Loan Default Explained: What It Means and How to Get Back on Track in the Philippines

Table of Contents

Introduction

Ever had that “I’ll pay it next week” moment that accidentally turns into “Oh no… it’s been three months!?” You’re not alone! Life happens — bills pile up, pets get sick, family comes to visit – and sometimes, your wallet just can’t keep up.

But before you spiral into panic mode, let’s talk about loan default – what it is, what really happens if you miss payments, and how to bounce back (without losing your mind or your credit score). 💪

Knowing the Consequences of Borrowing

Before you click the “Apply Now” button on your next loan, it’s super important to understand what could happen if you can’t pay on time. Borrowing is easy – especially with digital banks like Tonik – but defaulting? That’s where things get messy.

So let’s spill the tea on loan default, and how you can avoid turning your financial “glow-up” into a “glow-down.”

So… What Exactly Is Loan Default?

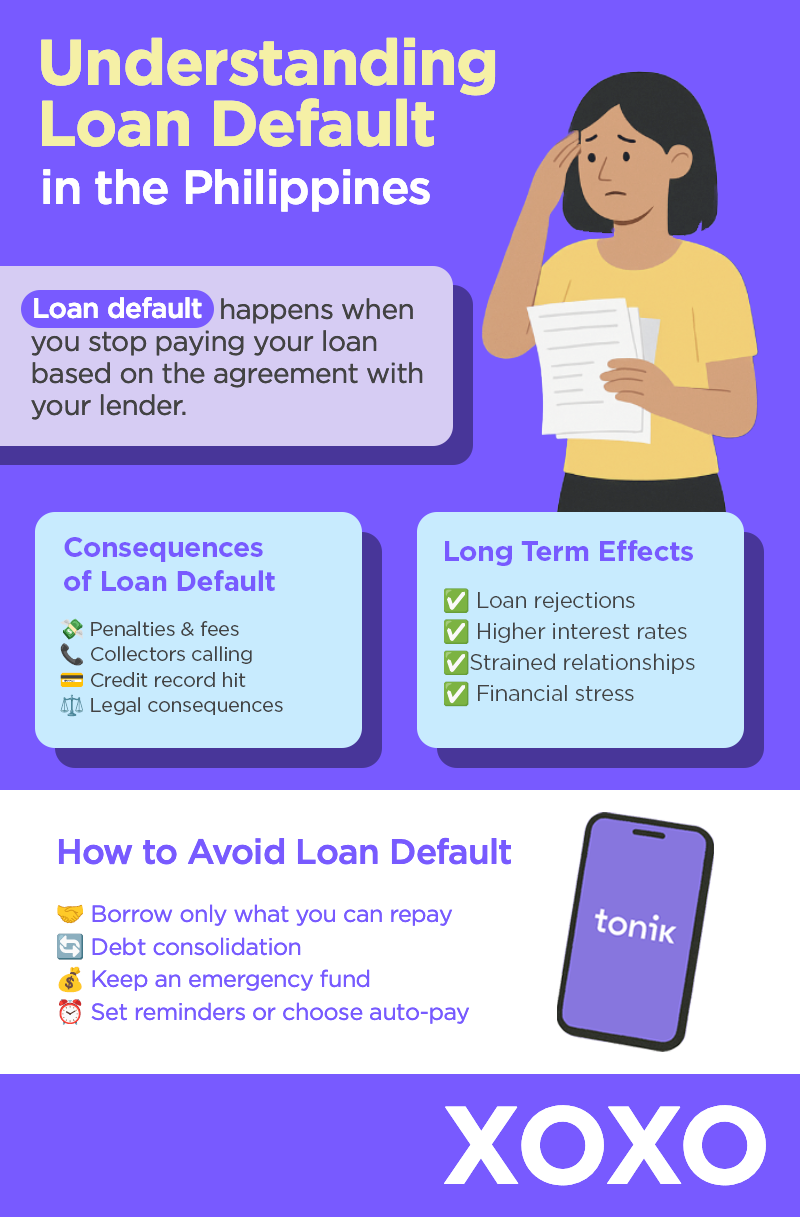

In simple terms, loan default happens when you stop paying your loan based on what you and your lender agreed on.

It’s not the same as just being late – default is when the lender officially marks your loan as “uh-oh” territory because payments are way past due.

Here’s how it typically goes:

- You miss a due date.

- You get a gentle reminder.

- Then a not-so-gentle reminder.

- Eventually, your lender declares the loan “in default.”

This can happen after a few months (depending on the lender), and it applies whether it’s a personal loan, credit card, housing loan, or unregulated private lending (a.k.a. those “too-good-to-be-true” loans that can turn scary fast).

