Installment Loan Without Credit History: How It’s Possible in the Philippines

Quick Take

Yes, in the Philippines, you can get an installment loan without credit history. Fintech lenders like Tonik evaluate alternative data such as income, employment, and mobile behavior to assess your eligibility. This makes it easier for first-time borrowers or those without a traditional credit history to qualify for loans.

Try Tonik Shop Installment Loan

If you’re a first-time borrower or a young adult just starting your financial journey, you might wonder if it’s possible to get an installment loan without credit history in the Philippines. Traditional banks often rely heavily on credit scores to assess loan eligibility, making it challenging for those with no credit history to secure a loan. But with the rise of digital lenders and alternative data, the game has changed. Now, you have more options than ever and getting an installment loan without credit history is no longer a pipe dream.

In this article, we’ll take a closer look at how you can qualify for an installment loan even without a credit history, what digital lenders look for, and how you can increase your chances of approval. Let’s dive in!

Table of Contents

- Can You Get a Loan Without Credit History in the Philippines?

- How Lenders Assess Borrowers Without Credit Scores

- Legit Installment Loan Options That Don’t Require Credit History

- Documents you’ll typically need:

- Tips to Increase Your Approval Chances

- Risks to Watch Out For

- Benefits of Building Credit Through Installment Loans

Can You Get a Loan Without Credit History in the Philippines?

The short answer is yes, especially with the rise of digital lenders in the Philippines. Unlike traditional banks that rely primarily on credit scores, fintech companies are offering alternative ways to assess your eligibility for loans.

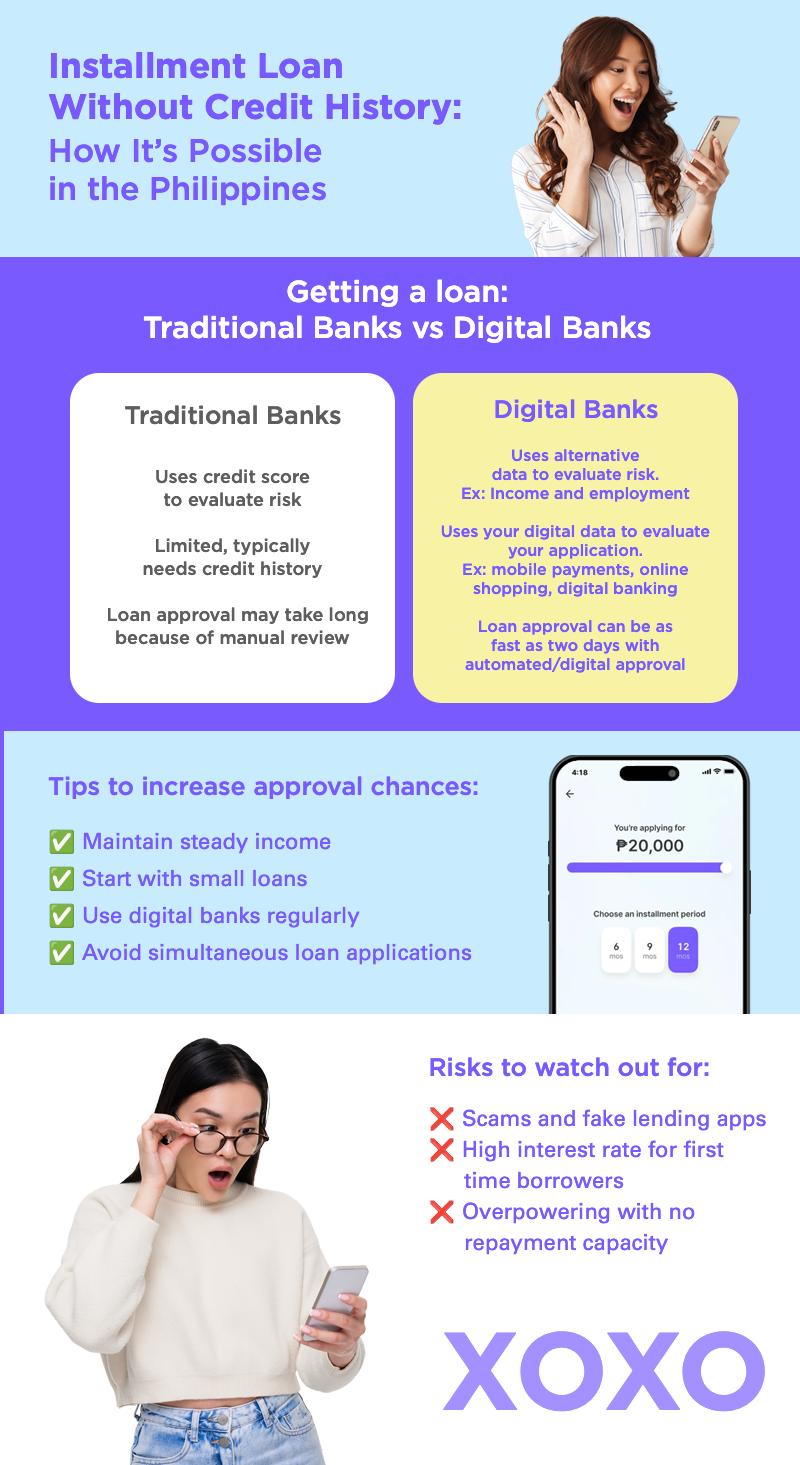

Traditional banks vs. fintech lenders: One of the biggest differences is that traditional banks use credit scores to evaluate risk, while fintech lenders often use alternative data. This is great news for borrowers with no credit history, as it allows them to qualify based on other factors like income, employment, and even their mobile and social media behavior.

