📊 Trying to glow up your credit score? You’ve probably come across two popular options: Credit Builder Loan and Secured Credit Card. But which one should you go for? 👇

| Feature | Credit Builder Loan | Secured Credit Card |

|---|---|---|

| Purpose | Build credit through installment payments | Build credit through responsible card usage |

| Upfront Cost | Monthly payments only (no deposit required) | Requires a security deposit |

| Interest | Yes, based on loan terms | May charge interest if balance isn’t paid in full |

| Credit History Impact | Positive if paid on time | Positive if used responsibly and paid on time |

| Access to Funds | Gets full loan amount after full repayment | Can use credit line right away |

👉 Get the Tonik App to start your credit journey smartly.

Table of Contents

What’s the deal with credit-building tools?

Let’s be real—credit scores can be confusing. But if you want to get approved for future loans, better interest rates, or even that dream condo, you need to build solid credit. The good news? Tools like credit builder loans and secured credit cards can help you do just that—one responsible move at a time.

But here’s the kicker: the right tool depends on you — your lifestyle, your goals, and where your finances currently stand.

Credit Builder Loans vs. Secured Credit Cards

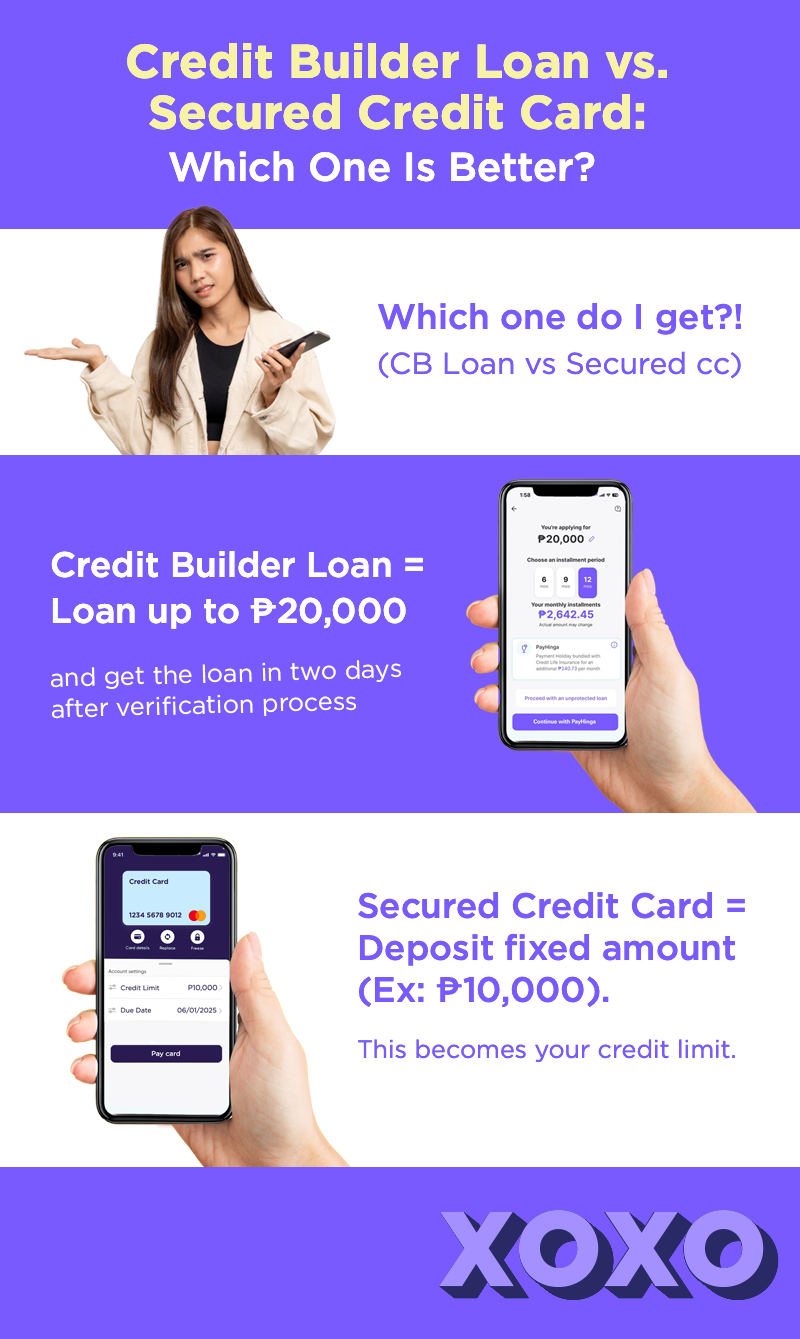

What’s a Credit Builder Loan?

