Emergency Loan: Your Guide to Quick Relief When Natural Disasters Strike

When typhoons, earthquakes, or floods strike, the damage can be overwhelming—not just to homes, but to your budget too. From fixing what’s broken to replacing what’s lost, the expenses can pile up before you even catch your breath.

That’s where a calamity loan comes in, whether it’s from SSS Calamity Loan, Tonik Credit Builder Loan, or others. Think of it as a safety net—an emergency loan designed to help you recover faster, without draining every peso you have. Here’s what you need to know to get it, use it wisely, and avoid delays along the way.

Table of Contents

SSS Calamity Loan, Emergency Loan, and Others

An emergency loan is a short-term loan made for urgent situations—whether it’s a typhoon, earthquake, or other unexpected crisis. They’re designed to be faster and easier to get than your usual loan, with:

✅ Fewer requirements – No mountain of paperwork here!

✅ Quick approval times – Sometimes just days from application to payout.

✅ Shorter repayment terms – Usually payable within 1–3 years, so you’re not stuck in long-term debt.

They can come from banks, cooperatives, fintech apps like Tonik, or government programs—like the SSS calamity loan, Pag-IBIG Calamity Loan, or GSIS Emergency Loan.

Where to Turn for an Emergency Loan After a Typhoon

When a disaster strikes, here are your main options:

- Government agencies – Programs like the SSS Calamity Loan, Pag-IBIG Calamity Loan, and GSIS Emergency Loan all serve members living in officially declared disaster zones.

- DSWD – Not a loan, but cash aid and relief packages can always help!

- Banks and credit unions – Some roll out special “disaster relief” loans. With Tonik’s Credit Builder Loan, you can borrow in a flash while still leveling up your credit. 100% online, zero hassle!

Pro tip: If you get a Tonik Credit Builder Loan, you can even opt for PayHinga, which is Tonik’s special offer of giving their customers payment holidays for as long as two months!

