Back then, you’d need to have your wallet with you whenever you go out. If you forget it at home, you’re bound to have a bad day ahead – unless your school or office is just within walking distance and you have a packed meal with you.

Nowadays, with e-wallets being as common as they are now, you can just leave your wallet and go cashless. All you need to pay for your daily needs is a phone with data!

Are you still on the fence about e-wallets? Don’t worry, we’re here to explain the basics and recommend the best e-wallets in the Philippines!

Table of Contents

What are E-Wallets?

E-wallets are apps that let you save, transfer, pay bills, and even invest using your phone. As the name suggests, they’re the virtual version of a traditional wallet, letting you make transactions both online and in-store!

Key Features of Digital E-Wallets

- Transfer funds in just a few taps: E-wallets allow you to send money to e-wallet users or their bank accounts.

- Paying bills is a breeze: They allow you to pay utilities, credit card bills, and more in just a few taps.

- Load up in no time: No need to go to a store to reload your prepaid phone. Load up using an e-wallet!

- Investing made easy: Some e-wallets let you invest in funds or stocks. How’s that for convenient?

- Rewards, rewards, rewards: Certain e-wallets reward users with points just for using their app.

Best Digital E-Wallets in the Philippines

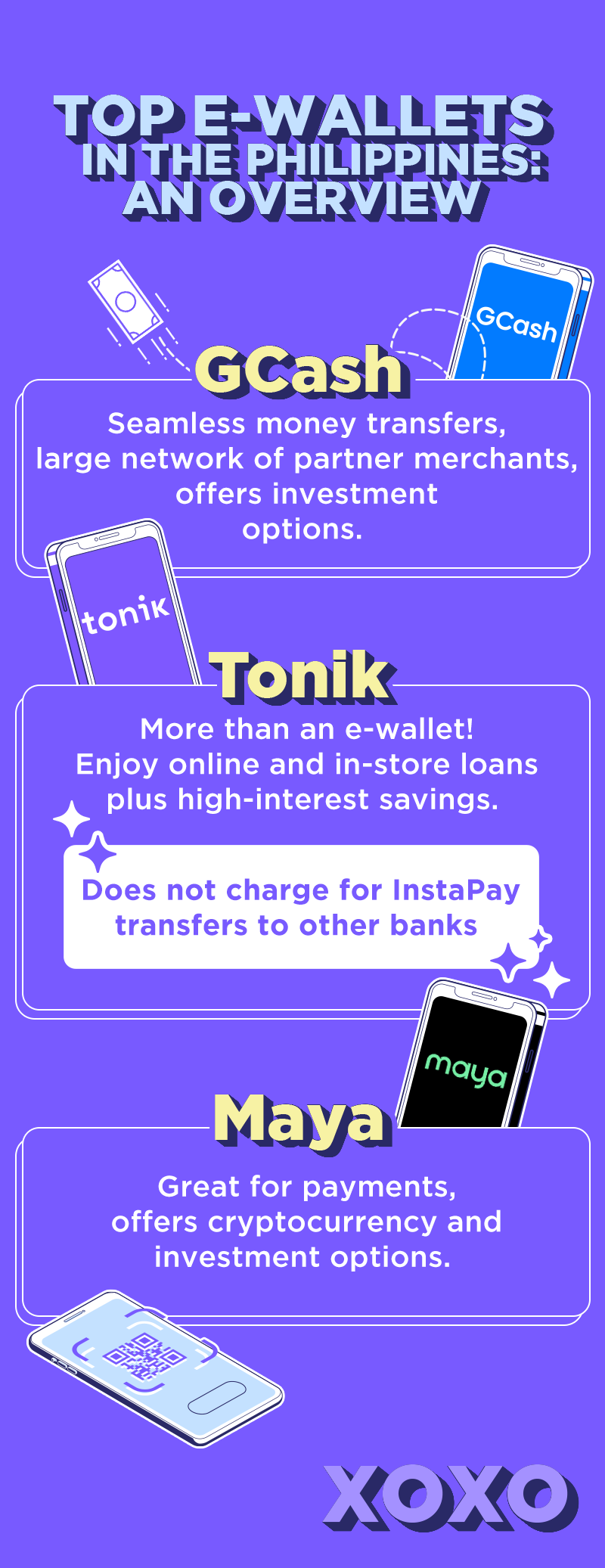

GCash

GCash is one of the most widely used e-wallets in the country. It offers a wide range of services, including money transfers, bill payments, mobile reloading, and investment options through GInvest. It’s known for its user-friendly interface and extensive network of merchants that accept GCash for payments.

Maya

Maya, formerly known as PayMaya, is another popular e-wallet in the Philippines. Like GCash, Maya offers various services such as money transfers, bill payments, and mobile top-ups. Maya also has features for cryptocurrency trading, making it a more versatile option for tech-savvy users.

Brief Overview and Comparative Analysis

User Experience:

Both GCash and Maya have intuitive interfaces, but GCash has a slight edge due to its larger network of partner merchants and service providers. Maya, on the other hand, attracts users with its more robust cryptocurrency and investment options.

Security Features:

Both e-wallets employ high-level security measures, including two-factor authentication (2FA) and biometric logins. GCash is well-regarded for its fraud detection systems, while Maya is known for its security around cryptocurrency transactions.

Fees and Costs:

GCash charges minimal fees for certain services, such as withdrawing funds through over-the-counter methods or transferring money to non-GCash accounts. Maya’s fee structure is similar but offers free withdrawals for its users who maintain higher account balances.

Use Cases and Applications

GCash excels in daily transactions like paying bills, sending remittances, and making in-store or online payments. Its strong merchant network makes it ideal for online shopping and physical retail payments.

Maya is well-suited for users who want to explore cryptocurrency investments while still having access to essential e-wallet functions like bill payments and local transfers.

More than an E-Wallet

If you want an app that you can use as an e-wallet and more, choose Tonik. We’re a full-service digital bank with online and in-store loan products. Want to start building credit? Get a Tonik Credit Builder Loan. Shopping for home appliances? Tonik Shop Installment Loan’s the way to go! We also offer high-interest Time Deposits and Stashes, earning up to 6% and 4.5% interest p.a. respectively.

But what really sets Tonik apart from traditional e-wallets is our commitment to top-tier security. With military-grade encryption, biometric verification, and advanced fraud monitoring systems, your transactions and personal data are always protected. Our trusted global partners, including Mastercard and V-Key, help ensure your financial safety at every step.

Ready to switch to Tonik? Download the Tonik App today, luv!