In recent years, the Philippines has seen the rise of alternative credit scoring, where lenders look at more than just your credit score. Instead, they assess a variety of factors that provide a clearer picture of your financial habits and trustworthiness.

How Lenders Assess Borrowers Without Credit Scores

So, how exactly do lenders determine if you’re eligible for a loan without a credit score? Here are some alternative data sources they may use:

- Income and employment information: Lenders will typically ask for proof of steady income (e.g., payslips, bank statements) and your employment status. This gives them confidence in your ability to repay the loan.

- Mobile usage and payment behavior: If you’re an active mobile user and regularly pay your phone bills or mobile data plan on time, lenders can use this as an indicator of your reliability.

- Social media or e-commerce activity: Your online presence can be a helpful tool for lenders. If you frequently make online purchases and have a positive transaction history, this can serve as proof of your financial responsibility.

- Bank transaction history (for digital banks): Digital banks like Tonik may review your banking history, looking for signs of regular deposits, savings habits, and responsible financial behavior.

The key here is being digitally visible. The more you engage in the digital world—whether it’s through mobile payments, online shopping, or digital banking—the more data there is for lenders to assess.

Legit Installment Loan Options That Don’t Require Credit History

There are several legit installment loan options available in the Philippines that don’t require a credit history, and they’re offered by trusted fintech companies. Here are some to consider:

- Tonik Bank: At Tonik, you can apply for a Shop Installment Loan or Credit Builder Loan. These options are perfect for first-time borrowers looking to build a credit profile without the need for a traditional credit history.

- BillEase: This Buy Now, Pay Later (BNPL) service allows you to make purchases and pay in installments, even with light approval requirements. It’s a great option for those who want to start small. Want to know how to budget smartly with BNPL? Read about it here.

- TendoPay: An additional option that partners with employers and businesses, offering flexible installment plans with minimal requirements, making it easier for borrowing employees without credit history to get started.

Documents you’ll typically need:

- Valid ID

- Proof of income (e.g., payslips or bank statements)

- Proof of address (sometimes)

Each lender may have slightly different documentation requirements, but these are the basics you can expect to provide when applying for a loan.

Tips to Increase Your Approval Chances

While getting an installment loan without credit history is possible, here are some tips to increase your chances of approval:

- Maintain steady income and have proof: Lenders want to see that you have a reliable income stream. Keep your payslips or bank transfer records handy to prove your income.

- Start with small loans: If you’re new to borrowing, start small. This helps you build a credit history and prove your ability to repay. The Tonik Credit Builder Loan would also be perfect for you, with its maximum loan amount being P20,000. We got you, luv!

- Pay on time: On-time payments are crucial for building your credit profile and ensuring future loan approvals.

- Open digital bank accounts and use them regularly: Banks and fintech lenders love seeing consistent activity. Use your digital accounts for savings or regular transactions to improve your chances.

- Avoid too many loan applications at once: Too many applications in a short period can hurt your chances of approval, as it may look like you're desperate for credit.

Risks to Watch Out For

As with any loan, there are risks to consider, especially when applying for an installment loan without credit history:

- High interest rates for first-time borrowers: Digital lenders may offer loans to those without a credit history, but they often come with higher interest rates due to the lack of a credit score.

- Scams and fake lending apps: Always ensure the lender is legitimate. Look for SEC registration and check reviews before applying. Stay clear of unregulated lending apps.

- Over-borrowing without repayment capacity: While it’s tempting to borrow a large amount, always consider your ability to repay the loan. Borrow responsibly to avoid financial strain.

Benefits of Building Credit Through Installment Loans

Taking out an installment loan without credit history can be a great way to build your credit profile and access better loan offers in the future. Here are some key benefits:

- Sets up future loan approvals: As you build a positive credit history, you’ll be more likely to get approved for larger loans, like auto or home loans.

- Access to better rates and larger loan amounts: With a solid credit profile, you’ll qualify for lower interest rates and higher loan amounts.

- Improved financial literacy: Managing installment loans can help you understand your spending habits, improve your budgeting skills, and build better financial habits.

Looking for an installment loan without credit history? Tonik offers convenient solutions like our Shop Installment Loan and Credit Builder Loan that can help you get started on your financial journey. Try Tonik Shop Installment Loan and start building your credit today!