Your hottest burning questions about virtual debit cards are finally answered in this handy guide!

If you haven’t been keeping up with the times yet, here’s some news for you: contactless and digital payments are a huge thing these days. Though it’s definitely been around for quite a few years now, the global COVID-19 pandemic only heightened society’s need for digital or contactless transactions, whether that’s something as simple as buying your favorite clothes online or paying for your groceries with a simple scan of a QR code. Online shopping and e-commerce also made a huge leap forward in these tough times. We constantly do fund transfers to our favorite Instagram shops, make sure our e-wallets are funded and equipped, connect our most used e-commerce websites with our bank accounts, and so many more, honestly! Cash and physical transactions are slowly becoming a thing of the past. The future of transactions is here.

While having actual bills and physical cards may be helpful in some ways, they remain very much prone to theft and fraud. Anyone could easily take your cash or your cards’ details and use them for their own gain. That’s not including all the annoying steps you need to take to contact your local bank to freeze your cards as well. Long story short: it could be quite the hassle carrying all these things around with you, and exchanging cash is not considered very hygienic in the middle of a global pandemic as well.

So, you’ve got your e-wallets, your online bank accounts...what else is missing? Ladies and gentlemen, enter: the virtual debit card, a handy dandy way of seamlessly going through all your digital transactions. Spoiler alert: Tonik Bank’s got your covered with the Philippines’ best virtual debit card (more on this later). To make your research into this even easier, we’re giving you the ultimate lowdown and everything you need to know about virtual debit cards, plus some tips that you can keep in mind for a more convenient financial lifestyle. Got some questions? Good, because we’ve got answers, luv.

Table of Contents

- What in the world is a virtual debit card Philippines anyway?

- Best virtual debit cards in the Philippines

- How do I even use this strange technology called a virtual debit card?

- Sweet. So how else are virtual debit cards going to make my financial life better?

- Wait, wait, wait! Is a virtual debit card even really secure or safe? My phone might get stolen! What about hackers?

- There are so many types of virtual cards out there and it’s really confusing! What’s the difference between all of these?!

- Okay, these virtual debit cards seem pretty cool! I want in! So, how do I get one?

What in the world is a virtual debit card Philippines anyway?

If you have your regular physical debit cards made out of plastic, virtual debit cards are not much different, TBH, except for the fact that they exist entirely on your banking app. Most digital banks (like Tonik!) will issue you a virtual debit card once you open an account. Your virtual debit card is then linked to this bank account and draws money from there. It will have a randomly-generated 16-digit number as well as an expiration date and a card verification number (CVC), just like the plastic debit card that you have kept inside your wallet. You’re able to store your virtual debit card on a digital wallet or various mobile payment apps, such as your ex-wallets (we’re kidding!): GCash, PayMaya, PayPal, Google Pay, DragonPay, GrabPay, Coins.PH, and more.

Best virtual debit cards in the Philippines

When it comes to virtual debit cards, the Philippines isn’t left wanting. The most popular traditional banks, BDO and BPI, now feature their own virtual cards that customers can use on their apps. Meanwhile digital banks like GoTyme, Maya, and CIMB likewise boast virtual debit cards for their customers on their respective apps for seamless online transactions.

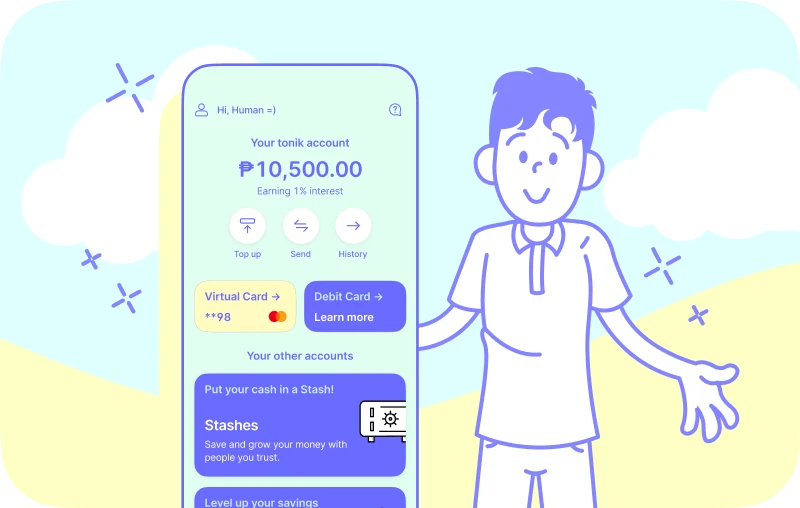

Not to toot our own horn, but Tonik Bank’s debit card is your best bet for security and convenience among all the local virtual debit cards. How? Let us count the ways. First of all, Tonik customers automatically acquire their virtual debit card the moment they onboard with the Tonik app. You’ll find your yellow virtual debit card on your Dashboard, which you can immediately use to shop online and pay bills through the app.

