AML Associate

Philippines - Compliance

This role is essential in ensuring our organization's compliance with anti-money laundering regulations and detecting and preventing financial crimes. As an AML Associate, you will play a crucial role in safeguarding our operations from illicit activities and protecting the integrity of our financial system.

Responsibilities

- Responsible for assisting the AML Officer & Head of Compliance in managing the alerts generated by the AML System (Essentials)

- Conducts prompt and accurate disposition of transaction alerts, make preliminary assessment on trends and makes appropriate report to the AML Officer.

- Principal Accountabilities:

- Prepares and submits reports on Covered Transaction and Suspicious Transactions to the Anti Money Laundering Council

- Prepares and submits Reports on Crimes and Losses to the Bangko Sentral ng Pilipinas

- Promptly and accurately manage transaction alerts generated by the AML System

- Discuss with the AML Officer transactions noted to be suspicious; coordinate with the concerned units relative to the noted suspicion and makes appropriate ST reports upon the instruction of the AML Officer & Head of Compliance

- Miscellaneous Duties and Responsibilities:

- Monitors AMLC issuances on a daily basis, prepares summary of the issuances and submits to the AML Officer for cascading to relevant units

- Daily Adverse News Checking

- Ensures that files and records on Alerts Disposition are complete and updated

- Perform other duties as may be assigned by the AML Officer or Head of Compliance from time to time

Qualification

- College graduate – preferably IT or BS Math or BS Accountancy

- At least 1 year banking experience; preferably in Compliance Function

- With good analytical skills

- Proficient in MS Office applications

- Above average oral and written communication skills; specifically in English

Interested? Send us your CV attalentacquisition@tonikbank.com

Share this post

Share this post

×

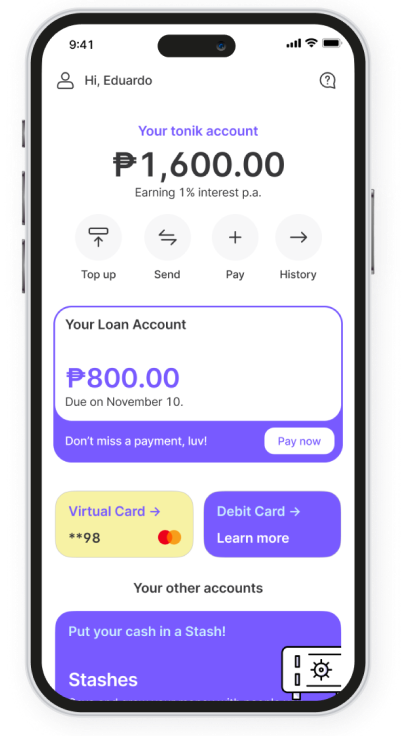

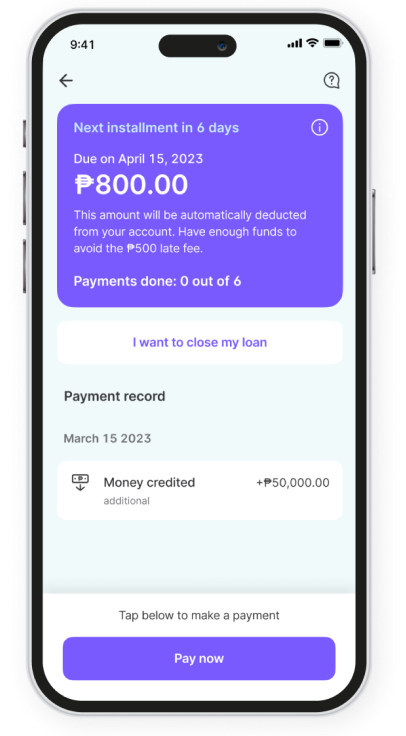

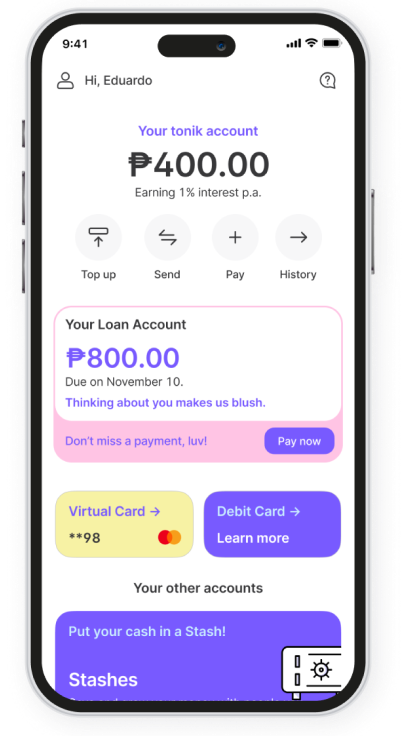

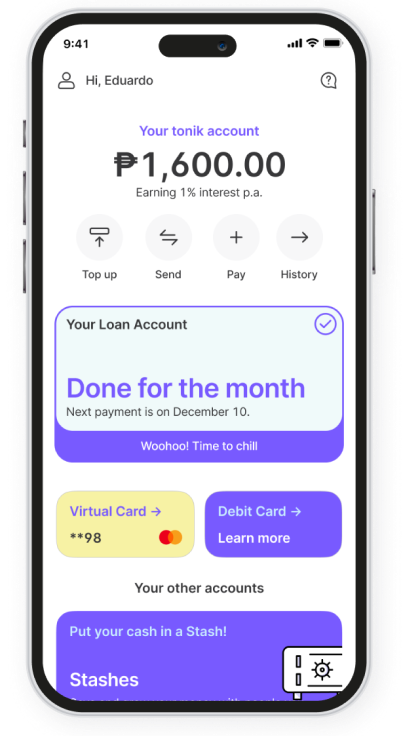

Payment Screens

Open your Tonik App.

Open your Tonik App. Check your Loan Details and Balance.

Check your Loan Details and Balance. Check your Loan Details and Balance.

Check your Loan Details and Balance. Top Up if you don't have enough balance.

Top Up if you don't have enough balance. Done for this month!

Done for this month!Upload your CV