Gone are the days when you had to bring around those daddy-sized clutch bags to fit your wad of cash. Nowadays, you just need to bring your phone to pay for things. That’s the beauty of cashless payments.

If you haven’t gone cashless yet, you’re missing out, luv. Here’s a quick guide to get you started!

Table of Contents

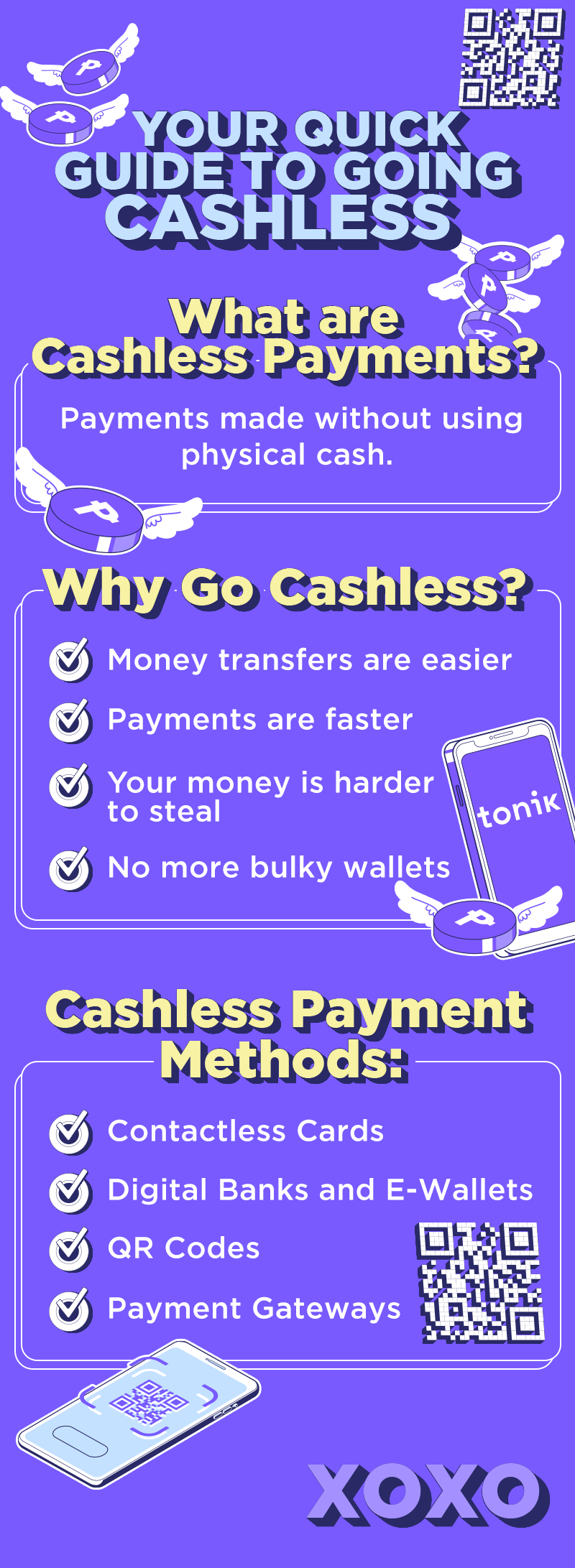

What are Cashless Transactions?

A cashless transaction or cashless payment is any payment made without the use of cold, hard cash. Instead, it’s made via mobile wallets, bank apps, credit/debit cards, QR codes, and online gateways.

Benefits of Cashless Payments

- They're super convenient: Without cash, your wallet becomes compact, and your pocket or bag becomes light!

- They’re more secure: If someone steals your phone or cards, you can easily call the bank or e-wallet's customer care team to block transactions. With us, you can simply lock your card using the app!

- They’re fast – like, really fast: Just scan a QR code, send payment, and you’re done.

- They’re trackable: Digital transactions leave a clear trail, making it easier to manage finances and keep track of spending.

Mobile Wallets

GCash

If you ask a random person on the street if they have GCash, there’s a big chance that they’re going to say yes. That’s because it’s one of the leading mobile wallets in the Philippines. You can use their app to pay bills, transfer funds, shop online, and even invest! Their app also has seamless integration with QR payments, making it a go-to for many Filipinos.

Maya

Another major player in the world of cashless payments in the Philippines is Maya. Formerly known as PayMaya, they have similar features to GCash with the added feature of cryptocurrency investments. If that random person you asked says they don’t have GCash, then they probably have Maya!

Bank-Based Apps

Aside from mobile wallets, you can also make cashless payments using digital banks like yours truly. Tonik Bank stands out as the first digital-only bank in the Philippines. We have a wide range of financial services including fund transfers, bill payments, savings accounts, and loans. Additionally, we have physical and virtual debit cards for cashless payments. Our physical debit card is free, in case you missed it. Go and get that #FreeLuv!

By the way, our savings accounts aren’t just your usual savings accounts. We have Stashes, which are customizable savings pockets that can earn up to 4.5% interest p.a. if you save with a group. If you’re in it for the long haul, we also have Time Deposits that can earn up to 6%!

Contactless Credit and Debit Cards

Contactless cards allow users to make payments by simply tapping their card on a reader, without needing to swipe or input a PIN for smaller transactions.

Both credit and debit cards from banks like BPI, BDO, and Citibank support contactless payments, allowing for quick, safe, and easy transactions at stores.

QR Code Payments

QR code payments are on the rise thanks to the plethora of cashless payment apps available. Simply scanning a QR code allows users to pay for items instantly, making it a popular option at stores, markets, and even for small businesses.

Online Banking and Payment Gateways

For larger transactions or e-commerce purchases, online banking and payment gateways provide secure and efficient options.

InstaPay

InstaPay is a real-time electronic fund transfer system that allows users to send money to other banks or e-wallets instantly. It’s available through most bank apps and digital wallets in the Philippines.

PESONet

PESONet is another fund transfer system, but unlike InstaPay, it is designed for larger amounts and may take a few hours to process. It’s widely used for business transactions and high-value transfers.

ICYMI, the Bangko Sentral ng Pilipinas (BSP) is working to have service fees waived for electronic personal transactions and payments to micro, small and medium enterprises (MSMEs). Nice, right? You can read more about the good news here.

Other Payment Gateways

Services like PayPal and Dragonpay are widely used for online shopping and bill payments. PayPal, in particular, is favored for international transactions, while Dragonpay caters to local businesses by offering over-the-counter payments and bank transfers.

Make it Seamless, Go Cashless

Just a few years ago, the idea of cashless payments sounded like sci-fi. Nowadays, it’s the norm. Don’t be late to the party, luv. Download the Tonik App and go cashless today!