The Immediate Consequences of Loan Default

💸 Penalties & Fees

Missed payments don’t just disappear – they multiply. Late payment charges, interest-on-top-of-interest, and mysterious “other fees” can make your ₱20,000 loan look like it’s been on a growth spurt. The longer you delay, the more it grows.

📞 Collectors Calling Nonstop

Once your loan defaults, expect calls, texts, and emails from collectors who are very enthusiastic about reaching you. Some might overstep, but remember – under BSP and SEC rules, harassment and threats are a big no-no. If anyone crosses the line, you can report them right away.

💳 Your Credit Record Takes a Hit

A default means your name gets a not-so-glowing mark in the Credit Information Corporation (CIC) database. That means future lenders will see you as a “risky” borrower – which could make getting a loan approved (or getting good rates) a lot tougher.

Legal Consequences (a.k.a. The Serious Stuff)

⚖️ Civil Cases

If you default, your lender can file a case to recover what you owe. That could mean salary deductions or even asset seizure — though it’s best to address the issue early and avoid getting to that stage altogether.

💥 Criminal Liability – Spoiler: You Won’t Go to Jail

Not paying your loan alone isn’t a criminal act in the Philippines. So good news! You can’t be jailed for non-payment.

BUT – if there’s fraud involved, or if you issued a bouncing check, that’s a different story. Stay honest, and you’ll be fine.

🚫 Blacklisting

Yup, lenders can put you on a “naughty list.” When you’re blacklisted, banks and other financial institutions might automatically reject future loan or credit card applications. If not rejected, it could affect your access to better loan terms – think higher interest rates, lower credit limits, or stricter approval checks.

The silver lining? It’s not permanent. With consistent on-time payments and responsible credit behavior, you can work your way back into good standing!

Long-Term Effects of Default

Here’s what might happen after a loan default:

- Loan rejections: Future lenders might think twice before approving your next loan, especially if they see a pattern of missed payments.

- Higher interest rates: Even if you get approved, you’ll likely face steeper rates because lenders will tag you as “high-risk.”

- Tough conversations: Co-borrowers and guarantors also get calls from collectors – and that can put a real strain on friendships or family ties. After all, when you miss payments, your debt can suddenly become their headache too.

- Financial stress: Constant reminders, sleepless nights, and worrying about your next step can take a real toll on your mental health.

It’s not the end of the world – but definitely an experience you’d rather skip.

What to Do If You Can’t Pay

📢 Talk to Your Lender (ASAP!)

Most lenders are more understanding than you think. Reach out, explain your situation, and ask about restructuring, grace periods, or smaller payments.

💰 Try Debt Consolidation

Too many loans stressing you out? Combine them into one manageable payment with a better rate. Your future self will thank you.

✅ Take a PayHinga

Sometimes, you just need a breather. Tonik’s PayHinga gives you the option to pause or ease your loan payments for a short period—without hurting your standing. It’s designed to help you recover financially when life throws unexpected challenges your way. So if things feel tight, don’t panic—take a PayHinga and bounce back stronger.

🧠 Get Financial Counseling

There are free programs from NGOs and government offices that teach financial literacy and debt management. Learning how to budget smarter is always a good idea.

💡 Know Your Rights

Collectors can contact you – but they can’t threaten, shame, or embarrass you. If they do, that’s a red flag (and a violation of BSP/SEC rules).

How to Avoid Loan Default (Like a Pro!)

- Borrow only what you can actually repay.

- Keep a small emergency fund – adulting’s safety net.

- Set reminders or go auto-pay.

- Avoid sketchy lenders who don’t follow regulations.

Remember: Prevention is cheaper (and less stressful) than collection!

FAQs

Q: Will I go to jail if I can’t pay my loan?

A: Nope! Non-payment is a civil issue, not a criminal one.

Q: How long does a default stay on record?

A: Usually a few years – depending on the lender and your repayment efforts.

Q: Can collectors contact my family or employer?

A: Only for verification purposes, not public shaming! If they threaten you, report it.

Q: What happens if I default on a “5-6” loan?

A: Unlike banks, informal lenders don’t follow BSP rules – so collections can get… intense. Stick to regulated lenders, please. 🙏

The Tonik Way Out 💜

If you’ve stumbled before – hey, no judgement! Tonik’s Credit Builder Loan is here to help you rebuild your credit score AND your confidence. It’s your chance to show lenders (and yourself!) that you’ve got this.

So don’t panic – just plan. With a bit of discipline, some Tonik magic, and your new financial wisdom, you’ll be back on track before you can say “paid in full!” 🚀