Appliance Loan Mistakes to Avoid (and How to Borrow Smart!)

Thinking about upgrading your home? Maybe you need a new refrigerator, TV, or air conditioner just in time for summer? Well, don’t go draining your bank account just yet. Instead of paying upfront, go for an appliance loan!

In case you didn’t know, an appliance loan is a loan that lets you borrow funds to purchase the home appliances that you need. Often, you can apply for them in store, just like our Tonik Shop Installment Loan.

But hold up! Before you sign on the dotted line, let’s talk about the common mistakes that can turn your loan from a smart move into a financial headache. Avoid these pitfalls and learn the best way to finance appliances!

Table of Contents

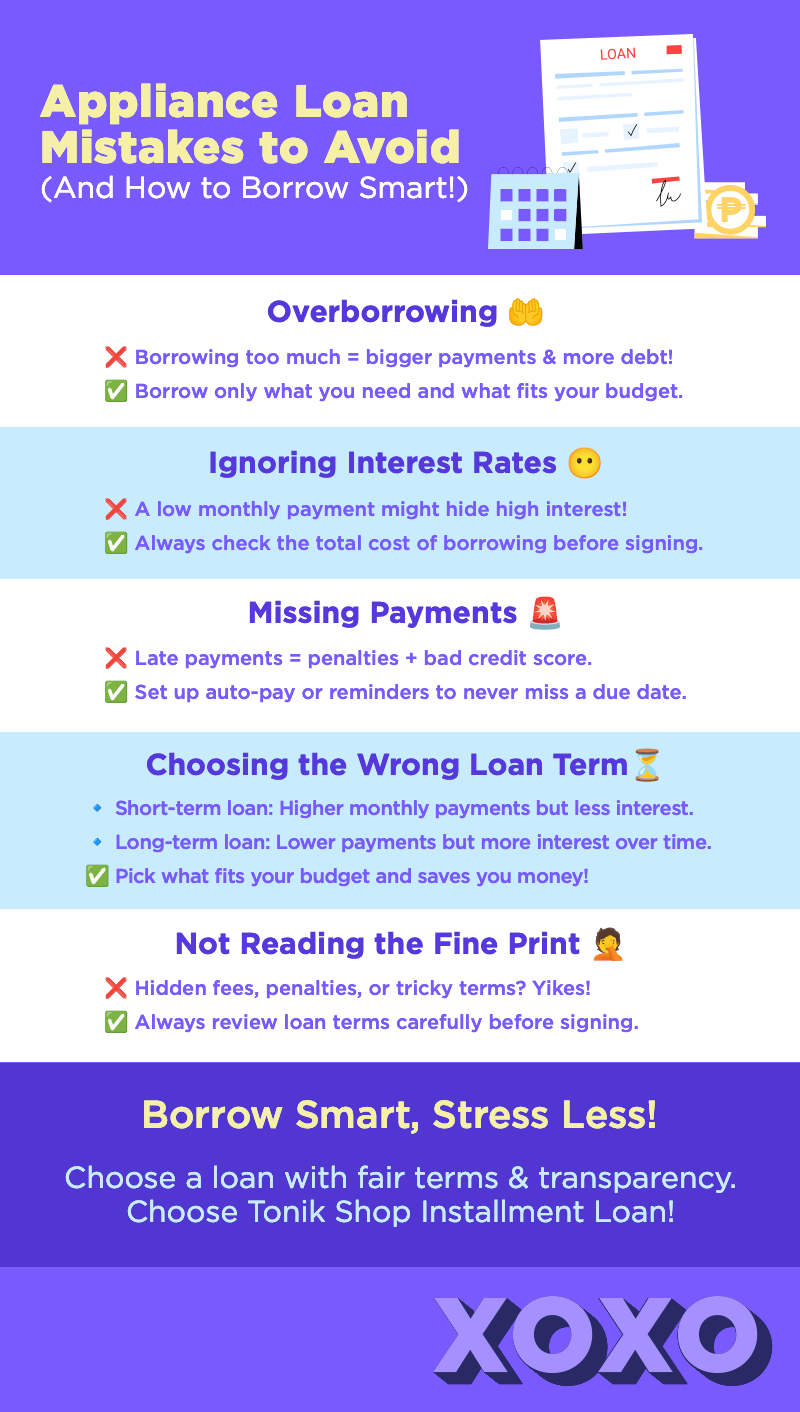

Overborrowing: Don’t Go Overboard

Just because you qualify for a big appliance loan doesn’t mean you should take it all! Overborrowing leads to higher monthly payments, and before you know it, you’ll be left paying for an appliance that you never afforded in the first place.

Reminders:

- Borrow only what you need for the appliance you want.

- Consider your monthly income and make sure you can comfortably afford repayments.

- A smaller loan = faster payoff and less interest paid overall.

Ignoring the Interest Rate

Don’t be blinded by a big loan amount or the promise of fast approvals. If the interest rate’s high, you’ll be paying way more than you thought. Some lenders offer appliance loans with hidden fees and sky-high rates. Make sure to consider the total cost of borrowing.

- Compare interest rates before committing.

- Opt for a fixed-rate loan to keep payments predictable.

- Use an appliance loan calculator to estimate the real cost before applying.

Missing Payments (Big No-No!)

You can ghost a date, but you can’t ghost a loan. Late payments mean penalties, higher interest, and a damaged credit score! You probably know what damaged credit scores lead to – a harder time to get approved for loans in the future. Make sure to pay your loans on time! Here are a few tips:

- Set up reminders for your due dates.

- Set aside the amount for your monthly installment to avoid spending it by accident.

- If cash is tight, contact your lender before the due date—they might offer solutions.

Quick side note: If you’re looking to improve your credit score, get a Tonik Credit Builder Loan! Build credit with up to P20K with affordable terms and minimal requirements.

Choosing the Wrong Loan Term

Loan terms can be tricky, and picking the wrong one can cost you more in the long run. Before using the best way to finance appliances turns into your worst financial decision, check out this quick breakdown so you can make a more informed decision:

Shorter loan term?

- Higher monthly payments, but less interest overall.

- You pay it off faster and save money!

Longer loan term?

- Lower monthly payments, but you pay more interest over time.

- Good if you need more breathing room in your budget.

Find the balance between affordability and saving money on interest!

Not Reading the Fine Print

Some lenders sneak in extra fees—processing charges, late payment penalties, and even early payoff fees. Before you accept that offer, read everything and make sure you know what you’re getting yourself into!

- Read the loan terms carefully.

- Ask questions—transparency matters!

- Choose a lender with fair terms and no sneaky fees (like Tonik!)

Borrow Smart, Stress Less!

Getting an appliance loan should make life easier—not add financial stress. Avoid these mistakes, and you’ll be on your way to financing appliances the right way.

And if you’re looking for the best way to finance appliances, we got you! The Tonik Shop Installment Loan keeps it simple—low rates, fast approval, and no hidden fees.

Download the Tonik App and visit a partner store to try it now!