In the Philippines, Petsa De Peligro—that dreaded stretch before the next paycheck—is an all-too-familiar struggle. Should we always greet petsa de peligro each month as a curse we are crippled by? This blog dares you, dearest reader, to understand the petsa de peligro meaning can help you navigate this recurring financial hurdle with practical strategies and a positive mindset.

Table of Contents

What is Petsa De Peligro?

Let’s start with the petsa de peligro meaning. It directly translates to "danger date" and refers to the days leading up to payday when funds are scarce. This phenomenon stems from mid-month budget depletion, rising living costs, and unexpected expenses. The petsa de peligro meaning goes beyond the literal—it reflects the financial and emotional stress experienced by many Filipinos during these tough times.

The Common Challenges of Petsa De Peligro

Budget Depletion

Mid-month expenses like utility bills, groceries, and unforeseen costs can drain funds quickly, reinforcing the petsa de peligro meaning of financial strain. For more detailed tips on tracking these expenses effectively, check out our guide on balancing the books with effective monthly expense tracking.

Rising Costs of Living

Inflation and increasing prices for essentials leave little room for flexibility, making petsa de peligro even more challenging to endure.

Stress and Anxiety

Financial instability during petsa de peligro often takes an emotional toll, emphasizing the importance of learning how to cope effectively.

Strategies to Survive Petsa De Peligro

Budgeting Tips

Knowing the petsa de peligro meaning helps you prioritize essentials and create a plan:

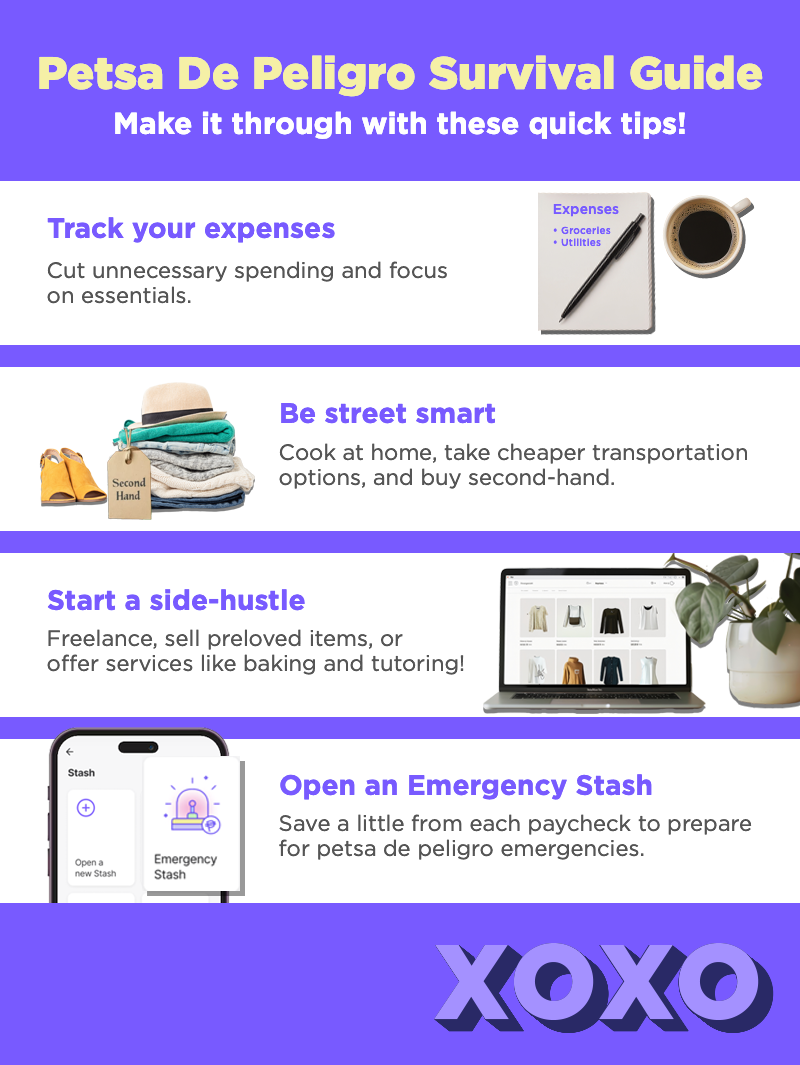

- Track Your Expenses: Understand where your money is going and cut unnecessary spending.

- Create a Survival Budget: Focus on essentials—food, transportation, and bills.

- Envelope Method: Use cash-based budgeting to allocate specific amounts for categories, reducing overspending.

Practical Money-Saving Hacks

Maximize every peso with these frugal hacks, especially when dealing with petsa de peligro:

- Cook at Home: Dining out is convenient but often costly—opt for home-cooked meals.

- Commute Smarter: Explore cheaper options like carpooling or public transportation.

- DIY Solutions: Repair or reuse items instead of buying new ones.

- Shop Smart: Buy in bulk or thrift from ukay-ukay for affordable finds.

Alternative Income Sources

Boost your cash flow with additional income streams during petsa de peligro:

- Freelancing or Gigs: Tap into skills like writing, graphic design, or tutoring.

- Selling Preloved Items: Declutter and earn by selling unused items online.

- Offer Services: From baking to handyman skills, leverage your talents for extra earnings.

Emergency Planning and Preparation

Being proactive can help minimize future petsa de peligro stress:

- Build a Petsa De Peligro Fund: Save small amounts consistently for emergencies.

- Stockpile Essentials: Buy in bulk during sales to avoid last-minute expenses.

- Plan Ahead: Set aside a portion of each paycheck for end-of-the-month needs. For strategies to handle debt, see our blog on important debt management tips.

Mindset and Emotional Resilience

Your mindset plays a significant role in surviving petsa de peligro:

- Stay Positive: Celebrate small victories, like sticking to your budget.

- Seek Support: Share your journey with friends or family for emotional encouragement.

- Practice Gratitude: Shift your focus to what you have rather than what’s lacking.

Avoiding the Petsa De Peligro Trap in the Future

While survival strategies are essential, long-term solutions can break the cycle:

Adopt Better Financial Habits

Commit to regular saving, thoughtful budgeting, and cutting unnecessary expenses. Check out how building your credit score can improve long-term financial stability.

Invest in Financial Education

Learn the fundamentals of personal finance through books, workshops, or free online resources.

Plan for Long-Term Stability

Build an emergency fund and explore investment opportunities to grow your money. If you're in a pinch, consider options like buy now, pay later plans.

How to avoid petsa de peligro forever!

Understanding the petsa de peligro meaning is the first step toward taking control of your finances. Surviving this period is about more than just getting through tough times—it’s an opportunity to reassess and improve your financial habits. With practical strategies, a proactive mindset, and long-term planning, you can turn petsa de peligro into a stepping stone toward financial freedom.