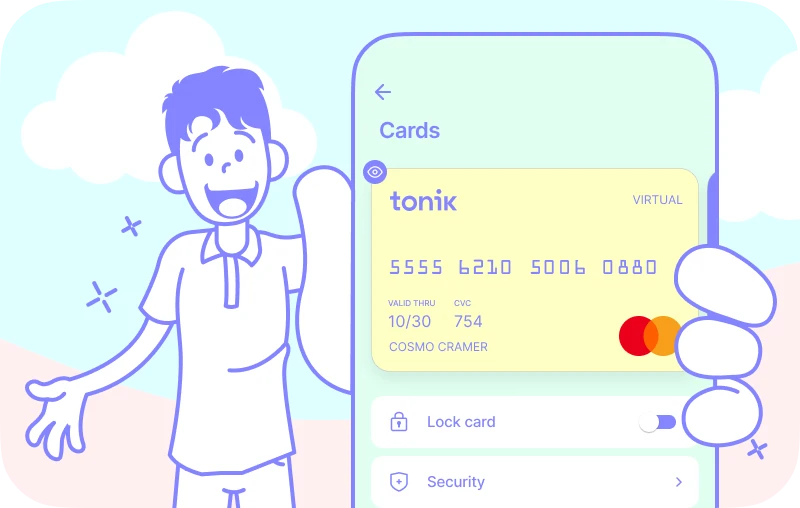

In case you’re worried about your Tonik virtual card’s online security, you can disable its online payments in the blink of an eye. Just tap your virtual debit card, go to “Security”, and toggle “Online payments” to disable it. On top of that, you can toggle “Lock card” which makes it impossible for anybody else to use your virtual debit card’s details without your knowledge or consent.

If that’s not enough to convince you of the Tonik debit card’s efficiency, here’s a bonus: You can manage your physical debit card on the Tonik app just as easily. That means you can also lock your physical debit card, disable payments, withdrawals, overseas use, and even reset your pin in your Tonik app with a toggle or two. No need to contact your bank just to block your cards due to emergencies or other scenarios. With the Tonik app, you’re in control in a matter of seconds!

TOC- Table FInd

How do I even use this strange technology called a virtual debit card?

Again, just like a regular debit card, you can use your virtual debit card Philippines number to pay for all your digital transactions, whether it’s on your favorite e-commerce website or online shop! Just place the card number there and you’re good to go. Plus, depending on your bank or virtual card provider, you can even use some virtual debit cards in physical stores by simply holding your phone to be scanned by a card reader (meaning no cash or card exchange in place, so it’ll be purely contactless! Hurray for the virtual card!).

TOC- Table FInd

Sweet. So how else are virtual debit cards going to make my financial life better?

Having a virtual debit card is very convenient, especially if you make most of your purchases and other transactions online. Here’s a list of reasons why:

-

They’re easy to get - Say goodbye to long forms and papers that you have to sign, or heading to branches for card applications. Again, virtual debit cards are issued as instantly as you open your digital bank account, like with Tonik.

-

It’s cheaper - When you order physical cards online, sometimes they may come with a processing or shipping fee. Since virtual debit cards exist purely online, then there’s no need for any sort of shipping or dinosaur-era stuff like that! It’s the 21st century, so we could get on with the times here.

-

It’s easier to use for all your online platforms - All types of virtual cards, whether it’s a debit card, virtual debit card Philippines or a credit card, are best used with online purchases and it’s the safer way to go. You can access these cards anywhere and anytime as long as you’ve got stable internet connection. Also, you can easily store a virtual card on all your e-wallets or payment apps. No more having to search for your wallet to get your card information. All it takes is a touch of a few buttons on your mobile phone! Tonik’s virtual debit card is partnered with Mastercard, so you can use it anywhere online where Mastercard is accepted.

-

You get to budget and save more with it - When you use a virtual debit card, you’re able to put a cap on your spending amounts. With regular credit cards or debit cards, it’s easy to go overboard on your limits and get sh00kt once you get your end of the month statement, or when you look at your available account balance. You can say goodbye to those pesky surprises with virtual debit cards. Control your spending and put a limit on your debit card anytime you want. You can also change the limit at will. On the Tonik app, you can do this by clicking on your virtual card, going to “Card Limits”, and then choosing a daily cap that is best for you, whether it’s as low as PHP 5000 or as high as PHP 250,000.