The Tonik Credit Builder Loan is more than just a money-lending feature. It’s designed to help clients who have low credit scores, or even no credit history at all, build credit slowly but surely. With flexible terms, low and competitive interest rates, Tonik’s Credit Builder allows you to enjoy a quick loan that isn’t too burdensome to repay, all the while building and improving your payment history.

Curious to know more about it? Read our blog, “What’s a Credit Builder Loan? Let’s Dive In”!

Typical features:

- Loan amounts: Up to ₱20,000

- Term: 6 to 12 months

- Interest: Yes, but lower than many traditional loans

- PayHinga: Gives you payment holidays up to two months!

✅ Pros:

- Low-risk way to build credit

- Forces a saving habit

- Doesn’t need a credit history to apply

⚠️ Cons:

- Late payment fee

- Late payments will reflect on your credit score

What’s a Secured Credit Card?

A secured credit card works just like a regular credit card—but with training wheels. You deposit a fixed amount (say, ₱5,000), which becomes your credit limit.

How it works:

- Your deposit = your credit limit

- Use the secured credit card like any other card

- Pay your bills on time to build credit

✅ Pros:

- Immediate access to credit

- Helps build credit through usage and timely payments

- Can be upgraded to an unsecured card later

⚠️ Cons:

- Requires an upfront deposit

- Interest charges if you don’t pay in full monthly

- Temptation to overspend (If you want to read up on the impact of consumerism on personal finances, we’ve got just the blog for you here!)

Head-to-head: How do they compare?

| Feature | Credit Builder Loan | Secured Credit Card |

|---|---|---|

| Eligibility | Often easier to qualify | May require a bank account and stable income |

| Initial cost | None (just monthly payments) | Yes (deposit required) |

| Flexibility | Fixed payments, fixed term | Ongoing, flexible use |

| Credit score impact | Builds score via installment loan behavior | Builds score via revolving credit behavior |

🔎 Read more on credit scoring in The Philippines here!

Which one should you choose?

Go for a Credit Builder Loan if:

- You want to build credit and a quick loan at the same time

- You prefer predictable monthly payments

- You want the chance of payment holidays (PayHinga) while building your credit score

Go for a Secured Credit Card if:

- You want flexible access to funds

- You’re confident in managing monthly repayments

- You already have a lump sum for a security deposit

🎯 Pro tip: Your choice should match your financial habits, stability, and long-term goals. Whether it’s a credit builder loan or a secured credit card, building credit is a journey—not a sprint.

Tips to win at credit building (whichever you choose)

💡 If you go with a credit builder loan:

- Set up auto-pay to never miss a due date

- Track your progress (and celebrate the wins)

- Don’t borrow more than you can commit to

💳 If you go with a secured credit card:

- Keep your credit utilization below 30%

- Always pay at least the minimum due (preferably the full amount)

- Avoid cash advances—they often come with high fees

🚫 Avoid these pitfalls:

- Missing payments = big hit to your credit score

- Taking on too many credit tools at once

- Ignoring interest rates and fees

Ready to start building your credit score?

If you're looking for a simple, no-fuss way to kickstart your credit journey, the Tonik Credit Builder Loan might just be your new best friend. Unlike a secured credit card, you don't need to shell out a big deposit upfront.

Here’s why Tonik’s Credit Builder Loan hits different:

✨ No credit history required: Perfect for first - timers

📆 Flexible terms: Choose between 6, 9, or 12 months

💸 Borrow up to ₱20,000: Start small and build up

⚡ Fast approval: Get approved within two days

🛡️ PayHinga feature: Enjoy up to two months payment holiday

📱 100% digital: Apply and manage your loan through the Tonik App

Whether you're starting from scratch or rebuilding your score, Tonik makes it easy, fast, and rewarding. And with zero temptation to overspend—unlike with a secured credit card—you can stay focused on your financial goals.

👉 Check it out here and take your first step to smarter credit-building today!