How to Budget Smartly When Using a BNPL Loan for Big Purchases

Here’s what I’ve learned about how to budget when using Buy Now, Pay Later (BNPL) loans: Treat those future payments like cash you’ve already spent. Only commit to installment plans that comfortably fit your monthly budget, avoid juggling multiple BNPL loans at once, and always prioritize needs over wants. Keep calendar reminders for due dates and factor in the total cost—including interest—before saying yes.

👉 Try Tonik Shop Installment Loan and shop smartly today.

Table of Contents

- What’s a BNPL loan and why budgeting matters

- 1. Assess your monthly cash flow first

- 2. Choose purchases wisely

- 3. Understand the true cost of your BNPL loan

- 4. How to budget? Set a payment strategy

- 5. Avoid overlapping loans

- 6. Monitor your budget weekly

- 7. Pay early when possible

- Why Tonik Shop Installment Loan is your smart BNPL partner

What’s a BNPL loan and why budgeting matters

When I first started learning how to budget with BNPL loans for big purchases like gadgets and appliances, it felt like a game changer—being able to spread payments over months without feeling the pinch right away. But I quickly realized that without a solid budget, it could spiral out of control.

Knowing how to budget properly isn’t just a nice-to-have—it’s the key to enjoying your purchases without the stress of surprise bills.

1. Assess your monthly cash flow first

Before you commit to any BNPL plan, it’s essential to understand how to budget your money effectively.

- First, take a close look at your monthly income. This isn’t just your salary—it includes any side gigs, freelance work, or other income streams.

- Next, list all your fixed and variable expenses—rent, groceries, bills, transportation, and even those little coffee runs.

- What’s left is your “safe-to-spend” amount—the real number you can confidently put toward BNPL payments without risking your essentials.

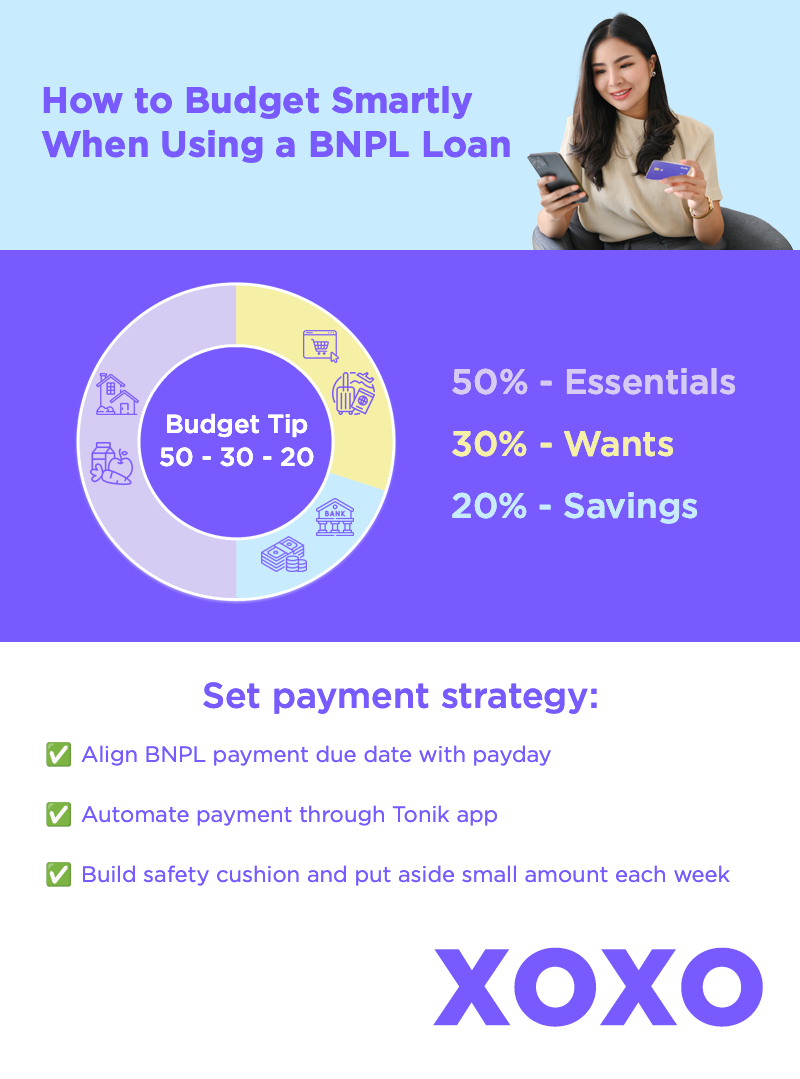

- I like to use the popular 50/30/20 rule as a starting point: 50% for essentials, 30% for wants, 20% for savings and debt repayment. But life isn’t always perfect, so adjust the percentages based on your priorities.

