Ipon Challenge Ideas to Try in 2025

So, you’ve probably overused the word Ipon by now, right? It’s our favorite Filipino word for saving money, and it’s also the perfect word to describe the latest trend in building a healthier financial future — Ipon Challenge! The basic idea? Set a goal, follow a plan, and watch your savings grow, one peso at a time. Whether it’s for a rainy day or that much-needed shopping spree, the Ipon Challenge makes saving money feel less like a chore and more like an exciting game.

Table of Contents

Benefits of joining an Ipon Challenge

- You’re motivated to save consistently: The best part of any challenge is seeing your progress and celebrating small wins. Saving money becomes less about sacrificing and more about achieving something exciting — whether it's your dream trip, a new gadget, or an emergency fund that actually works when you need it.

- You’ll find creative and fun ways to achieve financial goals: The Ipon Challenge doesn’t have to be all about boring numbers. It can be creative and fun, with different themes and ways to save that match your lifestyle. Try different Ipon Challenge templates such as charts, apps, or even Ipon Challenge printable trackers. You’ll be saving without even realizing it — seriously, who doesn’t love a challenge with a reward?

Creative Ipon Challenge ideas for 2025

Now, let’s talk about some fun and creative Ipon Challenge ideas for the new year. Trust me, these ideas will make saving money a whole lot more interesting!

Classic Savings Challenges

- 52-Week Challenge: Save progressively larger amounts each week. For example, start with PHP 1 on the first week, PHP 2 on the second, and so on. By the end of the year, you’ll have saved a hefty amount!

- Piso Challenge: Start with just PHP 1 on Day 1 and increase it incrementally until you’re saving PHP 100 a day. You’d be amazed at how quickly those small pesos add up!

- Pro-tip: You can even create an Ipon Challenge chart to track your progress. Take it a step further and get an Ipon Challenge printable so you can mark it yourself!

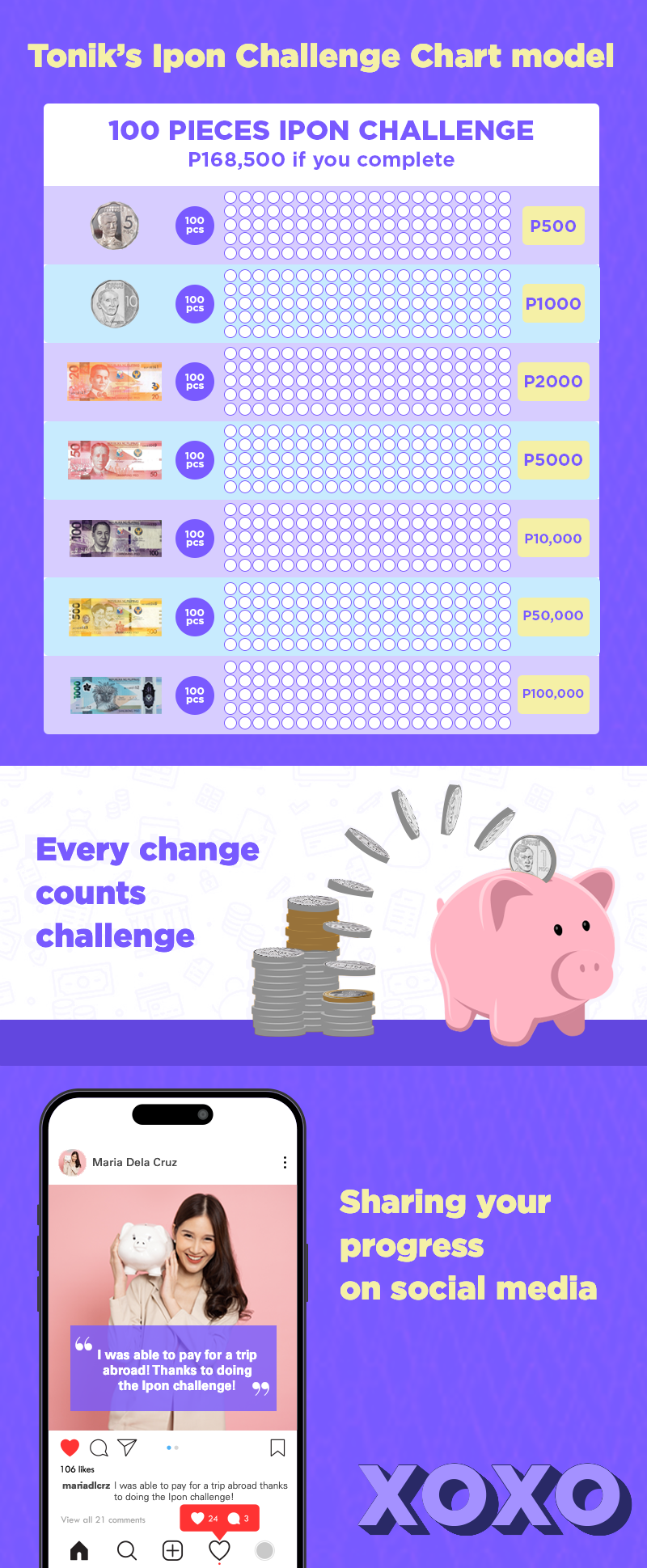

Ex: 100 pieces of Php5 will amount to Php500. Create a chart categorizing “100 pieces of Php500” and illustrate 100 circles where you can cross one circle out every time you’ve deposited to your savings. Do that until you’ve saved Php500!