-

Tracking your payments becomes simpler with it - Have you ever gotten confused as to how many times you’ve used your regular debit or credit card? Got those long paper statements and had to track down when and where you’ve done these transactions? You won’t have those problems when you’ve got a virtual debit card. For Tonik, since your virtual card is linked to your bank account, you can easily track your expenses on the app itself, because it shows up on a handy and neat list right then and there. As soon as you’ve made an online transaction, it’ll reflect on your app, leaving no room for confusion anymore. What else is awesome is that Tonik even sends you a monthly report to your e-mail address including all your transactions for better tracking purposes. So, for all things digital or online, this is really the best way to go!

TOC- Table FInd

Wait, wait, wait! Is a virtual debit card even really secure or safe? My phone might get stolen! What about hackers?

Actually, a big pro of your virtual debit card Philippines is the fact that it’s actually more secure than your physical debit or credit card! First off, they don’t exist as an actual card that you can touch, so no one can just take the card or jot down all the details that come along with the card. You also can’t misplace or lose them. Apart from that, the virtual numbers on your virtual debit card can’t be traced to your actual bank account, making it very ideal for all of your online and digital purchases or transactions.

Plus, you can amp up the safety measures with your virtual debit card Philippines by placing in single-use authorization codes whenever you purchase something online, making extra sure that you and only you alone can use it. But if you reallyyyyy think something fishy might be up with your card or if you suspect that someone else other than yourself has been using it, then you can actually freeze it yourself instead of calling your local bank or card company! On the Tonik app, you can effortlessly do this by tapping on your virtual debit card, and then clicking the switch on the “Lock card” feature so that you can have your peace of mind. And if your greatest [financial] enemy is yourself (yes, we’ve all been shopaholics at one point in our lives, hun), you can actually even lock it if you want to keep those wandering hands of yours from spending too much. Cool, right?

And even if your phone gets stolen, digital banking apps are quite hard to open now especially since users can add facial recognition or fingerprint recognition to them. Actually, even just unlocking your phone would be difficult in the first place thanks to all of these features! So on your phone, your virtual debit card is a lot safer versus a piece of plastic that can be taken from you anytime.

Some card companies can even issue you disposable or deletable virtual payment cards, which are single-use cards that can no longer be used after a transaction, making it even harder for anyone to steal your information. We’ll get into more of these types of cards in the upcoming segment below.

TOC- Table FInd

There are so many types of virtual cards out there and it’s really confusing! What’s the difference between all of these?!

With the rise of digital payments and transactions, we don’t blame you if things could get quite confusing. A virtual card has several types and it’s easy to get caught up in all the information circling around the internet. So, take note of these different virtual cards and the distinctions between each of them:

-

Virtual debit cards - These cards are linked to your bank account and gets its funds from there. They are normally issued immediately after you open a digital bank account, such as Tonik!

-

Virtual credit cards - These cards get funds from an available credit line that is granted to you once your credit card application is approved. Virtual credit cards need some time for approval before they are actually issued to you, unlike your virtual debit card Philippines.

-

Disposable virtual payment cards - These are commonly issued by select apps, virtual card companies, and other financial institutions, like Citi Cards. They also work like regular debit cards, except they are rendered defunct after you’ve used them for one purchase online. This helps with cases of fraud, because that means no one can take advantage and use the card details for themselves!

-

Virtual prepaid cards - A number of traditional banks offer virtual prepaid cards as part of their product line. These cards don’t draw from a credit line or your bank account. Instead, you call the shots and place how much you want into the prepaid card. Some types of virtual prepaid cards are reloadable, while some expire as soon as the initial amount in the card has run out.

-

Virtual gift cards - These fun gift cards are kind of like gift certificates from your favorite shops, except they exist online and are more secure. A virtual card makes popular presents between loved ones, friends, and family.

TOC- Table FInd

Okay, a virtual debit card seems pretty cool! I want in! So, how do I get one?

With multiple digital banks nowadays, you’re usually issued one instantly upon account opening or you can apply for other types of virtual payment cards depending on which bank you’re onboarding with! With Tonik, you’re immediately given a virtual debit card as soon as you open an account. And what’s cool is that opening an account with Tonik is as easy as 1-2-3.

All you basically need to do is download the Tonik app on your smartphone, input all of your details and verify your identity via a valid government ID card and a selfie (if you want a step-by-step guide on how to do this, just head on to this link to check out some convenient video guidelines), and in like, pretty much 5 minutes or even less, you’ve got your very own Tonik account and your virtual debit card! You can now link it to your preferred e-wallets and e-commerce websites and enjoy all the nifty features that come with having a virtual debit card! Just make sure to budget wisely, luv, and happy spending! XOXO