Ready to start building your credit? A Tonik Credit Builder Loan might be just what you need to improve your loan eligibility. Learn how to apply, and start building your financial future today.

Table of Contents

How to Apply for a Tonik Credit Builder Loan?

It's easy to get started! Follow these steps to apply for a Tonik Credit Builder Loan and boost your loan eligibility:

- Download the Tonik app.

- Fill out the application form and provide the required documents.

- Review the loan terms and submit.

- If approved, start making regular payments and watch your credit score grow, improving your loan eligibility for future applications.

The Tonik Credit Builder Loan is a powerful tool designed to help you build or improve your credit score, ultimately enhancing your loan eligibility. With Tonik, you can borrow up to Php 20,000 to kickstart your credit-building journey, all while making flexible payments that fit your budget. Plus, with PayHinga, you can take a breather when needed, allowing you to pause your payments for a short period without affecting your credit score.

By consistently making on-time payments, the Tonik Credit Builder Loan helps you establish a strong credit history and steadily improve your loan eligibility over time. This loan provides the perfect balance of financial freedom and credit-building power, all while ensuring you stay in control of your payments. Ready to start building your credit? Check out our deep dive into What’s a Credit Builder Loan? for more insights!

Advantages of a Credit Builder Loan

- Build or improve your credit score: Making on-time payments will gradually improve your credit score, which directly enhances your loan eligibility.

- Foster financial discipline: Since you’ll need to make regular payments, it’s a great way to develop financial responsibility and increase your loan eligibility for future borrowing.

- Gain access to better loan options: Improving your credit score can help you qualify for better loan terms in the future, improving your loan eligibility across the board.

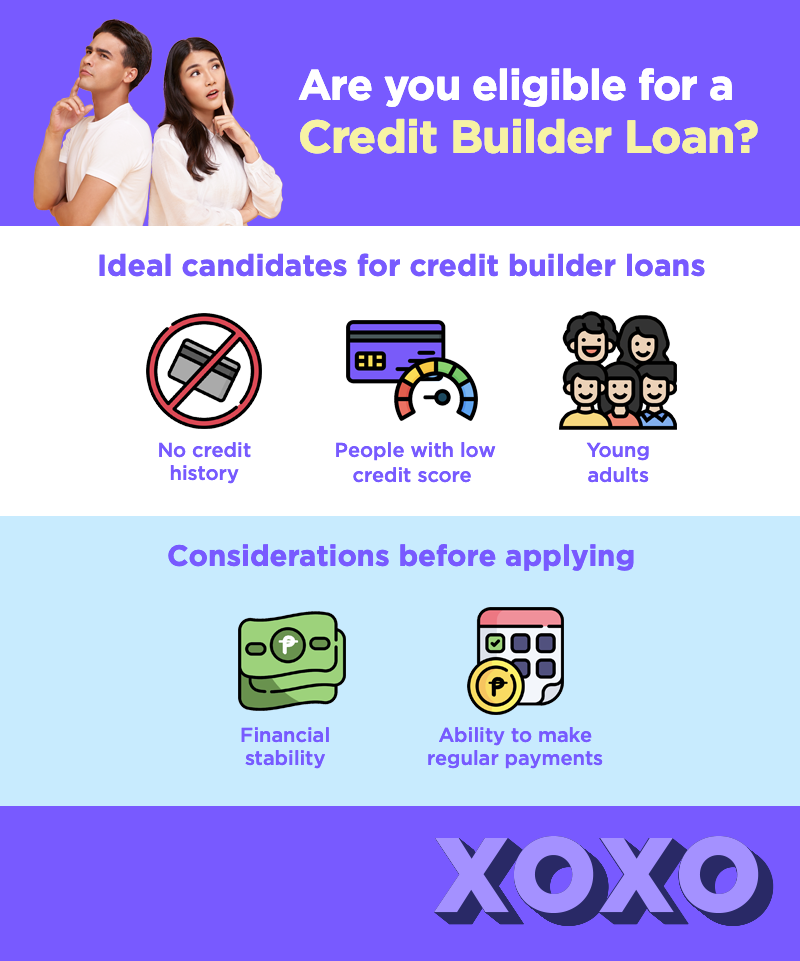

Ideal candidates for credit builder loans

Who can benefit most from a credit builder loan? Let’s explore:

1. Individuals with no credit history

If you’re starting fresh and have no credit history, a credit builder loan is an excellent way to build that initial record. Without a credit history, it’s tough to get approved for traditional loans or credit cards. This loan helps you get started on your journey to strong loan eligibility, setting you up for future financial opportunities.

2. People with low credit scores

For those who’ve faced some financial hiccups in the past, a credit builder loan can be a tool for recovery. By making consistent, on-time payments, you can gradually improve your credit score and show lenders that you’re financially responsible again. This will directly improve your loan eligibility over time. Want to know more about how your credit score works in the Philippines? Check out our article on the Truth About Credit Scoring in the Philippines.

3. Young adults or students

Young adults and students above 18 can benefit from starting their credit-building journey early. A credit builder loan is a smart and controlled way to establish a solid credit history, which will positively affect your loan eligibility down the road, helping you secure better financial deals in the future, like renting apartments or buying a car.

When to consider a Credit Builder loan

Now, let’s talk about the best times to consider applying for a Credit Builder Loan:

1. Planning major financial decisions

If you’re planning to apply for a mortgage, car loan, or any big financial commitment, a credit builder loan is a strategic move. By improving your credit score beforehand, you’ll increase your chances of securing better loan terms and rates, which will improve your loan eligibility.

2. Recovering from Financial Setbacks

Been through bankruptcy, missing payments, or had accounts in collections? A credit builder loan can be a helpful tool to restore your financial health. By demonstrating that you can manage a loan responsibly, you’ll show future lenders that you’ve bounced back from any financial setbacks, which will positively affect your loan eligibility.

Comparing alternatives

If a credit builder loan isn’t the right fit for you, there are a couple of alternatives worth considering to improve your loan eligibility:

1. Secured credit cards

A secured credit card is another option for building credit. With a secure card, you deposit a certain amount of money, which becomes your credit limit. By making on-time payments, you can improve your credit score, which helps increase your loan eligibility. However, credit builder loans are often a better option if you want to build a credit history without having to worry about high-interest rates or fees attached to credit cards.

2. Co-signed loans

If you have a family member or friend with good credit who’s willing to co-sign a loan for you, this can help you get approved for larger loans. While co-signed loans carry more risk for the co-signer, they can be a way to build your credit and improve your loan eligibility if you're unable to qualify on your own.

Considerations before applying

Before applying for any loan, including a Credit Builder Loan, it’s important to think carefully about your financial situation, especially regarding your loan eligibility:

1. Financial stability

It’s crucial to have a stable income before committing to a loan. Even though a credit builder loan is smaller and manageable, you still need to ensure that you can make regular payments without straining your finances. Stability is key to ensuring that your loan eligibility remains strong.

2. Ability to make regular payments

A credit builder loan can only work if you’re able to make payments on time and in full. Missing payments will not only hurt your credit score but could also lead to fees and additional charges. So, make sure you're confident in your ability to stick to the repayment schedule, which will improve your loan eligibility in the long run!

Ready to build your credit smartly and improve your loan eligibility?

A Tonik Credit Builder Loan is a great option! With flexible terms and easy application, we’re here to help you start your credit journey and improve your loan eligibility.

For more information or to apply, head over to our Tonik Loans Page.

So, what are you waiting for? Let’s start building that credit, luv, and boosting your loan eligibility!