How Tonik’s PayHinga Feature Helps You Take a Break from Payments

Quick Take (TL;DR): Tonik’s PayHinga is a smart little add-on to your Shop Installment Loan that gives you up to 2 months of breathing room from repayments—without any interest piling up. Think of it as a built-in payment holiday for when life gets unpredictable. Bonus? It comes with bundled loan insurance, including credit life and disability coverage, to give you peace of mind no matter what.

👉 Try Tonik Shop Installment Loan

Table of Contents

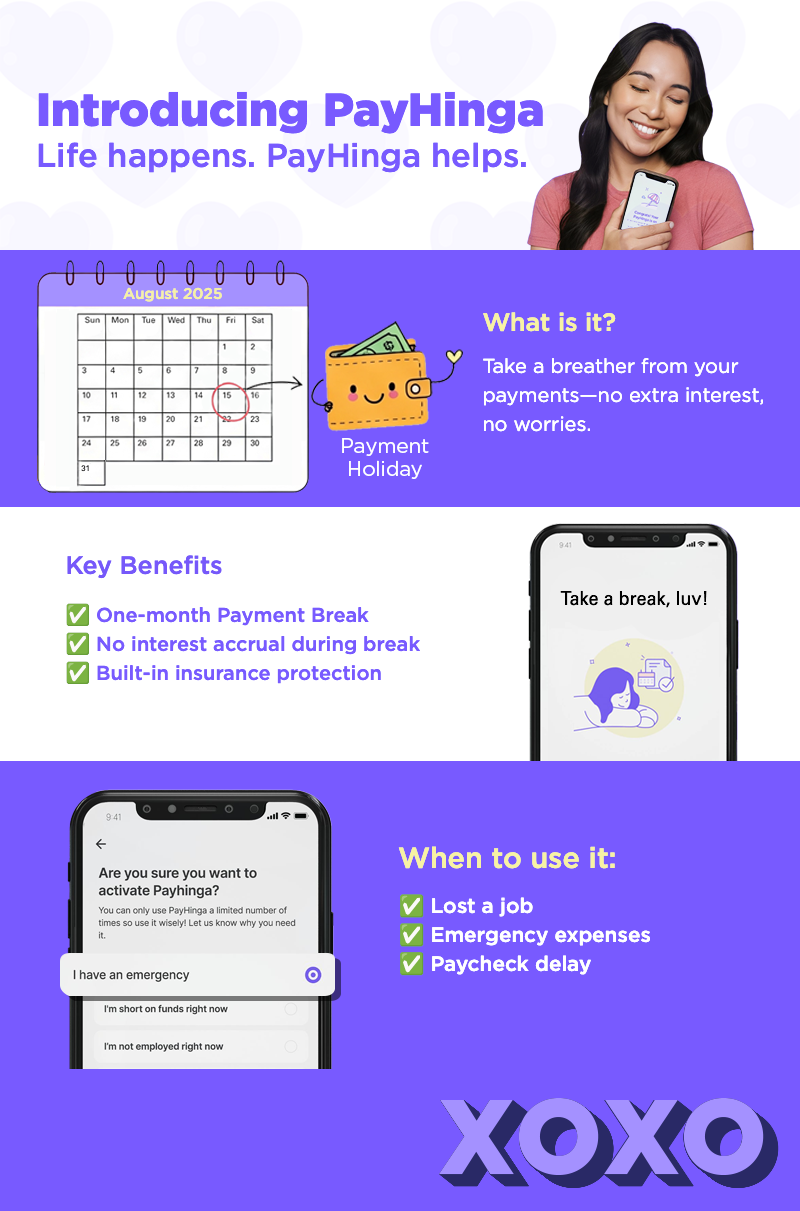

What is PayHinga?

PayHinga is Tonik’s way of giving you a bit more breathing room when you need it most. It’s a repayment break feature you can opt into at the time of applying for a Shop Installment Loan.

Think of it as your financial “pause button.” Once you activate PayHinga, you get up to 2 full months off from payments—without the stress of added interest. It’s especially handy if you’re a freelancer, entrepreneur, or just riding the highs and lows of unpredictable income.

And the best part? PayHinga comes with built-in loan insurance coverage that covers your remaining balance in case of death or permanent disability—so even during a pause, your loan stays protected.

Key Benefits of PayHinga

Here’s why PayHinga is a smart move:

✅ Up to 2-months of payment holiday – Hit pause on your loan repayment when you need it. No stress.

✅ No interest accrual – Those breaks? Don’t worry, they won’t cost you extra.

✅ Built-in loan insurance – Credit life and disability insurance come included.

✅ Coverage of up to 120% of your loan balance in case of major life events.

How PayHinga Works

PayHinga keeps it simple–but here’s what to know before you activate:

Activation Rules:

- You must opt in during your initial loan application.

- You must make 3 consecutive on-time payments to unlock the feature.

- You must activate it before your next due date.

What Happens After Activation:

- Your loan repayment schedule shifts by up to 2 months.

- No interest piles up during your break(s).

- A small monthly fee applies to keep your protection and access intact.

PayHinga Fees and Conditions

Transparency is key, so here’s what you need to know:

- Monthly Fee: 9.11% of your monthly installment—charged whether you use the break or not.

- Non-Refundable: Once you opt in, you can’t remove it from your loan.

- What's Covered: That fee includes your loan insurance, so you’re protected from Day 1.

Built-in Loan Insurance Coverage

PayHinga isn’t just about taking a breather—it’s about staying protected.

- Credit Life Insurance – In the unfortunate event of your passing, the insurance pays off your remaining loan.

- Credit Disability Insurance – If you become permanently disabled, the loan will be handled.

- Coverage Details:

- Up to 120% of your remaining loan balance

- Valid until your loan is fully paid, or until you turn 59—whichever comes first

- Coverage is provided by Sun Life Grepa Financial

How to Activate and Manage PayHinga

No paperwork. No phone calls. Just your Tonik app.

- Tap to activate via your loan dashboard in the app.

- After using PayHinga, you must make 3 on-time payments before using it again.

- Once activated, your up to 2-month break is applied.

- Insurance details and status? View it all right in the app.

Consider This Before Opting In

PayHinga is a helpful safety net—but it might not be for everyone.

Here’s what to keep in mind:

⚠️ It’s not a freebie – The PayHinga fee applies monthly, even if you don’t hit pause.

✅ Perfect for freelancers, gig workers, or anyone with income ups and downs.

❗ Once activated, you’ll get up to 2 full months of payment holiday. No partial skips allowed.

Final Thoughts: Is PayHinga with Loan Insurance Worth It?

If you value flexibility, peace of mind, and a plan B—then yes, it’s absolutely worth it.

PayHinga gives you up to 2 months of repayment relief when you need it most, without interest piling up. And with credit life and disability insurance built in, your loan stays protected even if life throws you a curveball.

Tonik designed PayHinga for today’s modern money movers—people who hustle hard, pivot fast, and plan ahead. It’s not a shortcut. It’s smart banking for real life, luvs. 💜