, especially for freelancers or gig workers 📉

- Medical expenses can show up without warning

- Natural disasters and home repairs happen more often than we’d like 🌧️

- Having a safety net helps you avoid loans or credit card debt

How big should your emergency fund be?

A good rule of thumb is 3 to 6 months of essential expenses. If you spend ₱20,000 a month, your emergency fund should ideally be around ₱60,000 to ₱120,000. 💡

The Purpose of an Emergency Fund

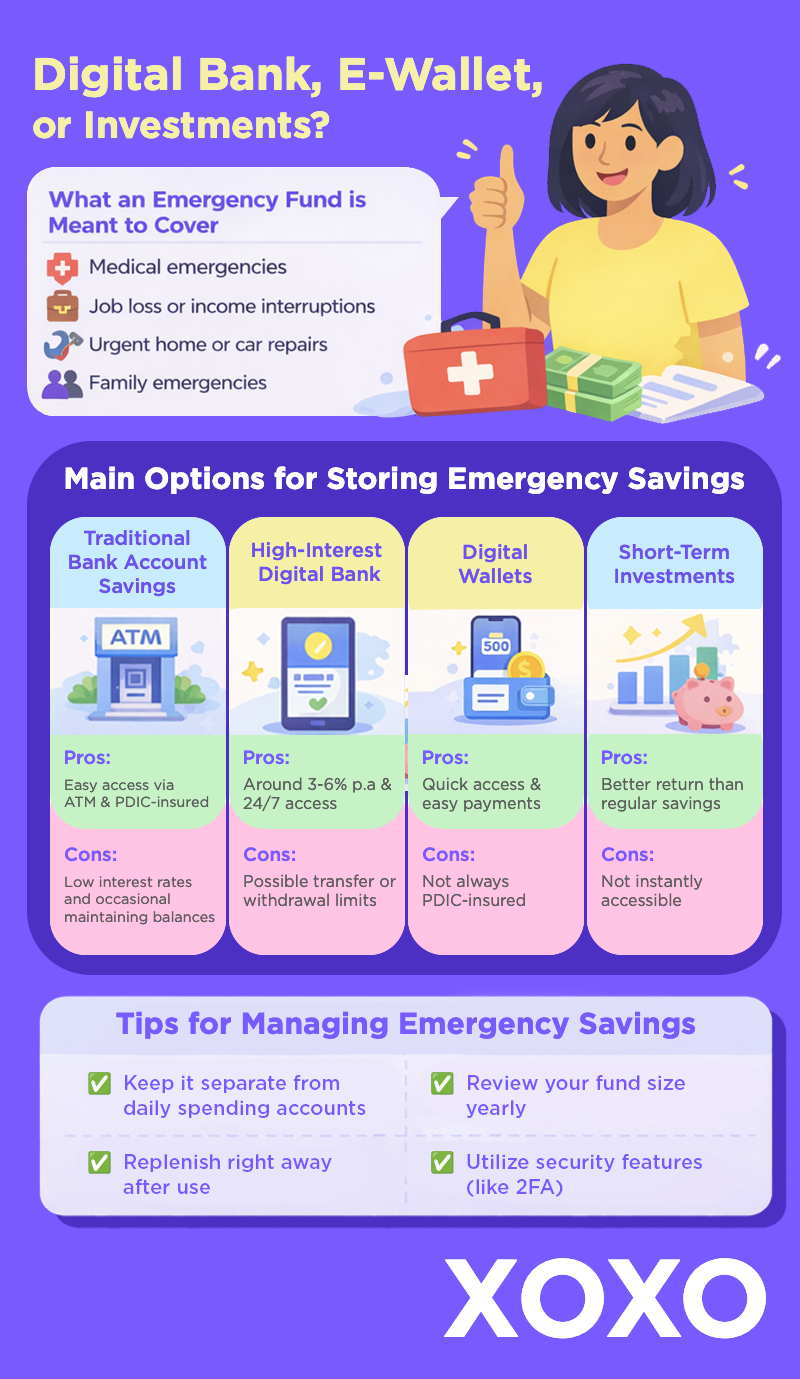

Your emergency fund is meant to cover:

- Medical emergencies 🩺

- Job loss or income interruptions

- Urgent home or car repairs 🏠

- Family emergencies

Because of this, your emergency fund should be:

- Easily accessible – ready when you need it

- Stable and low-risk – no wild market swings

- Liquid – fast withdrawals, no waiting

Earning interest is great – but safety and access always come first. ✅

Main Options for Storing Emergency Savings

Traditional Bank Savings Accounts 🏦

Pros:

- Easy access via ATM or over-the-counter

- PDIC insured up to ₱1,000,000

- Secure and reliable

Cons:

- Low interest rates (often below inflation)

- Some accounts require maintaining balances

Best for: People who value security and familiarity for their emergency fund.

High-Interest Digital Banks 📱

Pros:

- Higher interest rates (around 3-6% p.a.)

- Some accounts may require a minimum maintaining balance to unlock higher interest rates (e.g., keep a ₱10,000 average daily balance to earn 6% p.a., while 5% p.a. is guaranteed no matter the balance)

- No monthly fees

- 24/7 access through mobile apps

Cons:

- Possible transfer or withdrawal limits

- Requires good digital security habits

Best for: Savers who want their emergency fund to stay liquid and grow.

Digital Wallets ⚡

Pros:

- Super fast access for immediate needs

- Easy payments and transfers

Cons:

- Not always PDIC-insured

- Low interest and balance caps

- Higher risk if your phone or account is compromised

Best for: Keeping a small emergency buffer, not your entire emergency fund.

Short-Term Investments (Optional for Partial Allocation) 📈

Examples: Time deposits, money market funds, low-risk bond funds

Pros:

- Better return than regular savings

- Helps your emergency savings keep up with inflation

Cons:

- Not instantly accessible

- Slight market risk

Best for: Those with larger emergency funds (₱100,000+) who can afford to lock away a portion.

Option | Liquidity | Safety | Potential Returns | Recommended Use |

|---|---|---|---|---|

Traditional Bank | High | Very Safe (PDIC) | Low | Core emergency fund |

Digital Bank | High | Safe (PDIC) | Moderate | Growth-oriented emergency fund |

Digital Wallet | Very High | Limited protection | Very Low | Small, immediate expenses |

Short-Term Investment | Moderate | Varies by product | Higher | Partial long-term reserve |

How to Structure Your Emergency Fund (Recommended Allocation)

A tiered approach keeps you ready and earning:

- Tier 1 (20%) – Digital wallet for instant needs (medical bills, small repairs)

- Tier 2 (60%) – Digital or traditional bank savings for core emergencies

- Tier 3 (20%) – Time deposits or money market funds for extra growth

Think of it as your emergency fund with backup plans. 💪

Tips for Managing Your Emergency Savings

- Keep your emergency fund separate from daily spending accounts

- Review and adjust your fund size every year 📆

- Replenish it right away after use

- Turn on strong security features like 2FA 🔐

- Watch interest rates and move funds when better options pop up

Why Tonik Bank Works Well for Emergency Savings

PDIC-Insured and Fully Digital

Tonik is a BSP-regulated digital bank and PDIC-insured up to ₱1,000,000 so your emergency fund stays protected—without the branch visits.

Competitive, High-Interest Rates

With Stashes and Time Deposits, Tonik helps your emergency savings grow faster than traditional banks. 🚀

Easy Access and Full Control

Check balances, move money, or manage your emergency fund anytime through the Tonik app—because emergencies don’t follow office hours. ⏰

Flexible Savings Options

- Stashes – Perfect for liquid emergency savings

- Time Deposits – Best for funds you won’t need right away

- Group Stash – Ideal for families or partners saving together 👨👩👧👦

Recommended Setup Example

- ₱10,000-₱20,000 in an e-wallet for instant access

- ₱50,000-₱100,000 in a Tonik Stash for steady growth

- ₱50,000+ in a Tonik Time Deposit for long-term reserves

This setup keeps your emergency fund diversified, accessible, and earning—all in one secure Tonik ecosystem. ✨