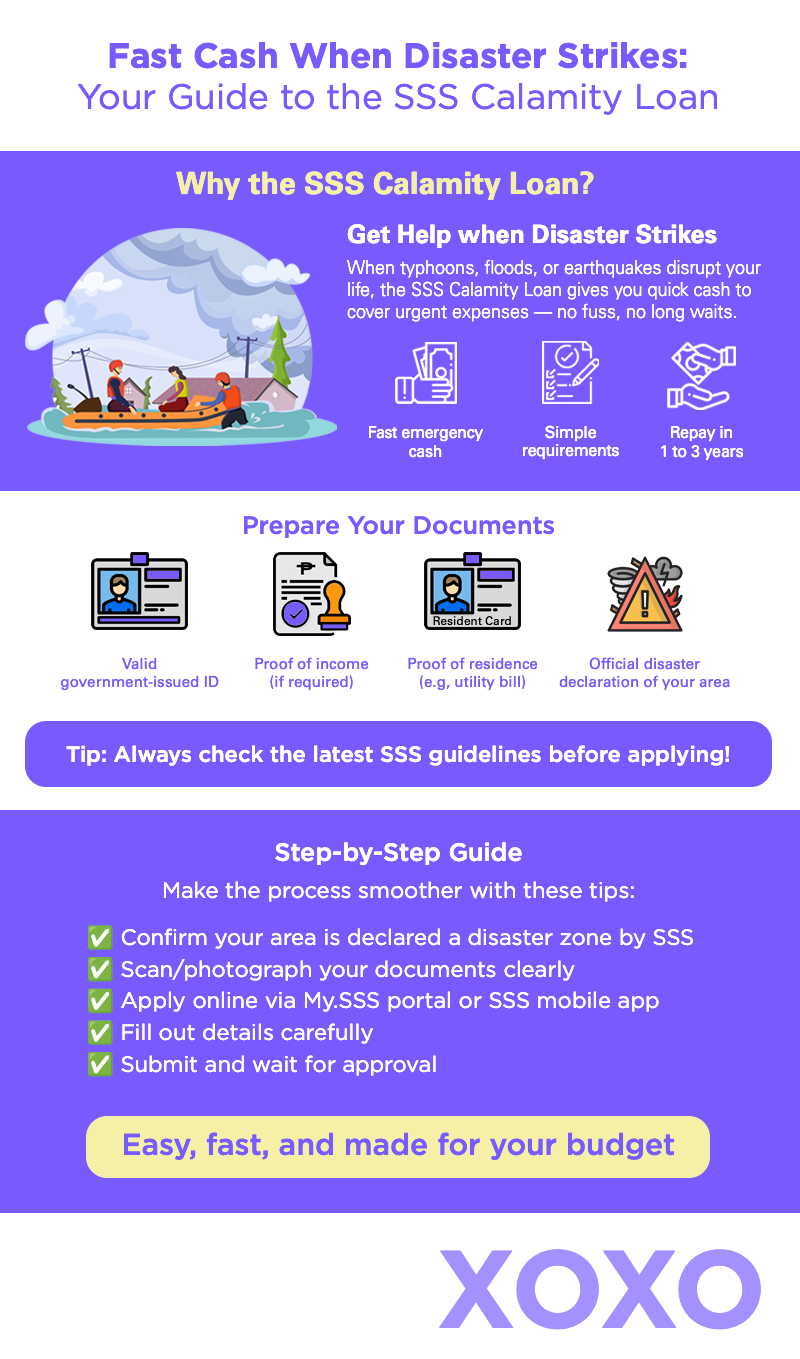

Requirements and Eligibility

Here’s what you’ll generally need to prepare for the SSS calamity loan or most other emergency loans like the Tonik Credit Builder Loan:

✅ Valid government-issued ID

✅ Proof of residence (utility bill or barangay certificate)

✅ Proof of income (pay slip, remittance slip, or business permit, if needed)

✅ Official disaster declaration covering your area (Specifically for SSS loan)

Pro tip: Always double-check the latest loan guidelines before applying to avoid delays! Requirements can change depending on the situation.

How to Apply (Step-by-Step)

- Check if your area qualifies – SSS will announce eligible locations after a disaster.

- Get your documents ready – Have everything scanned or photographed clearly.

- Choose your application method – Apply via the My.SSS portal or SSS mobile app.

- Fill out your details carefully – Mistakes can mean delays!

- Submit and wait for approval – Government loans may take a few days; fintech loans may be faster.

Tips for Faster Loan Approval During Disasters

Disasters are stressful enough—you don’t need extra waiting time. Here’s how to cut it down:

- Pre-register on your chosen lending platform before an emergency hits.

- Save digital copies of your documents in your phone or cloud storage.

- Link your bank account or e-wallet ahead of time so funds can be released instantly.

Stay Alert for Scams!

Unfortunately, disasters also attract scammers. Protect yourself from:

🚫 Fake lenders asking for “processing fees” before giving you a loan.

💸 Hidden charges or ridiculously high interest rates.

📱 Shady apps with poor customer service in times of crisis.

If you spot something suspicious, verify the lender with the SEC or BSP.

Before You Borrow, Consider These Alternatives

Before taking out a loan, explore other forms of aid:

- Government cash assistance – Ayuda, DSWD SAP, or LGU relief

- Support from cooperatives or NGOs

- Loan payment deferrals or extensions from your existing lender

These can help reduce the amount you need to borrow. Not to mention, you can build your own emergency fund so you can avoid borrowing money when the time comes.

Final Reminders

Emergencies are tough—but with the right help, you can start rebuilding sooner.

- Borrow only what you need and can pay back comfortably.

- Read the terms carefully before signing anything.

- Stick to trusted sources for loans and aid.

An emergency loan, from an SSS Calamity Loan to the Tonik Credit Builder Loan — can be the helping hand you need to get back on track, luv. 💜 Read how you can qualify for a Tonik Credit Builder Loan here! Used wisely, it can give you breathing room so you can focus on what matters most: recovery.