This step is crucial because it gives you a clear picture of your financial health, so you can avoid biting off more than you can chew. To help you decide what kind of things to invest on, you might find our blog about the best summer appliances useful!

2. Choose purchases wisely

- One of the most important lessons I learned about how to budget is distinguishing between needs and wants.

- Before jumping on that shiny new gadget or appliance, ask yourself: Is this something I truly need or just a nice-to-have? Take for example, a washing machine that saves you hours each week is a need, while the latest smart TV might be more of a want.

- Think about what adds real value to your daily life—items that save time, improve comfort, or help you work better deserve higher priority.

- If it’s something you want but can wait for, consider saving up and paying in full later rather than financing it immediately with BNPL.

Prioritizing wisely keeps your budget healthy and helps prevent buyer’s remorse.

3. Understand the true cost of your BNPL loan

It’s easy to get caught up in the excitement of spreading payments, but how to budget means knowing the full financial picture.

- Calculate your total repayment amount—including the original price plus interest and any fees. This helps you see what the purchase really costs.

- Using Tonik’s installment calculator super helpful—it breaks down what you’ll pay each month so you can plan better. During the summer months, be smart and invest in cooling appliances like refrigerators and air conditioners, which are both easily purchased with installments!

- Keep an eye out for hidden fees or penalties if you miss a payment, as these can quickly inflate your debt and wreck your budget.

Having this clear understanding upfront saves you from nasty surprises down the road.

4. How to budget? Set a payment strategy

Planning is everything when it comes to how to budget your BNPL repayments.

- Align your BNPL payment due dates with your payday so you always have the cash ready. This simple step prevents scrambling for funds at the last minute.

- Automate your payments through your bank or Tonik’s app. I can’t stress enough how much this reduces stress and avoids late fees.

- If you’re a bit of a saver, try creating a mini-sinking fund: Put aside a small amount each week specifically to cover your BNPL installments. It’s like building a safety cushion for your budget.

Having a strategy like this means your repayments become manageable, not a headache.

5. Avoid overlapping loans

I used to think juggling multiple BNPL loans was doable, but here’s what how to budget taught me: One at a time is way safer.

- Multiple monthly repayments can quickly overwhelm your budget and lead to missed payments or added fees.

- Focus on clearing one BNPL loan before taking on another. This keeps your finances manageable and your stress low.

- Use budgeting apps like Moneygment, GCash, or Tonik’s tools — or even a simple spreadsheet — to track what you owe and when.

Keeping your BNPL loans organized is key to staying on track and protecting your credit score.

6. Monitor your budget weekly

Budgeting isn’t a “set it and forget it” thing — how to budget well means regular check-ins.

- I recommend setting a weekly budget review to track spending and adjust for any unexpected expenses, like a surprise bill or emergency.

- Use apps that sync with your accounts for real-time tracking. The Tonik app and GCash all help me stay updated on my balance and upcoming payments.

- These weekly check-ins keep you accountable and help you catch small problems before they become big ones.

Staying proactive is the best way to keep your budget — and BNPL payments — on point.

7. Pay early when possible

If you ever get extra cash, paying your BNPL loan early is a win-win move I picked up while learning how to budget.

- Tonik lets you pay early with zero penalties, so you save on interest and get one step closer to being debt-free.

- If you receive bonuses, tax refunds, or unexpected income, putting some or all of it toward your loan cuts, costs and clears your mind.

- Trust me, reducing mental debt is just as important as saving money — it feels amazing to have fewer payments hanging over you.

Why Tonik Shop Installment Loan is your smart BNPL partner

From personal experience, Tonik’s Shop Installment Loan stands out as flexible, transparent, and easy to use — exactly what you need when figuring out how to budget for big purchases. Want to know more about Buy Now Pay Later Loans in the Philippines? Read more here.

You get clear fees, online convenience, and helpful tools to plan your payments right, so your budget stays healthy and stress-free.

👉 Ready to buy big without the worry? Try Tonik Shop Installment Loan today. Your wallet (and your peace of mind) will thank you. Budget smart, spend smarter. You’ve got this!