Themed Challenges

- Travel Fund Challenge: If you’re dreaming of sandy beaches or mountain escapes, why not save for it? Set a specific target amount for your dream vacation and get creative with how you reach it.

- Holiday Shopping Challenge: Christmas and other holidays come with expenses, and the Ipon Challenge can help you save for all those gifts and year-end goodies!

- Gadget Fund Challenge: Keeping up with the latest gadgets? Make it a goal to save for the newest tech or that shiny new phone you’ve had your eye on. It’s all about treating yourself without the guilt. Updating an Ipon Challenge chart will definitely keep you on your toes and reduce any form of guilt whenever you purchase an expensive gadget.

Habit-Based Challenges

- No-Spend Days Challenge: Pick certain days in the month to skip non-essential purchases. Whether it’s your favorite latte or that impulse buy, you save the money you would have spent.

- “Every Change Counts” Challenge: Save all the loose change or small bills you get on a daily basis. Trust me, those coins can add up faster than you think!

- Expense Replacement Challenge: Skip little luxuries like coffee shop drinks or takeout and save that amount instead. You’ll be surprised how much money you can save by just cutting out a few daily habits!

Group and Family Challenges

- Family Piggy Bank Challenge: Get the whole family involved! Each member contributes a set amount each week towards a shared savings goal. It’s a great way to bond and save together.

- Friends’ Saving Goals: Team up with friends to save toward a common goal, whether it’s a trip, an event, or even a group investment. A little friendly competition never hurt anyone!

- Pro-tip: Why not make a Group Stash on the Tonik Bank app? You only need at least three members, and you can earn 4.5% interest p.a. No matter where your family or friends want to use your shared savings, the experience of saving money becomes a lot more interactive!

Digital and App-Based Challenges

- The Tonik Solo Stash – You don’t have to look far for an ipon challenge template. Just open the Tonik App and start stashing! Tonik Stashes are customizable savings pockets that you can use to save up for almost any goal you can think of, like your next travel destination, your next big purchase, maybe even your wedding! You can open up to 5, and they can earn up to 4% interest p.a.

- Automated Round-Up Savings: There are plenty of apps that let you round up your purchases and save the difference. Imagine buying a coffee for PHP 48. Your app rounds it up to PHP 50, saving PHP 2 without you even noticing!

- QR Code Wallet Challenge: Use a QR code to scan and send money to a dedicated savings wallet each time you make a purchase. It’s a high-tech way to save without lifting a finger.

Lifestyle-Based Challenges

- Declutter and Save: If you have unused items lying around, sell them! The proceeds go directly into your savings, giving you more than just a clean space —hello extra cash.

- Eco-Friendly Challenge: Save money and the planet by reducing your energy consumption, buying fewer single-use items, or going green in other ways. Every eco-friendly habit counts toward your savings!

- Fitness and Finance Challenge: For every workout or fitness milestone you hit, add to your savings. A healthy body and a healthy bank account? Yes, please!

Big Goal Challenges

- Emergency Fund Challenge: Save for life’s unexpected twists by committing to a monthly target. An emergency fund can give you peace of mind and ensure you're always ready for anything.

- Debt-Free Fund: Do you have debts weighing you down? Set up a debt-free fund challenge to help pay off your loans systematically — one payday at a time.

- Dream Home or Car Fund Challenge: Saving for something big? Whether it's a new house or your dream car, set a target and start saving now. Your future self will thank you. Not to mention, the money you’ve saved thanks to that Ipon Challenge chart will definitely come in handy once you’re determining your budget for various needs.

Tips for success

- Set clear goals: Whether it’s a vacation fund or an emergency stash, know exactly why you’re saving. Clear goals and an optimistic imagination will help you stay motivated.

- Track your progress: Use Ipon Challenge printable trackers, apps, or journals to keep an eye on how much you’re saving. It’s always rewarding to see how far you’ve come!

- Celebrate milestones: Reach a savings milestone? Celebrate it! Treat yourself to something small — this is your journey, after all.

- Find accountability partners: Share your progress with friends or family to stay accountable. Having a support system makes it even more fun and rewarding. Even better, share your Ipon Challenge template to inspire others to do the same!

- Stay flexible: Life happens. If you need to adjust your challenge or take a break, don’t stress. The key is consistency, not perfection. You can always scribble on your Ipon Challenge printable trackers or even make a note on savings apps to note down unforeseen circumstances that disrupted your savings journey. Hiccups along the way aren’t the end of the world!

Incorporating technology in Ipon Challenges

- Saving apps and digital wallets: Popular tools like Tonik’s Stash and Time Deposit can automatically save for you, helping you stick to your goals without lifting a finger. Treat it as your Ipon Challenge template if you’re not following any style of saving yet.

- Pro-tip: You can open up to five Time Deposits in your Tonik app! All of them will earn a guaranteed 5% interest p.a. But if you manage to maintain an ADB of Php 10,000, your first TD account will earn up to 6% interest p.a. We reward good saving habits in Tonik!

- Social Media Sharing: Share your progress on social media to inspire others and keep yourself motivated. Treat this as an excuse to humble brag about the vacation you were able to pay for with your savings. Sometimes, a little public accountability can also go a long way. You might even want to post your Ipon Challenge chart to feel extra responsible and transparent in your financial journey!